Meeting PIT requirements head on

|

| One key detail that can easily be overlooked by expatriates is that taxable income must be calculated in Vietnamese dong |

Whenever talking about taxes, there are many questions that arise in taxpayers’ minds, especially when there are frequent changes in tax regulations.

Questions often range from the very simple to the very complex, including topics surrounding obligations, liabilities, administration and of course, the dreaded penalties that are never too far from thought. This article focuses on issues that relate to personal income tax (PIT), which will help to answer some questions that often concern taxpayers.

The PIT Law in Vietnam, effective since 2009, has been a hot topic in recent months. This is especially true with new provisions regarding capital investment and capital transfers. During 2009, income from capital investment and capital transfers was exempt due to a planned stimulus package to offset the potential impacts of the world economic downturn on Vietnam.

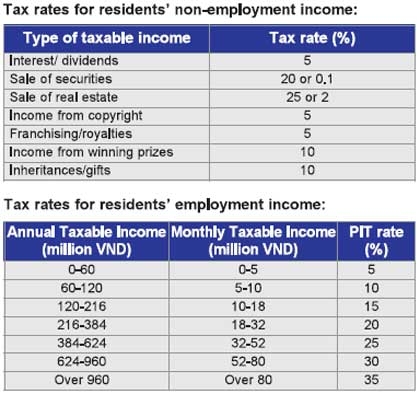

If an individual is recognised as being a resident they will be taxed on worldwide income, irrespective of the source. Non-residents, however, will only be subject to tax on income arising in Vietnam. Criteria for residency are broad, but include staying in Vietnam for more than 183 days per year. Previously, leasing a property for more than 90 days, including hotel rooms, would also cause an individual to be considered as resident, however, this clause has recently been removed with Official Letter 3473/TCT_TNCN, dated September 8, 2010. The different tax rates for residents’ non-employment income are as follows:

One key detail that can easily be overlooked by expatriates is that taxable income must be calculated in Vietnamese dong. This means that all compensation that is treated as taxable must be converted from the foreign currency into dong at the average trading exchange rate on the inter-bank foreign currency market as at the date when the income arose.

|

|

Withholding tax

In simple terms, withholding tax means the income-paying entity calculates and withholds tax payable from the income of the taxpayer before paying such income.

For income from capital investments organisations are responsible to withhold PIT each time they pay income or dividends to an individual for capital investments, the amount to be of income or dividend to be withheld is 5 per cent.

For income from transfer of securities at the time of each transfer of security, an appropriate amount of tax must be withheld prior to making payment to the transferor. Generally, the basis for determining the tax amount to be withheld is the transfer price without any deductions for business expenses multiplied by the tax rate of 0.1 per cent.

Individuals with a number of income sources may select the place to lodge their tax registration, either at the income-paying entity or at the tax department in the locality where they conduct business.

Income-paying entities who wish to withhold tax on income from capital investments or transfers of securities need to make the tax declaration on form 3-KK-TNCN. The time limit for lodging the monthly tax declaration is the 20th day of the following month.

If an income-paying entity has a total annual amount of tax withheld, on any type of declaration, lower than VND5 million then it must make and lodge a quarterly declaration. The time-limit for lodging a quarterly declaration is the 30th day of the first month in the following quarter. The administration schedule is outlined below:

All income-paying entities which pay income subject to deductions must provide an annual declaration of PIT finalisation irrespective of whether tax is deductible or not.

An individual with income from a capital transfer must declare PIT at the same time as conducting procedures for the transfer of the capital to another entity in accordance with the law.

An individual who has already registered with the tax office will pay tax at a flat rate of 20 per cent on income from transfer of securities and must conduct tax finalisation if the tax payable at the rate of 20 per cent is greater than the tax already deducted at the rate of 0.1 per cent, per annum. If tax is overpaid, a request for a tax refund or an offset of tax in the following year can be made.

Refunds and Penalties

Individuals are entitled to a tax refund if the amount of tax paid is greater than the amount of tax payable within the tax assessment period.

The file for a tax refund is comprised of a letter requesting a tax refund on form 1-HTBT, a copy of the individual’s identity card or passport, a tax finalisation declaration and the relevant vouchers proving deduction of tax plus the relevant tax receipts. In order to lodge a tax refund application the taxpayer must go to the tax office that manages the income-paying entity.

Penalties for under-paid tax may be up to three times the under-paid amount if the underpaid tax is considered tax evasion. In other cases of under-paid tax, interest may be charged at 0.05 per cent, per day (H”18.25 per cent, per annum).

Conclusion

The information provided is intended for taxpayers reference as a brief guideline only and is only focused on typical PIT issues in Vietnam. In practice, there are many small technical requirements which need to be considered. For further details or clarification you’ll need to check with your local tax advisors for specific guidance and professional advice.

If you require any assistance please contact Ronald Parks, Tax Partner or Lan Phuong Pham, Tax Manager, of Grant Thornton Vietnam at Ronald.Parks@gt.com.vn and #LanPhuong.Pham@gt.com.vn respectively.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version