Lower expenses in logistics as an outcome of GMT

Vietnam is regarded as having the region’s highest logistics costs. How will the implementation of a minimum global corporate tax affect overseas funding?

|

| Dang Dinh Dao, former director of the Institute for Economic Research and Development at the National Economics University |

When enterprises, and foreign-invested ones in particular, invest, profit remains the only objective. Currently, logistics costs account for 17-18 per cent of the value of products in Vietnam, whereas the global average is approximately 10 per cent. Transporting products from industrial and export processing zones to seaports incurs higher logistics costs than transporting from Vietnamese seaports to those in importing countries.

Vietnam has always used preferential corporate income tax solutions to compete with other nations for foreign investment due to its high logistics costs. But from 2024, many nations will implement a global minimum tax (GMT) with a 15 per cent minimum rate. Therefore, tax competition is no longer effective, and in order to attract this capital, Vietnam must reduce all business costs, particularly in logistics.

How can logistics costs be reduced?

It can be stated that Vietnam offers numerous perks in the development of logistics. It has a coastline of thousands of kilometres with numerous deepwater ports; a North-South railway system that connects 21 provinces and cities; and railway lines between Hanoi and Haiphong, Hanoi and Lao Cai, and Hanoi and Dong Dang in northern Lang Son province. In addition, National Highway 1A, the Ho Chi Minh Road, runs from north to south.

Transport accounts for approximately 60 per cent of logistics costs. If utilised wisely and sensibly, it will not only minimise logistics costs but also make it easy for domestic merchandise to go to the global market by rail via Lao Cai and Dong Dang to make their way strongly into the Chinese domestic market or transit from China to Europe.

Rail transport offers numerous highlights, such as being quick, safe, and capable of transporting a wide variety of products, but we have neglected this vital mode of transport in export operations.

There are approximately 390 industrial parks across the country, but there is no genuine logistics centre because the geographical region is too compact and requires a warehouse system and infrastructure. The objective of logistics is to supply consumers with products and services at the lowest cost and in the shortest amount of time.

Due to the absence of a logistics system and large enough centres, however, transportation expenses are high, limiting the competitiveness of products, particularly for exports, and luring foreign investment in light of the enactment of a GMT.

Why are foreign companies still in charge of logistics when the government is so engaged in market development?

The master plan to develop the logistics centre system towards 2020, with an eye on 2030, was established in 2015. It focused on the objective of building a network of logistics centres capable of meeting the requirements of production and circulation of domestic and import-export products, and tapping market opportunities to boost manufacturing and company operations by reducing costs.

The plan also stipulated that by 2020, the development rate of logistics services would be 24-25 per cent a year, with a 10 per cent contribution to GDP, and that logistics costs would be reduced to 20 per cent of GDP. By 2030, logistics expenses would account for 15 per cent of GDP and contribute 15 per cent to GDP.

What are the issues with terminal logistics?

Over 90 per cent of Vietnam’s exports are conveyed by sea, but Vietnamese companies only account for 12 per cent of the volume of products transported by sea. The remainder is owned by foreign companies. As an import and export powerhouse, Vietnam primarily exports free on board and imports at cost, insurance, and freight. Businesses import and export products through Vietnamese ports, so the entire revenue from transportation, insurance, and other expenses goes to foreign companies.

Therefore, firms cannot be diligent in transporting products to consumers when the cargo market is experiencing hardships.

While Vietnam consistently has a trade surplus in commodities, it consistently has a trade deficit in services. In 2022, Vietnam had a commodities trade surplus of $11.2 billion and a services trade deficit of $12.6 billion, with the cost of transportation and insurance coverage for imported goods accounting for $9 billion alone.

Where does Vietnam’s logistics market stand?

Vietnam is one of the 20 nations with the greatest foreign trade operations around the world, and its population makes its logistics market exceptionally enormous.

In recent times, e-commerce has expanded substantially and thus the logistics industry is expanding and attracting an increasing number of talented students. In reality, the market is currently controlled by foreign companies. According to the Vietnam Logistics Business Association, the growth rate of this industry is 14-16 per cent per year, with an average scale of $40-42 billion per year. There is a presence of approximately 3,000 local businesses and 30 firms providing international logistics offerings, including big names such as DHL, FedEx, and Maersk Logistics.

It is significant to note that foreign logistics companies only account for approximately 1 per cent of the total but generate a great deal of income, given that 89 per cent of domestic logistics businesses are small or medium-sized.

| Vietnam’s logistics industry looks bright despite headwinds Vietnam’s logistics industry remains a bright spot amidst intensifying headwinds in the global market. |

| Green logistics remain a taxing endeavour Vietnam’s logistics businesses are advancing on a green path connected with digital transformation, but are also in a highly energy-intensive and polluting industry, raising concerns about the long-term sustainability and financial viability of the sector, experts have said. |

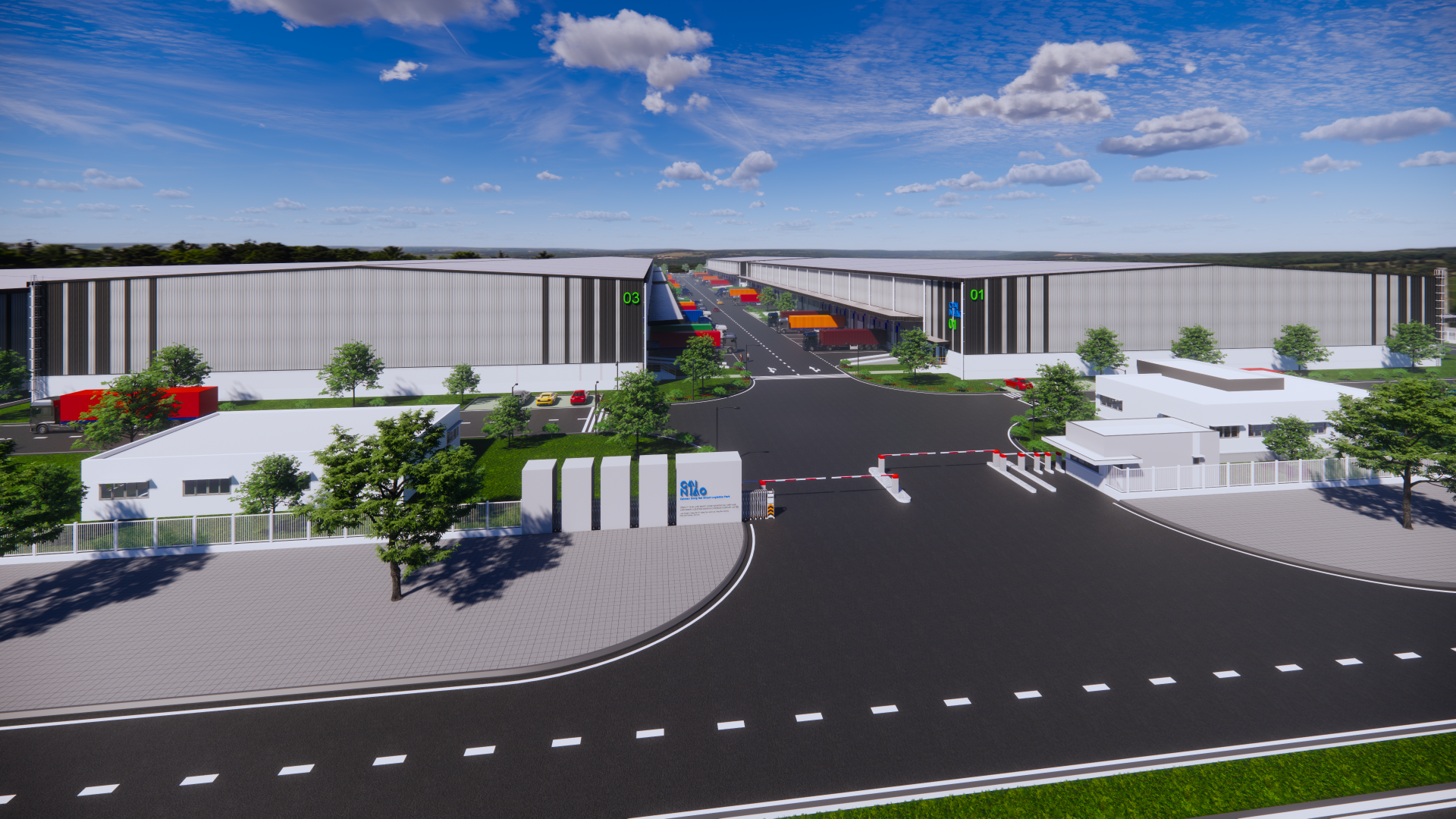

| Cainiao Dong Nai smart logistics centre approved Cainiao Vietnam, a subsidiary of Cainiao Network, the logistics arm of Alibaba Group, has expanded its investment to the southern province of Dong Nai after successfully investing in the Cainiao Logistics centre in Long A. |

| Buon Ma Thuot city set to become logistics hub in Central Highlands The People's Committee of Dak Lak province has recently issued a plan to improve the infrastructure of industrial clusters and establish a logistics and hi-tech industrial centre associated with biological and agro-forestry processing technological research in Buon Ma Thuot city by 2025. |

| Cainiao Vietnam to enhance supply chain with premium warehousing With the launch of premium warehouse facilities in strategic locations, Cainiao Vietnam, a subsidiary of Cainiao Network, the logistics arm of Alibaba Group, is contributing to the development of the logistics sector in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version