Long-term sustainability for Vietnam’s social wellbeing

For the citizens of Vietnam, this step is critical as it will enhance the ability of the VSS to deliver meaningful pension benefits to participants well into the future.

|

| Ketut Ariadi Kusuma, Team leader for Finance, Competitiveness, and Innovation World Bank in Vietnam |

Pension benefits provide income when someone retires. As the retirement date is usually far into the future, pension benefits must cover the loss of purchasing power due to accumulated inflation over this period. In response, pension investments must provide returns higher than inflation.

This need is compounded by Vietnam’s aspirations to become a high-income country by 2045, as contributors in today’s workforce will expect their pension benefits to be commensurate with a high income at this time in just over two decades.

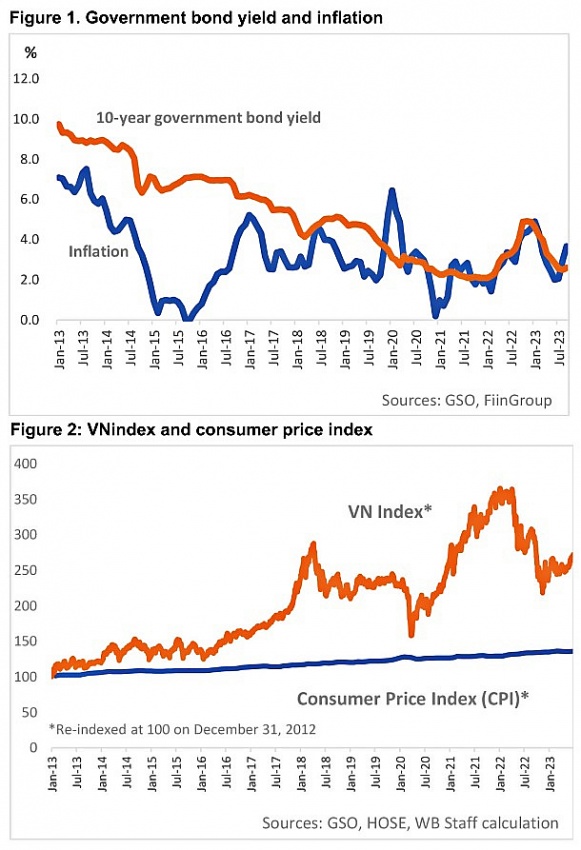

So far, VSS investments have been concentrated in government bonds – a safe destination that yields positive returns. However, the growing size of the VSS and the recent success of Vietnam’s economy have helped drive down the yields of government bonds to the point where they are lower than the current inflation rate (see Figure 1). For this reason, the clock is ticking for VSS to start the process of diversifying into other instruments.

In considering investment options, a pension fund must balance the risk and return. As pension investment has a long-term horizon, it is critical to look at the long-term risk profile of the investment. Government bonds are safe, but the risk of over-investment in government bonds lies in its inability to provide sufficient returns to protect and increase pensioners’ future purchasing power.

Meanwhile, international experience suggests that corporate securities, such as stocks and bonds, provide returns well above inflation in the long term. Even in Vietnam, where the stock market is notoriously volatile, investment in stocks over the long run would give investors almost double the purchasing power compared to 10 years ago (see Figure 2).

|

The VSS must build its own capacity for portfolio investment. That can be done gradually. Most VSS investment should remain in government bonds for now, but it should be allowed to put a small portion (5-10 per cent) of its fund into new asset classes in the next 3-5 years. For the new asset classes, a practical way is to allow the VSS to invest through entrusted funds managed by licensed professionals.

There are numerous asset managers in Vietnam that are licensed by competent authorities, have long experience and track records, and can help the VSS manage part of its investments. Through this process, the VSS can learn and have time to develop its internal capacity.

Other pension funds in the region, such as Japan and Malaysia, started this journey a couple of decades ago, and their pension funds today have become a reliable source of retirement income for their citizens. In the case of Malaysia, a mix of domestic and international investment, in government and corporate securities and others, has yielded returns in excess of 2.5 per cent above government bonds every year. Compounding such returns over 20 years, for example, would result in more than 60 per cent higher pension income for pensioners.

VSS participation in the corporate securities may, in fact, help the development of the capital markets. A major reason for high volatility in the Vietnamese stock and bond markets is the lack of sizeable long-term institutional investors. The markets are dominated by small investors who move in and out of the market, driven by short-term trigger events.

Meanwhile, the VSS is a long-term investor whose decision to invest or dis-invest is not driven by short-term events. The presence of institutional investors like the VSS would reduce volatility in the corporate securities markets. With VSS participation, the market would be further developed and, in turn, provide it with a better risk-adjusted return for its investment.

Realising this step requires the Law on Social Insurance to facilitate diversification of VSS investment to achieve a balance between asset safety and long-term sustainability. This will enable the VSS to deliver benefits to Vietnamese people into the future.

| VBSP: policy credit contributes to enhancing social wellbeing Millions of needy households and other beneficiaries gained access to policy credit sources from Vietnam Bank for Social Policies to feed their production and business requirements in the first half of this year, according to a July 7 conference for the bank reviewing activities and performance in H1. |

| World Wellness Weekend promotes wellbeing in Vietnam Hylton Lipkin, general manager of Garrya Mu Cang Chai and Le Champ Tu Le Resort Hot Spring and Spa, is a World Wellness Weekend ambassador in Vietnam. He sees the weekend as fun, but also a significant few days for Vietnamese people to raise awareness about their health and wellbeing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version