Inflation warning ahead of fuel hikes

The Ministry of Industry and Trade (MoIT) last week warned that public demand for electricity and petrol had “suddenly been increasing since early this year,” prompting authorities to devise measures to “ensure electricity and petrol supplies,” which will help bring inflation under control, at about 4 per cent as set earlier by the government.

|

| Inflation warning ahead of fuel hikes |

Fresh figures from the MoIT showed that in the first five months of this year, the electricity volume consumed increased 12.1 per cent on-year – this has outpaced the initial scenario of an on-year rise of 8-9 per cent.

Since late April, scorching and prolonged sunny weather throughout the country has resulted in a very high increase in consumed electricity. For example, in late April, the peak volume reached 47,670MW, up 13.2 per cent on-year. Notably on May 28, for the first time in the history, the total electricity volume consumed exceeded one billion kWh.

This may contribute to a climb in prices in the market, affecting the government’s efforts to control inflation, according to the MoIT.

According to the General Statistics Office, a hike in power prices contributed to an on-year rise of 3.25 per cent in the consumer price index (CPI) last year. Specifically, the price of household electricity rose 4.86 per cent, leading to a 0.16 per cent increase.

In the first five months of this year, the CPI ascended 4.03 per cent on-year, driven by an electricity price hike of about 0.35 per cent.

The price of electricity has increased due to hot weather has been one of the main cause behind a climb in May CPI of 0.05 per cent on-month, 1.24 per cent against last December, and 4.44 per cent as compared to the same period last year, the GSO stated.

It is expected that the domestic electricity price will increase soon, following a mechanism to adjust the average electricity retail price in Vietnam taking effect in May.

Under this decision, the electricity price can be revised every three months, with the adjustment of increasing from 1 to 10 per cent. Last year, Vietnam Electricity increased the price twice, at 3 and 4.5 per cent in May and November, respectively.

“It is an imperative to closely watch the country’s power transmission situation and weather and hydrographic developments so that we can take proper and timely solutions in accordance with schemes that the MoIT has formulated based on a quarterly and monthly basis in 2024,” said Deputy of Industry and Trade Phan Thi Thang.

“This will help ensure sufficient electricity in all circumstances and for production and business activities and for people’s life.”

The government last week also asked the MoIT to intensify collaboration with relevant ministries in managing prices of items whose prices are subject to state management, including electricity and petrol, so that petrol supplies must be ensured to contribute to controlling inflation as targeted by the government.

Since early this year, petrol prices have undergone 24 times of adjustment, both increases and reductions, but in general, increases have been bigger than decreases. Last week, the petrol price also rose by an average of 60 US cents per litre.

In addition to potential rises in prices of electricity and fuel, the GSO has also warned about a rise in inflation following a 30 per cent increase in salary for those working at state-owned units, besides a potential 6 per cent climb in Vietnam’s regional minimum wage for privately owned units.

According to the GSO, psychologically, increases in salaries will often cause a hike in prices in the market, as an increase in fuel and electricity prices often do. This will also pressure the government’s efforts to control inflation.

More than a week ago, the Ministry of Finance released three possible inflation scenarios for 2024. The inflation rate is projected to increase by about 3.72, 4.03, and 4.5 per cent under three scenarios.

Meanwhile, the State Bank of Vietnam (SBV) estimates that the inflation target of 4-4.5 per cent this year may be reachable, but it said that many significant pressures in the latter half of 2024 will increase, in addition to many unfavourable factors that could be prolonged both inside and outside the country.

“It is requested that ministries and sectors continue to provide consultancy for the government to limit negative impacts on prices in the domestic market, ensuring the balances of supply and demand of indispensable item groups such as food and foodstuff, electricity, and fuel to help stabilise prices,” said SBV Deputy Governor Pham Thanh Ha at a meeting of the Steering Committee for Price Management of the government organised on June 12 in Hanoi.

“The SBV will continue to offer flexible and proactive measures to help stabilise the macroeconomic situation and control inflation,” Ha said.

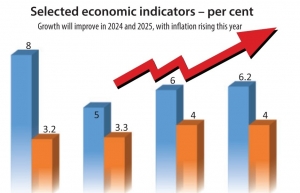

The World Bank has projected that inflation in Vietnam is projected to pick up slightly from an average 3.2 per cent in 2023 to 3.5 per cent in 2024.

“This projection reflects an expected increase in government-administered prices, such as education and health services which constitute 6.17 and 5.4 per cent, respectively of weight in the CPI basket,” the World Bank said. “On the other hand, despite the continued conflicts in Ukraine and the Middle East, oil and commodity prices are tipped to soften slightly in 2024. The CPI will moderate to 3 per cent in 2025 and 2026 based on the expectation of stable commodity and energy prices.”

Meanwhile, according to the Asian Development Bank (ADB), the monetary policy in Vietnam will pursue the dual objectives of price stability and growth, even as policy space is limited. Inflation is expected to edge up in tandem with the economic revival.

“The expected slowdown in the global economy in 2024 could tame global oil prices and consequently ease inflationary pressure,” the ADB said. “Inflation is forecast to rise slightly to 4 per cent in 2024 and 2025. Though the inflation forecast remains below the 4–4.5 per cent target, near-term pressure may persist from geopolitical tensions and disruptions of global supply chains.”

Global analysts FocusEconomics also said, “In 2024, our panel expects inflation to average below the government’s 4–4.5 per cent target. Higher-than-expected food prices pose an upside risk,” it said. “We see consumer prices rising 3.6 per cent on average in 2024, and climbing 3.4 per cent on average in 2025.”

| Monetary policy, executed judiciously, has effectively managed inflation dynamics and risks to broader macroeconomic stability. In late 2022, the SBV decisively increased interest rates to proactively contain inflation risks, maintain stability, and safeguard the banking system. This strategy proved effective, resulting in a decline in inflation by early 2023 and a return to the target range, and contributing to enhanced financial stability. Core inflation, reflecting underlying demand pressures, has also receded. Anticipating potential risks of future economic slowdown influenced by global factors that could impact macroeconomic stability, the SBV adopted a pre-emptive and front-loaded approach, easing monetary policy through interest rate cuts to stay ahead of potential challenges. This relaxation could alleviate the burden on small and micro firms. This relaxation of monetary policy will be complemented by fiscal stimulus and sectoral policies within the context of the national economic policy mix to mitigate the risks of an economic slowdown. Source: International Monetary Fund |

| Vietnam’s economic outlook is subject to heightened external and domestic downside risks. Given Vietnam’s openness to the global economy, the main uncertainty stems from slower-than-expected global growth, particularly among major trading partners such as the United States, European Union, and China. Such developments could impact the recovery of Vietnam’s manufacturing exports, and by extension that of industrial production and growth. An escalation of geopolitical tensions could affect the level and direction of exports. Domestically, the real estate market recovery could take longer than expected, dampening investor sentiment and slowing private sector investment, an important contributor to economic growth. The continued worsening of the financial sector’s asset quality – resulting from the real estate market downturn – could undermine growth prospects as capital buffers, especially at some larger state-owned commercial banks, are relatively thin. Climate-related disasters pose additional downside risks for the country. Vietnam has been known for its exposure to typhoons during August to November, which incur economic costs every year. For instance, in 2020, the country’s central region experienced six storms in October, causing $2 billion in damage. Source: World Bank |

| Inflation pressure to potentially moderate for Vietnam Although upcoming increases in electricity and salaries will pressurise inflation, a reduction in purchasing power could make it possible for the government to control it. |

| Inflation control under pressure from all directions A rebound in domestic consumption and electricity price hikes may put the government’s efforts to control inflation under pressure this year, in addition to salary increases. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version