Increasing demand for rice points to favourable year

In the first week of December, the price of rice exported from Vietnam continued to increase. The price of 5-per-cent broken rice has increased by $5 per tonne to $450, compared to the last week of November. This price is partly driven by the demand of the Indonesian market, according to the Vietnam Food Association.

|

| Increasing demand for rice points to favourable year, photo shutterstock |

Demand for rice is growing strongly in Asian countries in general. Indonesia’s Logistics Agency Perum Bulog in November announced a plan to increase rice stocks in 2023 to 1.3 million tonnes through domestic and import plans. As of November 22, Indonesia’s national rice reserves have fallen to below 600,000 tonnes. Purchasing rice has become difficult since July due to limited domestic supply and India’s policy of restricting rice exports, according to the Vietnam Trade Office in the country.

“The price of Vietnamese rice is the highest in the world,” said Nguyen Viet Anh, general director of the Orient Food Company. “For more than a month, we have had no rice to sell.”

Vietnam’s rice exports have increased sharply since October this year, after the General Department of Foreign Trade of India issued an export ban on broken rice and imposed a 20-per-cent export tax on white and brown rice, which accounted for 60 per cent of the country’s total rice exports as of September 15.

Huynh Thanh Tung, general director of Angimex JSC, commented, “The advantage of Vietnam’s rice exports is also resonated by the appreciation of the US dollar. “Angimex has exported over 200,000 tonnes of rice of all kinds by now, exceeding the plan set for 2022.”

The peculiarity of the rice industry is that orders are signed on a monthly basis, with most export orders being paid for in USD. Thus, fluctuations in the USD exchange rate have helped many businesses improve their profit margins.

And more businesses feel that the upward trend in export rice prices will last at least until the end of the first quarter of 2023, due to severe weather conditions in many Asian countries, which account for 90 per cent of global rice production. Climate change, severe drought in the US, Europe, and China – the country with the largest rice demand in the world – put rice in short supply.

In its August report, the US Department of Agriculture (USDA) lowered its global rice production forecast for the 2022-2023 crop year to 512 million tonnes, down 2.3 million tonnes from the previous forecast and 1.2 million tonnes lower compared to the 2021-2022 season due to reduced production in India, Bangladesh, and Europe.

The USDA also continued to raise its forecast for global rice consumption in the 2022-2023 crop to a record of 518.7 million tonnes, a slight increase of 100,000 tonnes from the previous forecast and an increase of more than two million tonnes compared to the 2021-2022 crop year. In comparison to the previous crop year, consumption is forecast to increase in Bangladesh, China, Nepal, Nigeria, the Philippines, and Vietnam.

Rice supply from Vietnam may not increase insignificantly. According to the Ministry of Agriculture and Rural Development (MARD), Vietnam produces 43-44 million tonnes of rice per year. However, the country is on a path to reduce the area of rice cultivation to 3.5 million hectares by 2030, according to a resolution on national land use for 2021-2030.

In Vietnam’s Mekong Delta – which accounts for a good half of the country’s rice production and 90 per cent of rice exports – the area of land for rice cultivation is decreasing, said Nguyen Van Doan, head of the Crop Production Department’s Representative Office in Ho Chi Minh City. “In 2023, the Mekong Delta maintains an area of about 3.9 million hectares, with an output of 24 million tonnes, instead of 4.3 million hectares in 2015,” Doan explained.

Vietnam, the world’s third-largest rice exporter, wants to move up the value chain. Previously in 2022, the government had assigned the MARD to develop a project with one million hectares of high-quality rice to improve the value and income of the people involved, ensure food security, and boost processing and exporting activities.

Pham Thai Binh, general director of Trung An High-Tech Farming JSC, said that the government’s plan of creating one million hectares of high-quality rice is achievable. “If the project is successful and produces 6-7 million tonnes of high-quality rice for export, it can earn $10 billion, instead of just over $3 billion as at present,” Binh said.

Currently, Trung An has more than 10,000ha of high-quality rice land, with an output of about 100,000 tonnes that is mainly exported to Europe. However, Trung An’s export output is still low, due to difficulties in capital to expand the rice cultivation area. “This is currently the biggest limitation of the business,” Binh said.

Le Thanh Hoa, deputy director of the Department of Agricultural Processing and Market Development under the MARD, commented, “Rice exports in 2022 can still reach seven million tonnes if businesses make good use of opportunities from India’s current restrictions and the trend of replacing wheat in some countries.”

In the first 11 months of 2022, Vietnam exported over 6.67 million tonnes of rice, up 16 per cent in volume over the same period in 2021, according to the General Department of Vietnam Customs.

Hoa noted that Vietnam’s rice market accounts for 24.5 per cent of the market share in China, which has an import demand of about 5.3 million tonnes of rice each year.

“Vietnam is proposing to China to increase the number of factories licensed to export plain rice, fragrant rice, and sticky rice. Currently, there are 22 Vietnamese enterprises that are licensed to export rice to China, but each year they can only export with a certain limit.”

| Rice farmers provided blockchain-based weather insurance for first time Vietnamese farmers will soon have the opportunity to share the risk of loss of rice yields caused by floods and shifting rainfall patterns thanks to weather index insurance with an affordable premium. |

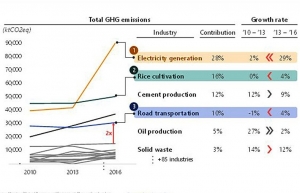

| Innovating towards net zero: energy, rice, and transportation in Vietnam Vietnam is striving to hit its net zero targets by 2050, and there are certain industries which should be focused on. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version