Hotels and resorts see global interest

|

| More international investors are discovering the Vietnamese hospitality sector, Photo: Le Toan |

A recent report from CBRE revealed that foreign investor demand has mostly been led by Asian-based groups. These include several hotels in large cities and resort destinations.

The comparatively higher yields available in Vietnam continue to lure Asian-based property developers and real estate companies. Mid-market business and tourist hotels in Ho Chi Minh City and Hanoi are the main focus, due to the lack of supply in the gap between high-end and low-end operators.

The interest among domestic buyers is also robust. Some groups are seeking to purchase development sites and properties, with others opting to pursue joint ventures with foreign investors to gain access to capital and operational know-how.

According to Thuc Nguyen, manager of Research and Consulting Services at CBRE Vietnam, investment in hospitality has come predominantly from the Southeast Asian region, but is increasingly global. Notably, an increased number of enquiries has recently come from Europe and North America.

“Vietnam is still a relatively immature market with limited high-quality assets out there. Vietnam has only recently become accessible and attractive as a global destination. Current owners don’t want to sell or the asking price is too high,” Thuc told VIR.

|

Thuc further cited that interest ranges from three-star to five-star assets, in Ho Chi Minh City and Hanoi, as well as in coastal cities. He stressed that this strong interest would continue in 2018.

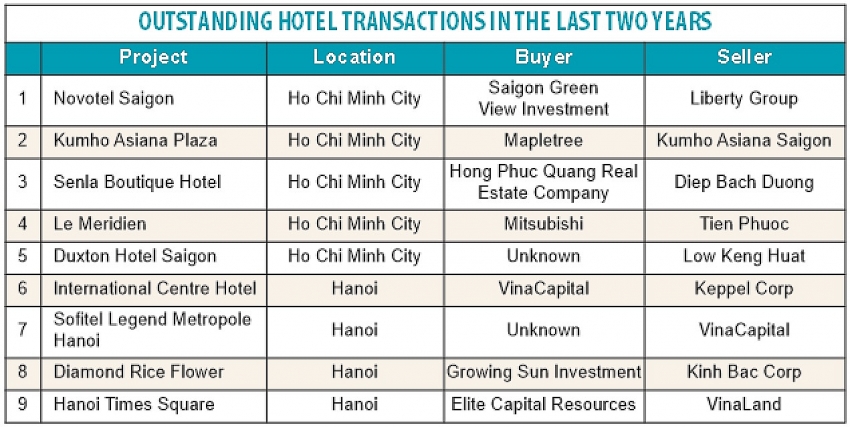

Most hospitality transactions were not publicised, meaning the list of hospitality transactions is longer than some number suggest.

International hotel operators continue to enter Vietnam, with Travelodge Asia recently announcing plans for its first property in the coastal city of Nha Trang, which is scheduled to open in 2020.

According to Stephen Burt, chairman of Travelodge Asia, the group considers Vietnam to be a very important destination for the company. “It is a vibrant country that international travellers are discovering in ever-increasing numbers. It is also very encouraging to observe the level of governmental support for transport and social infrastructure that will further assist the hospitality industry,” Burt said.

Spanish hotel company Melia Hotel International has strengthened its footprint in Vietnam with the recent signing of three new properties in Ho Chi Minh City, namely Melia Saigon Central, INNSIDE Saigon Central, and INNSIDE Saigon Mariamman, bringing the group’s number of current and future properties in Vietnam to ten.

With the region’s rising affluence, improved infrastructure, and increased flight connectivity, there is an enormous potential in the growing “bleisure” market in Vietnam, which is a booming tourism hotspot and a priority market for Melia.

“Vietnam is quickly emerging as a top travel and business destination and is a big part of our strategic focus for Asia Pacific,” said Bernardo Cabot Estarellas, senior vice president Asia Pacific of Melia Hotels International.

Last month, InterContinental Hotel Group (IHG) acquired a 51-per-cent stake in Regent Hotels and Resorts for an amount of $39 million. Regent has an operation contract for BIM group’s Regent Residences Phu Quoc, which will become operational in 2019. With this transaction, IHG expanded its portfolio to ten hotels and resorts in Hanoi, Danang, and Ho Chi Minh City.

Indochina Capital recently joined with Japan’s Kajima to build up a chain of hotels in Hanoi, Ho Chi Minh City, and Danang under the brand name of Wink Hotels. The two first land plots were revealed to be in Ho Chi Minh City and Danang – two business and tourism hubs of Vietnam. The 226-room hotel in Ho Chi Minh City will come online in 2019, whereas the 243-room hotel in Danang will be put into operation in 2020.

Hoteliers saw a positive market performance in 2017, with more than 13 million international visitors arriving and an average nationwide occupancy rate of more than 70 per cent.

Phan Xuan Can, chairman of Soho Vietnam, a consultant firm specialised in hotel transactions, told VIR that the hotel segment has been very active in the last three years and caught the attention of many foreign investors, mainly from Japan, South Korea, Hong Kong, and Singapore.

Korean investors, Can said, mostly wanted large-scale, high-end hotels with up to 250 rooms in Hanoi, Danang, and Ho Chi Minh City, where many Koreans live, while Japanese investors are interested in smaller-scale hotels with less than 150 rooms in Hanoi and Ho Chi Minh City. Singaporean investors, meanwhile, hunt for multi-purpose complexes featuring a hotel segment.

Can said that Hanoi and Ho Chi Minh City currently have a limited land fund for hotel development, since the prices are high, while Danang and Phu Quoc are offering more opportunities for investors, with much land left to develop.

It can be expected that the number of hotel transactions will remain high until at least 2019, due to the limited supply and high demand.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

- Kido Group divests from ice cream and frozen foods (December 18, 2025 | 16:49)

Tag:

Tag:

Mobile Version

Mobile Version