Growing appetite for quality snacks

|

| Growing appetite for quality snacks |

Hemant Rupani, managing director of Mondelez Kinh Do Vietnam, said that the nation is a very attractive snack food market with a rising income level, growing purchasing power, and changing lifestyle. In particular, around 73 per cent of women are working so they have less and less free time. “Therefore, they often choose convenient products like snacks when they don't have time for a sit-down meal,” he said.

Rupani added that Vietnam is a youth-centric country and youngsters are demanding better quality and better choices in snacks. A recent study by research firm Nielsen on consumer behaviour pointed out emerging trends in Vietnam, including health and wellness, premiumisation, convenience, and indulgence. As a result, snacking is maturing from being a treat or something sweet to a nutritious alternative to cater to the demand for quick and healthy food.

In fact, Vietnam is among the most developed snack markets in Southeast Asia, joining Thailand, Indonesia, and Malaysia in the $3.5-billion club, according to a recent report from Japanese consultant Corporate Directions. It is predicted that by next year the Vietnamese snack market will reach around $1 billion.

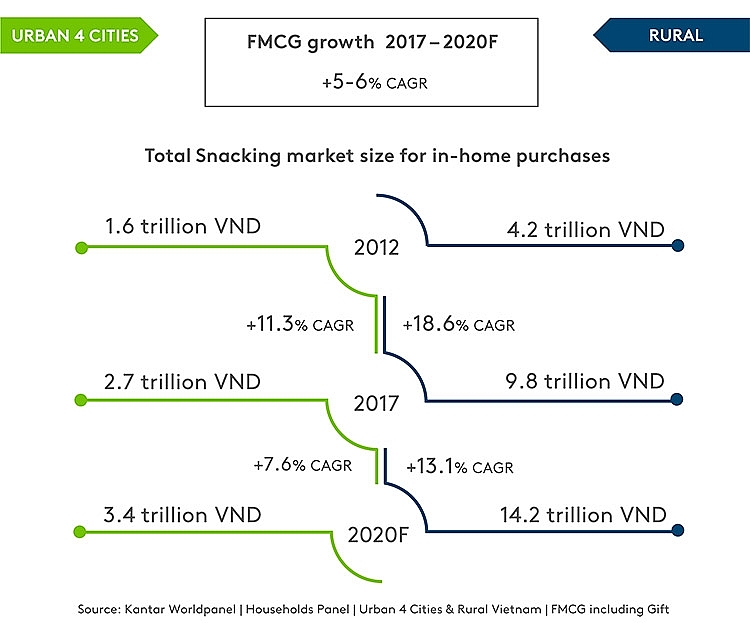

In light of this bright outlook, snack producers have stepped up their game to capitalise on the potential. Nguyen Huy Hoang, commercial director at market researcher Kantar Worldpanel Vietnam, said that Vietnam’s snack market is becoming fiercer as both local and international players are making efforts to attract consumers by launching new products that reflect changing trends.

“In addition, the emergence of mergers and acquisitions in recent years, particularly in retail, creates opportunities for foreign manufacturers to enter the Vietnamese market, mostly through their retailing partners in modern trade,” said Hoang. “Family Mart and 7-Eleven will support their Japanese suppliers to distribute its products in their store chains, for example.”

Japanese snack producer Koike-ya officially made its debut in Vietnam by establishing a factory in the southern province of Dong Nai to make its Karamucho spicy snacks. This is the company’s first overseas factory, and with the investment capital of around $8.7 million, the factory has an annual output of 4,200 product tonnes.

Meanwhile, Mondelez acquired Kinh Do in 2015. The company has made efforts to build on the heritage and legacy of local brands and enrich that with global know-how and high-quality products. Almost every year around 70 per cent of the firm’s investment goes to improving its goods and factories. Mondelez Kinh Do Vietnam is not only a market leader in the biscuit and mooncake sectors, but is also prominent when it comes to packaged bread, cakes, and pies.

Other foreign snack brands such as Oishi (Liwayway), Poca (PepsiCo), and Choco Pies (Orion) have benefited from the snack boom in Vietnam. In 2018, South Korea’s Orion Confectionery earned ₩92 billion ($80.9 million) from selling 600 million Choco Pies in Vietnam. This was reportedly the highest sales Orion has ever attained in the country, even surpassing domestic sales in South Korea. Vietnam is the second country to accomplish the feat, after China.

|

Local producers are also striving to maintain market share. According to London-based market researcher Euromonitor International, Vietnam One One Food JSC maintained its dominance in the popular rice snacks category, which saw the fastest value growth over the year. Meanwhile, Tan Tan Food & Foodstuff Co., Ltd. saw strong value growth in nuts, seeds, and trail mixes for the fourth consecutive year in 2019.

Laurent Levan, president of the Philippines’ URC Vietnam, said, “In Vietnam, the love for snacks is strong, leading to fiercer competition among businesses. There is an uplift in consumer spending on snacks from consumers in both urban and rural areas.”

“Target customers for this product are young people who often change their tastes and habits and easily adopt new trends. This helps to create more growth for the industry,” he said.

Levan further noted that, “Vietnam now is a home ground for many international and local brands. We strongly believe that our portfolio which includes both local and imported merchandise can help us supply good products to the Vietnamese people.”

A quarter of URC Vietnam’s business is comprised of its food segment, including snacks and confectionery. In 2018, its biscuit products experienced a growth rate of 21.9 per cent. URC Vietnam is investing in Vietnam’s snack industry for the long term, with parent company Universal Robina Corporation (URC) and its other regional offices already either market leaders or influential players in the ASEAN and Oceania region.

Mondelez Kinh Do Vietnam’s Rupani stated that Vietnam is a vibrant market of the ASEAN. In Vietnam, there are a large number of contenders in every industry, ensuring a great deal of competition. “In most sectors there are no dominant players, and even those with a large market share are only operating at around the 20-30 per cent level.”

In addition, the Vietnamese snack market will become more competitive with the implementation of the EU-Vietnam Free Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. More foreign producers and imported fast-moving consumer goods will flood the market.

Rupani added, “Competition is healthy as it keeps us grounded. We have a strong portfolio of local and international brands, and we are constantly striving to better serve our customers. These agreements will also provide an opportunity for Mondelez Kinh Do Vietnam to export to overseas markets. There are slight disadvantages as many ingredients in our products have to be imported with duties, but as the trade agreements develop, the government will be progressive in recognising and correcting this issue.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version