Gradually changing perspective about life insurance

It was in 1999 when Prudential entered the insurance market in Vietnam. At that time, life insurance was still a completely new and strange concept for many Vietnamese people.

|

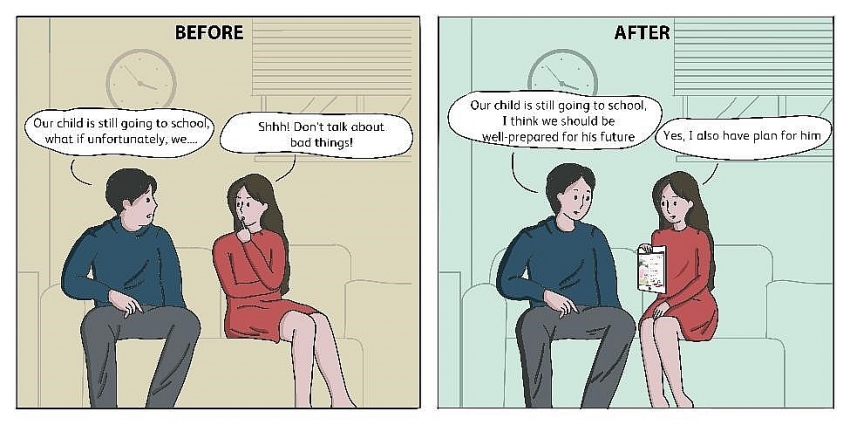

| Avoid mentioning risks or proactively preparing for unexpected events? |

Back then, Vietnamese people’s mindset for protecting themselves for the future was entirely focused on savings. The implementation of a savings plan was arbitrary and lacked discipline. As a result, they did not have enough to spend when difficulties occurred. Vietnamese people also tended to avoid talking about, thinking of, or discussing unfortunate things. The Vietnamese expression "an unfortunate man would be drowned in a teacup" partly reflects this mindset. People would not make any preparations to face the uncertainties of life.

However, due to the developing economy, improving standards of living, and the emergence of a life insurance industry, the way Vietnamese people plan for uncertainty has gradually been changing over time.

|

| With life insurance, financial plans are implemented more effectively and stably |

As one of the first enterprises to bring life insurance to Vietnam, Prudential has witnessed how Vietnamese people's perspective has changed over the past 20 years.

Baker said, “Life insurance has contributed to a change in Vietnamese people's perception. Instead of trying to avoid conversations about unfortunate things, increasingly we see Vietnamese people being more proactive about making contingency plans to minimise the impact of risks in their lives.”

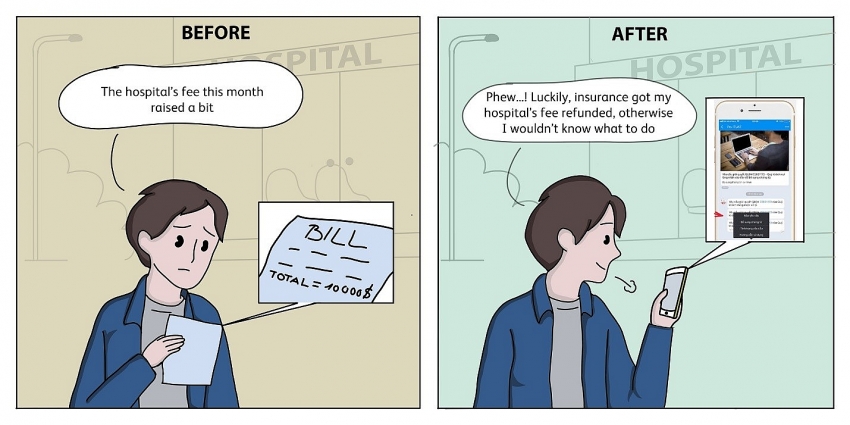

One particular area where there has been a change in mindset has been critical illness. Many Vietnamese people acknowledge that there is likely to be a period where their health deteriorates, and they become more vulnerable to illness. They are making financial plans to ensure they can have a good quality of life in this period with a Critical Illness Policy.

A report from the Insurance Supervision and Management Department (the Ministry of Finance) indicates that the growth rate of the insurance industry over the years has been very positive, particularly in the past eight years when growth has reached over 20 per cent.

Prudential in particular experienced significant growth over the past 20 years and is now serving more than 1.5 million customers.

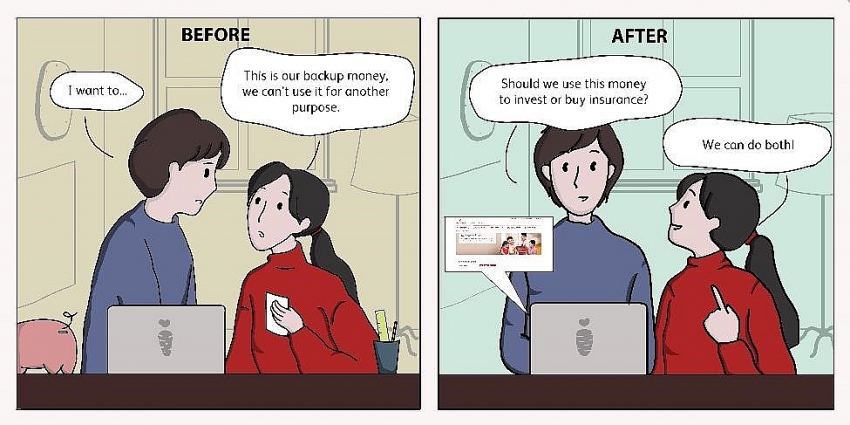

To win over customers, today's life insurance products not only provide plans for financial protection to help customers overcome risks in life but also accompany them on their life path so they can realise their dreams and ensure a sustainable future.

Prudential has pioneered product diversification to provide the most appropriate and optimal financial solutions. In 2008, the company launched the investment-linked insurance product named Phu-Bao Gia Dau Tu, the first of its kind in the market. This product had many outstanding features that met customers' needs for financial protection and desire for investment to grow assets.

|

| ILP products help protect and invest efficiently |

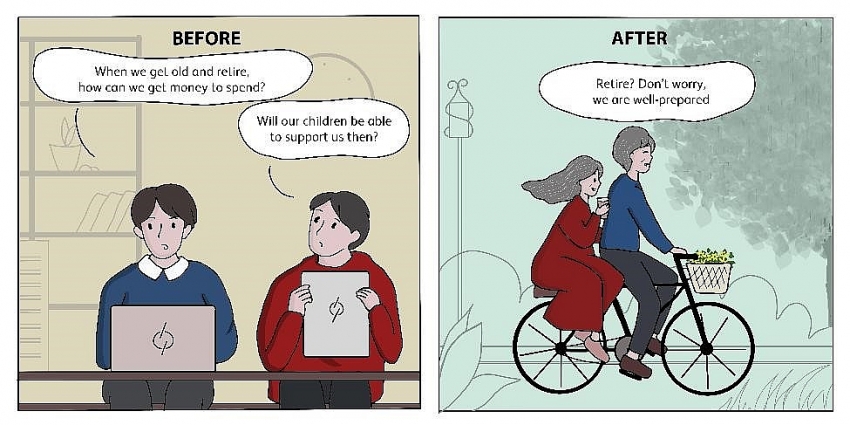

In addition to helping customers prepare for uncertainty and grow assets, Prudential's insurance products are also designed to meet different customer needs such as preparing for their children’s academic studies, retirement, and much more.

|

| Preparing an effective financial plan is the key to a happy retirement |

Also, according to the Insurance Supervisory and Management Department's report, in 2018, Prudential was the industry leader for insurance benefits payment with a total amount of VND6,703 billion ($291.4 million). Total claim payments for death benefits, total permanent disability and medical expenses amounted up to VND832 billion ($36 million) for more than 103,000 cases.

The life insurance industry's emergence, along with the rise of pioneering enterprises such as Prudential, has helped millions of Vietnamese families make financial plans and ensure a stable future for their families. “For over 20 years, this is one of the sustainable values that Prudential has delivered and disseminated to help Vietnamese people progress through life,” said Baker.

|

| Unexpected medical expenses are partly supported by life insurance |

It’s noteworthy that Prudential is the only foreign life insurer in Vietnam to have received the Second-Class Labour Medal from the State President of Vietnam in 2014. Recently, the company also scooped three awards at the Asia Insurance Awards 2019 in Singapore, including the "International Life Insurer of the Year – Vietnam".

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version