Global 5G subscriptions to top 2.6 billion by end-2025: Ericsson report

|

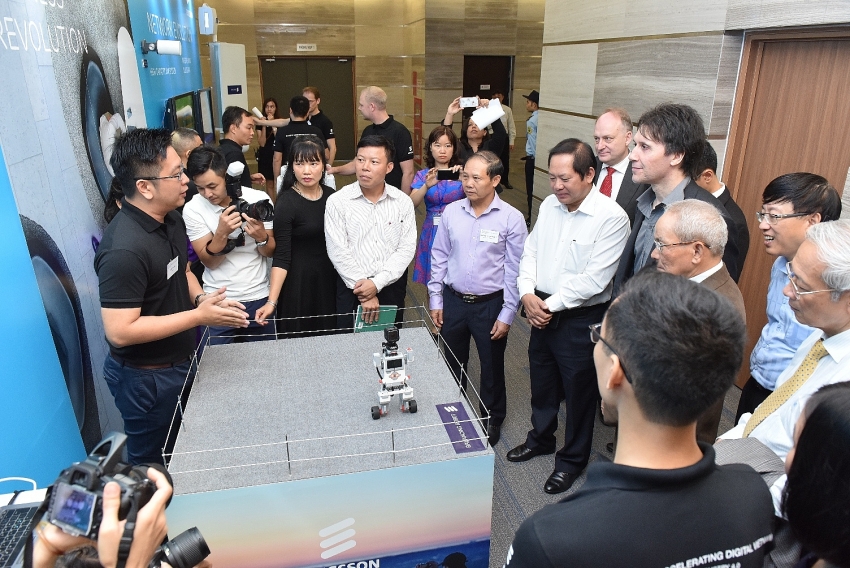

| Ericsson and ARFM demonstrated the uses of 5G technology |

Average monthly data-traffic-per-smartphone is forecast to increase from the current 7.2GB to 24GB by the end of 2025, in part driven by new consumer behaviour, such as virtual reality (VR) streaming. With 7.2GB per month, one can stream 21 minutes of HD video (1280x720) a day, while 24GB would allow streaming 30 minutes of HD video with an additional six minutes of VR each day.

The report also projects that 5G will cover up to 65 per cent of the global population by the end of 2025 and handle 45 per cent of global mobile data traffic.

2019 is the year leading communications service providers in Asia, Australia, Europe, the Middle East, and North America switched on their 5G networks. South Korea has already seen a big 5G uptake since its April 2019 launch. More than three million subscriptions were collectively recorded by the country’s service providers by the end of September 2019.

China’s launch of 5G in late October has also led to an update of the estimated 5G subscriptions for year-end 2019, from 10 million to 13 million.

Fredrik Jejdling, executive vice president and Head of Networks, Ericsson, said, “It is encouraging to see that 5G now has broad support from almost all device makers. In 2020, 5G-compatible devices will enter the volume market, which will scale up 5G adoption. The question is no longer if, but how quickly we can convert use cases into relevant applications for consumers and enterprises. With 4G remaining a strong connectivity enabler in many parts of the world, modernising networks is also key to this technological change we’re going through.”

In Southeast Asia and Oceania, it is expected that by 2025 4G (LTE) will have become the main mobile technology, with 63 per cent of the total number of subscriptions even though today WCDMA/HSPA is still the region’s dominant technology. 5G subscriptions are expected to make up 21 per cent of all subscriptions in the region by 2025.

According to another of Ericsson’s recent studies, "5G for business: a 2030 market compass" report, up to $700 billion of 5G-enabled business-to-business (B2B) value by 2030 can be addressed by service providers, which corresponds to 47 per cent of the total 5G-enabled market expected to be served by ICT players. For Southeast Asia and Oceania, the total projected value of 5G-enabled digitalisation revenues is forecasted to be at $88 billion by 2030, and of this, up to $41 billion or almost half, can be addressed by telecoms service providers.

Given its current momentum, 5G subscription uptake is expected to be significantly faster than that of LTE. The most rapid uptake is expected in North America with 74 per cent of mobile subscriptions in the region forecast to be 5G by the end of 2025. Northeast Asia is expected to follow at 56 per cent, with Europe at 55 per cent.

Other forecasts include: the total number of cellular IoT connections now seen at 5 billion by the end of 2025 from 1.3 billion by the end of 2019 – a compound annual growth rate of 25 per cent. NB-IoT and Cat-M technologies are estimated to account for 52 per cent of these cellular IoT connections in 2025.

On-year traffic growth for the third quarter of 2019 was high at 68 per cent, driven by the growing number of smartphone subscriptions in India, the increased monthly data traffic per smartphone in China, better device capabilities, an increase in data-intensive content, and more affordable data plans.

The report also takes an in-depth look at service providers’ tariff plans, revealing that most service providers who have launched 5G have priced 5G packages about 20 per cent higher than their nearest available 4G offering. Lastly, there is an article describing how automotive IoT meets different use case requirements of automotive and transport applications.

Ericsson, which stock is listed Nasdaq Stockholm and on Nasdaq New York, now has more than 75 commercial 5G agreements or contracts with unique communication service providers, of which 23 are live networks. Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans networks, digital services, managed services, and emerging business and is designed to help our customers go digital, increase efficiency, and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world.

| Huawei pushes 5G in Southeast Asia, brushing off 'tech war' with US Chinese phone giant Huawei said Sunday (Nov 3) it was ready to roll out 5G infrastructure across Southeast Asia, dismissing US warnings its tech could ... |

| 5G could boost annual revenue of Vietnamese telcos by $300 million The total number of 5G subscriptions in the ASEAN is forecast to exceed 200 million in 2025, and in Vietnam alone, the rollout of 5G ... |

| 5G to proliferate to more smartphone tiers, device classes next year With 5G coverage expected to expand strongly in the near future, new 5G NR devices and networks are being launched at a rapid rate to ... |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- France supports Vietnam’s growing role in international arena: French Ambassador (January 25, 2026 | 10:11)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- Russian President congratulates Vietnamese Party leader during phone talks (January 25, 2026 | 09:58)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- Int'l media provides large coverage of 14th National Party Congress's first working day (January 20, 2026 | 09:09)

- Vietnamese firms win top honours at ASEAN Digital Awards (January 16, 2026 | 16:45)

Tag:

Tag:

Mobile Version

Mobile Version