Forestalling impending deflation risk

Average inflation in 2021 may not be high, said Nguyen Duc Do, deputy director of the Institute of Economics and Finance under the Academy of Finance, as the economy “will not be able to fully recover” and the inflation rate increase of 2020 compared to 2019 reached only 2.31 per cent, much lower than the National Assembly’s (NA) goal of 4 per cent.

|

The NA set the target for 2021’s GDP growth at 6 per cent, with an average consumer price index (CPI) growth of 4 per cent, based on the unpredictable global situation. Do laid out two possible scenarios for inflation in 2021, both between 2 and 3 per cent, with the higher one based on potential strong fluctuations in gasoline and food prices.

However, both scenarios rely on a better-controlled pandemic thanks to efforts in vaccine development and distribution.

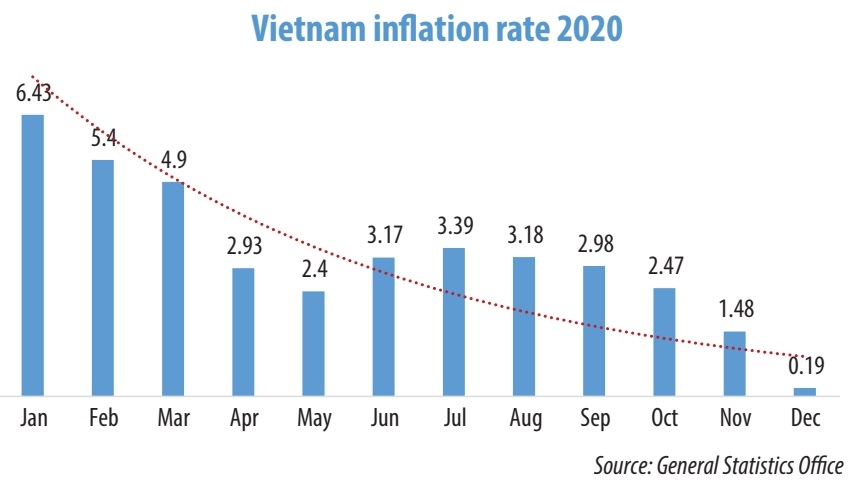

Prices tend to decrease or stabilise at lower levels in the face of major disruptions of supply and demand, and recover slowly as the crisis is gradually controlled. However, looking at the composites in 2020, Vu Dinh Anh, economic expert from of the Ministry of Finance’s (MoF) Price Market Research Institute warned of deflation as a very real possibility, as monthly inflation rates steadily dropping towards the zero mark over the last months of 2020.

Prices were frozen throughout 2020 except for a spike in June, which was caused by three consecutive increases in gasoline prices after a series of declines since the Lunar New Year, as well as the rise in pork prices in the first days of June, with transportation climbing the strongest with 6.05 per cent.

The CPI last month only increased by 0.19 per cent compared to the same period in 2019, showing that the price level and inflation in 2020 hardly changed, Anh said, and even remained similar to the depression in 1999-2000 when economic growth was at a record low coupled with low inflation.

Last year’s inflation showed the demand-pull factor, as total retail sales of consumer goods and services expanded only by 2.6 per cent compared to 2019 and, if excluding the price factor, decreased by 1.2 per cent. The leading role of demand-pull in inflation was stronger as the industry’s producer price index in 2020 decreased by 0.6 per cent, while services fell by 0.73 per cent, with only agricultural prices seeing an increase of 8.24 per cent. Meanwhile, the import-export price indices decreased by 0.59 and 1.32 per cent, respectively.

In addition, currency movements would support higher inflation rates, with the total means of payment increasing by 12.56 per cent on-year as of December 21.

The credit growth of the economy reached 10.14 per cent in 2020, while it grew by 12.14 per cent the year before. Meanwhile, GDP growth in 2020 stood at only 2.91 per cent, compared to 2019’s 7.02 per cent.

Basic inflation in December last year increased by 0.99 per cent over the same period, and the average base inflation in 2020 ascended by 2.31 per cent compared to 2019.

Moreover, the US Dollar Index last month remained almost unchanged both over the same period last year and as the year’s average, while foreign exchange reserves increased sharply amid a trade balance surplus of $19.1 billion.

“This looming deflation could go hand-in-hand with the pandemic throughout the entirety of 2021 if there are no reasonable inflation stimulus measures,” Anh said.

However, there are still several factors that will cause the CPI to rise in 2021, preventing the economy from falling into deflation.

Expert Nguyen Cong Dinh from the Department of Price Management under the MoF said that commodity markets tend to rise based on the prospects of a weakening dollar, while inflation could return if stimulus measures for the economy are stronger.

“Prices of many types of raw materials and fuels on the global market will increase again when the pandemic finally gets under control and production, trade, and international exchange are restored,” Dinh said.

He also explained that price increases will focus on agricultural products and base metals, as supplies are tightened by unfavourable weather and China’s demand for metals and stimulus measures for its economy.

Therefore, the management and administration of prices and inflation control “should continue to be done cautiously, flexibly, and proactively in 2021” to keep inflation below 4 per cent, thus following the NA’s set target.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

Tag:

Tag:

Mobile Version

Mobile Version