Foreign banks close to coveted new status

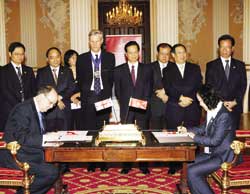

Prime Minister Nguyen Tan Dung last week gave the crucial green light for HSBC and Standard Chartered to secure more Vietnamese market shares in the near future.

Foreign financial houses are banking on rich pickings in the local market |

HSBC Vietnam president and CEO Thomas Tobin said the new Ho Chi Minh City-based HSBC Bank (Vietnam) Limited, wholly-owned by the Hongkong and Shanghai Banking Corporation Limited, would help amplify HSBC’s organic presence as part of its dual growth strategy for Vietnam, which is based on strategic alliances and organic expansion.

“This is a great milestone in our long history in the country. Local incorporation will now give us a platform to enhance our direct participation in Vietnam’s fast developing financial market,” said Tobin.

HSBC has so far forged strategic partnerships with Vietnam’s third largest joint stock commercial bank Techcombank and Vietnam’s leading insurance and financial services group Bao Viet Holdings.

“The new licence [to be granted by the State Bank of Vietnam] will allow us to reach our existing and new customers through a broader distribution network in major economic centres of Vietnam,” he added. The new bank would focus on consumer, small and medium-sized enterprises (SME) and internet banking.

In its proposal for establishing the local incorporation, HSBC unveils an initial chartered capital of $100 million in the first year, which will be increased to VND3 trillion ($187.5 million) in the second year to meet the central bank’s requirement.

HSBC also has plans to open three additional branches in Danang, Can Tho and Binh Duong in a near future.

Standard Chartered Bank, meanwhile, said the future full approval would be a springboard for its consumer and wholesale banking business development in the bank’s key growth market in Asia.

“Full approval would enable us to rapidly grow our distribution network across Vietnam and provide a new range of innovative consumer and SME banking products and services,” said Ashok Sud, Standard Chartered’s Vietnam CEO.

“The decision will enable Standard Chartered to move ahead with planning to open as many as 20 to 30 new branches in Vietnam over the next three to four years,” said Ray Ferguson, Standard Chartered Bank’s Regional CEO Southeast Asia.

Standard Chartered has offices and branches in Hanoi and Ho Chi Minh City and is a strategic partner with Asia Commercial Bank, Vietnam’s largest privately owned bank.

A year ago, the State Bank outlined regulations for opening wholly foreign-owned, locally-incorporated banks in Vietnam. However, foreign applicants have had to wait for either an agreement or memorandum on inspectorate cooperation on management, supervision and information exchange signed between the central bank of Vietnam and its counterpart in the nation where the foreign bank is headquartered.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version