FiT revamp vulnerable to speculation

|

| The MoIT would replace the FiT with competitive bidding Photo: Le Toan |

The central province of Binh Thuan, where there is high potential to develop renewables in Vietnam, has asked relevant authorities to carefully review the financial capacity of locally-invested company HLP Invest after it submitted a proposal to survey land for a giant $4.4 billion wind project.

Established in 2017, HLP Invest initially had a charter capital of only VND3 billion (over $130,000), with seven founding individual shareholders. Among them, general director Nguyen Manh Cuong is the largest shareholder, contributing about 38 per cent of the charter capital.

Besides that, Cuong is also the founding shareholder of VSP Binh Thuan II Solar Power JSC, which is proposing to transfer 100 per cent of capital to overseas investors.

Cuong said that in order to select qualified investors and push the project in time, it may have to tighten the requirements, with Vietnam poised for a renewable energy boom thanks to a feed-in tariff (FiT) of 9.35 cents per kilowatt-hour (KWh) for solar, FiT of 8.5 cents KWh for onshore, and FiT of 9.8 cents KWh for offshore wind projects, for a period of 20 years.

Some experts, however, have raised questions as to whether or not domestic companies are simply registering projects like this and then reselling it to other investors, with wind farm development depending critically on the experience of international project developers.

“Most solar and wind developers in Vietnam have no idea about energy and are only interested in land acquisition. They consider renewable energy projects as real estate ones so the strategy is to get the land and/or the power purchase agreement then sell as soon as possible to take the profits,” solar rooftop expert Mai Van Trung told VIR.

|

Risky developments

According to the Ministry of Industry and Trade (MoIT), as of May 11 there were 92 solar power projects and 10 wind power ones operating commercially in the nation, with a total capacity of nearly 6,000MW.

The ministry admitted that some projects have been transferred partially or wholly to foreign investors by establishing joint ventures or share sales, including investors from Thailand, the Philippines, China, Singapore, and Saudi Arabia.

One Indian renewable investor who has three renewable energy projects across Asia told VIR that Vietnam’s surging demand and high FiT for renewable are luring interest, but it poses more risks for latecomers as the rate will be locked in the coming time.

According to Decision No.13/2020/QD-TTg dated April 6 on incentives for development of solar energy in Vietnam, the newly-released FiTs will only be available for projects with commercial operation date prior to December 31. This is a short timeline, considering the long lead-in-time for some deliveries and, for many projects, completing land acquisition procedures.

Meanwhile, Nguyen Dang Anh Thi, an energy and environmental specialist in Canada said, “We have seen a boom in investment into renewable energy, mostly solar photovoltaic (PV), in Vietnam in the last three years. It is a good sign that the country is doing the right thing in clean energy transition. However, as an emerging market where a reasonable legal framework is yet to be established, while the current FiT is attractive, there is no question that a lot of so-called investors have been trying to acquire as many projects as they can.”

Thi added that the big concern is while real investors with strong technical expertise and financial resources are still looking for good projects to invest, others are just sitting on their projects doing nothing but trying to make money by selling their licences.

This project speculation not only limits the country from having the correct and best investors but also causes damage to the business environment. Specifically in solar PV, these activities will potentially cause delays in venture installations and overall delays in the national energy master plan, causing electricity shortages.

Meanwhile, John Rockhold, chairman of the Vietnam Business Forum’s Power and Energy Working Group, pointed out that many local businesses have registered renewable energy projects and then find a way to sell to others because local authorities do not get the necessary data to carefully and impartially appraise project proposals, with no specific standard criteria to assess the capacity of the investor including experience, financial and technical capacity.

He suggested that this could be minimised by requiring data to impartially appraise the capacity of investors by competent authorities and actively support investors by facilitating compensation and land clearance to minimise difficulties raised.

The hot renewable development of Vietnam, while bringing success, is also spurring more risk for investors involved in mergers and acquisitions and competition for land, and causing issues with an overloaded grid and transmission lines.

An auction fix

The MoIT is studying and proposing to apply a bidding mechanism for developing renewable energy sources to replace the FiT mechanism in the future. With the support of the World Bank, the government is designing a programme based on the present strategy developed through consultations with various ministries and the private sector. This is considered to be more beneficial for the development of Vietnam’s renewable energy market when technology costs fall sharply, and renewable energy can compete with traditional sources including coal and gas.

A competitive bidding mechanism, if established, can help to select the right investors and reduce the development risks perceived by them, thus reducing risk premium expectations in equity returns and cost of debt of the project, according to energy and environmental specialist Thi. As a result, the competitive bidding could lead to a reduced solar PV tariff being offered. “There are many international best practices in competitive bidding around the world for Vietnam to learn from,” Thi added.

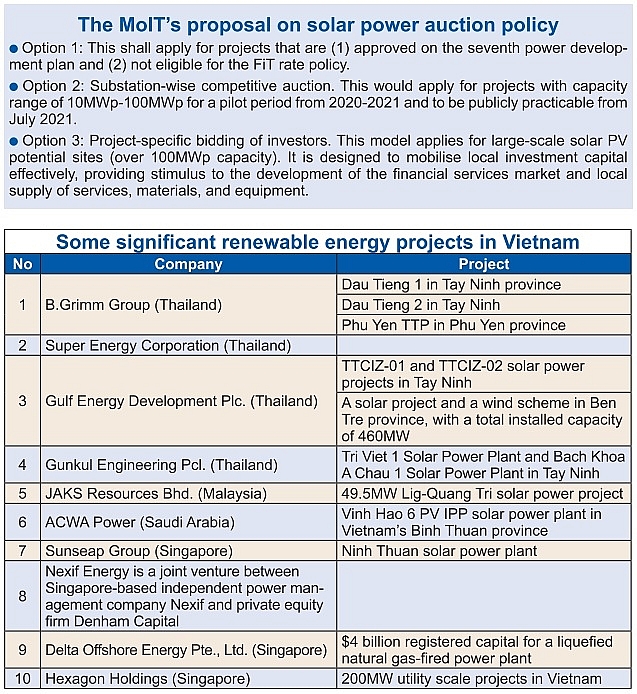

The Vietnam Business Forum’s Power and Energy Working Group said that the MoIT proposed in March a “competitive pricing mechanism for solar PV power project development” to the prime minister for approval, which outlines three auction options that can apply in parallel for years to come (see box).

Rockhold said that with the first option, concerns remain that financially unqualified investors are getting licences for projects approved under the national power development plan who only registered bids to pass the project on to foreign investors. Regardless of their capacity to back up a competitive bid, they manipulate bidding with the sole goal of selling their major or minor stakes in project companies for marginal profit. “As soon as an under-qualified local investor has his project approved, he will reach out to sell the project right away. Bidding or not, they were planning this from the start. In this case, it would not fix the problem,” Rockhold said.

Meanwhile, the second and third options might help to eliminate under-qualified investors to secure projects and sell them at a later stage as in bidding dossiers they have to prove their qualifications and capacity to bid. “Auctions also require that all information and costs on land, grid connections, compensation and more are made available,” Rockhold added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

Tag:

Tag:

Mobile Version

Mobile Version