Export goals supported by resolution

The Vietnamese government in its resolution for the July cabinet meeting released two weeks ago ordered ministries and localities to closely follow the international and regional situation in order to take the initiative in analysing, forecasting, and formulating scenarios to cope with the new situation. It also asked for “timely implementation of priority policies on inflation control and macroeconomic stability to ensure major balances of the economy, while also boosting socioeconomic recovery and development”.

|

| Vietnamese exports are being affected by current global economic fluctuations, Photo: Shutterstock |

The government also required ministries and localities to “quicken cuts, reduction, and simplification of administrative procedures; improve the business climate; and facilitate and reduce costs for investment and business”.

The government also required the Ministry of Industry and Trade (MoIT) to seek solutions to boost exports and closely control imports, while taking advantage of commitments in signed free trade agreements in order to expand export markets.

The MoIT is ordered to direct Vietnam’s trade offices overseas to seek more information and demands from the markets where they are located in order to provide consultancy for the government and the prime minister on how to boost exports to these markets.

The Ministry of Planning and Investment (MPI) has warned of big risks in global markets, which can affect the Vietnamese economy, mostly exports. “The domestic economy is quite open to the global economy, with the country’s total export-import turnover nearly double its GDP. Thus it is prone to be vulnerable to external shocks,” said an MPI report sent to the government.

Vietnam’s GDP expanded to $363 billion in 2021. Exports of goods and services, valued at $55 billion 15 years ago, soared to $336.3 billion in 2021. Imports were valued at $332.23 billion – up 26.5 per cent on-year, while total trade turnover hit $668.5 billion, up 22.6 per cent.

Looming risks

In its latest Global Economic Prospects report released in June, the World Bank stated that global growth is expected to slump from 5.7 per cent in 2021 to 2.9 per cent in 2022 – significantly lower than 4.1 per cent that was anticipated in January.

“It is expected to hover around that pace over 2023-24, as the situation in Ukraine disrupts activity, investment, and trade in the near term, pent-up demand fades, and fiscal and monetary policy accommodation is withdrawn,” said the World Bank in a press release. “Growth in advanced economies is projected to sharply decelerate from 5.1 per cent in 2021 to 2.6 per cent in 2022 - 1.2 percentage points below projections in January. Growth is expected to further moderate to 2.2 per cent in 2023, largely reflecting the further unwinding of the fiscal and monetary policy support provided during the pandemic.”

Two weeks ago, the bank released a forecast that Vietnam’s GDP growth is forecast to surge from an estimated 2.6 per cent in 2021 to 7.5 per cent in 2022. Vietnam’s economy expanded 5.2 per cent in Q4/2021, 5.1 per cent in Q1/2022, and 7.7 per cent in Q2/2022, as consumers satisfied pent-up demand and foreign tourist arrivals picked up.

“However, this positive outlook is subject to heightened risks that threaten recovery prospects. Risks include growth slowdown or stagflation in main export markets, further commodity price shocks, continued disruption of global supply chains, or the emergence of new COVID-19 variants,” the forecast explained. “Domestic challenges include continued labour shortages, the risk of higher inflation, and heightened financial sector risks.”

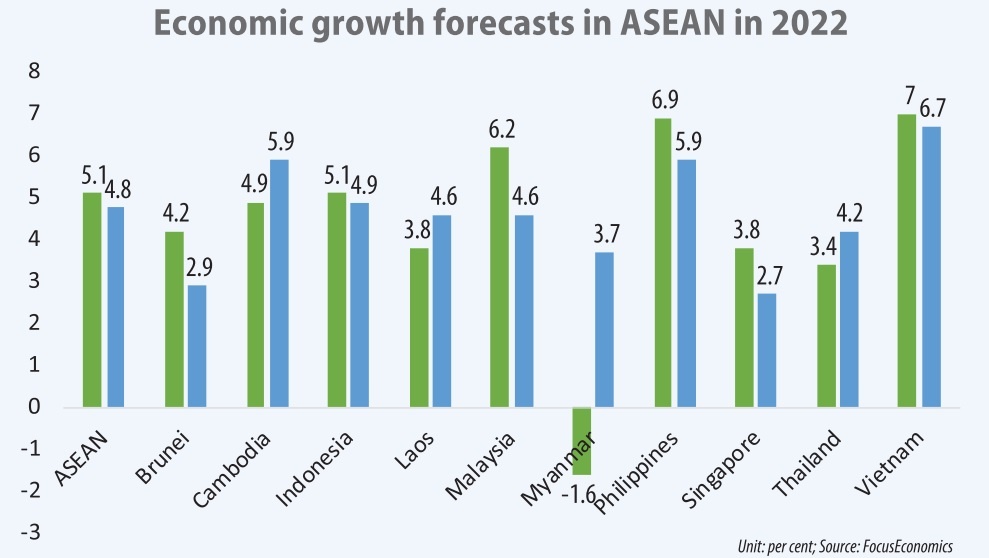

The Asian Development Bank (ADB) in its Outlook Supplement report released three weeks ago revised the growth forecasts for developing Asia from 5.2 to 4.6 per cent for 2022 and from 5.3 to 5.2 per cent for 2023, reflecting worsened economic prospects because of the Russia-Ukraine conflict, more aggressive monetary tightening in advanced economies, and pandemic lockdowns in China.

“In Vietnam, trade continued to expand in the first half of 2022, and domestic mobility, manufacturing, and consumption rapidly recovered. But the economy faces challenges from a deteriorating external economic environment triggered by the aggressive monetary tightening of advanced economies and growth moderating in China,” the report read. “On balance, however, the growth forecast is maintained at 6.5 per cent for this year and 6.7 per cent for next year.”

Vietnam’s key export markets such as the US and the EU are projected to suffer from difficulties until the year’s end.

The ADB predicted that growth in the US will weaken in 2022, with the forecast revised down to 2.2 from 3.9 per cent and sliding to 1.7 per cent in 2023. The downward revision reflects a much more aggressive tightening by the Fed than was assumed in the bank’s previous outlook report in response to higher-than-expected inflation.

Inflation in the US will remain elevated this year, at a projected 7 per cent, due to continuing pressure from high commodity prices before moderating to 3 per cent in 2023.

Meanwhile, the growth in the euro area accelerated to a seasonally adjusted annualised rate of 2.5 per cent in Q1/2022 from 1 per cent in the previous quarter. This was primarily driven by increasing inventories and positive net trade, which outweighed a contraction in household spending and a slowdown in fixed investment amid soaring inflation, souring consumer sentiment, and persistent supply constraints.

Also, the EU has slashed its forecasts for economic growth amid the prolonged Russia-Ukraine conflict and disruptions to energy supplies. Accordingly, the EU’s GDP will expand 2.7 per cent this year and 2.3 per cent in 2023.

Minister of Planning and Investment Nguyen Chi Dung said, “Any fluctuations in the global market including high inflation, high prices of materials, and supply chain disruptions can have negative impacts on the country’s macroeconomic stability, economic growth, exports, inflation, and people’s livelihoods.”

|

Taking caution

By late last year, projecting that the global market will see negative fluctuations in goods demands, the National Assembly set a target that Vietnam’s export-import turnover for 2022 will be $660.8 billion, including $329.9 billion for exports and $330.9 billion for imports. This means a $1 billion trade deficit.

This target is lower than what was reaped last year, in which the export-import turnover hit $668.5 billion, with a trade surplus of $4.08 billion. In the first seven months of this year, total trade hit $431.94 billion, up 14.8 per cent on-year, with a trade surplus of $764 million. This included $216.35 billion for exports, up 16.1 per cent; and $215.6 billion, up 13.6 per cent, according to the General Statistics Office.

Many key export markets of Vietnam saw an on-year rise in export turnover, such as China ($30.4 billion – up 6 per cent), the US ($67.1 billion, up 24.3 per cent), Southeast Asia ($20.6 billion, up 27.1 per cent), the EU ($27.9 billion, up 22 per cent), and South Korea ($13.9 billion, up 14.5 per cent).

However, the MoIT noted in its 7-month trade situation of Vietnam that the world economy’s recovery is slowing down, and a short-term recession may occur. Inflation may continue to be high in some major economies, accompanied by faster monetary policy adjustment, potentially posing risks to the stabilisation of the global financial and monetary markets.

The MoIT said, “The global economic outlook will continue to be influenced by the direction of the Russia-Ukraine conflict, and the adjustment of financial-monetary policies in many nations will affect supply and consumption, thereby affecting production, and import and export activities.”

Currently, the price of fuel and input materials remains high, which resonates with the recovery of domestic consumption, creating inflationary pressures and high production costs, in addition to labour shortages and decreased consumer demands for non-essential goods.

“This requires the whole trade and industry sector not to be negligent. It must closely monitor the situation of supply and demand fluctuations, and commodity prices worldwide and in this country in order to use suitable solutions to achieve the desired goals of the sector,” said the MoIT.

| Textile-garment exports set to reach 43 billion USD this year: VITAS Vietnamese textile-garment producers set to earn up to 21 billion USD from exports in the second half of 2022, raising total shipments of the year to around 42 – 43 billion USD, Chairman of the Vietnam Textile & Apparel Association (VITAS) Vu Duc Giang told a press conference on July 21. |

| Exports to the Americas eye strong rebound Robust rebound in America post-pandemic has ushered in multiple opportunities to beef up export of Vietnam’s key products. |

| Firms must work to fully benefit from UKVFTA: Insiders The UK-Vietnam Free Trade Agreement (UKVFTA) has given a big push to Vietnamese exports, but insiders said firms still have much to do to make the most of the deal. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Spring Fair 2026 boosts domestic demand (March 02, 2026 | 16:30)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

Tag:

Tag:

Mobile Version

Mobile Version