Expansion in Vietnam a must for Japanese investors

Japanese investors continue to step up their merger and acquisition (M&A) activities in Vietnam. Do you expect any other mega deals from Japanese investors in the coming time?

|

| Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation |

The financial sector in Japan stands out as one of the sectors where the consolidation is almost complete, leaving a handful of players actively looking at the Southeast Asian markets for growth opportunities. At the same time, the pool of attractive targets in the Vietnamese financial sector has diminished after some transactions closed in recent years, limiting opportunities for additional mega deals.

Beyond the financial realm, Japanese companies are also interested in having stakes in the social infrastructure of high-growth countries like Vietnam, particularly in sectors such as food, energy, telecoms, and logistics. While the scale of investments in these sectors may be modest, the overall interest and commitment from Japanese companies remain robust.

The financial strength of Japanese companies, amassing $2.26 trillion in cash reserves over the years, shields them from the impacts of tightened financial markets and higher interest rates. Although the weakness of the Japanese yen is negative for the short-term, Japanese companies are actively pursuing mega deals in both Japan and the US. The feasibility of other mega deals in Vietnam hinges on the availability of compelling opportunities in the market.

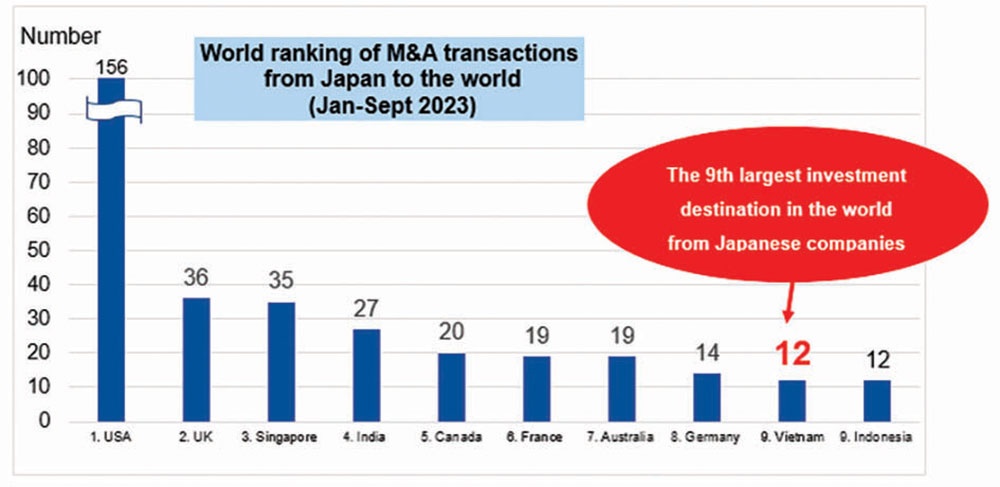

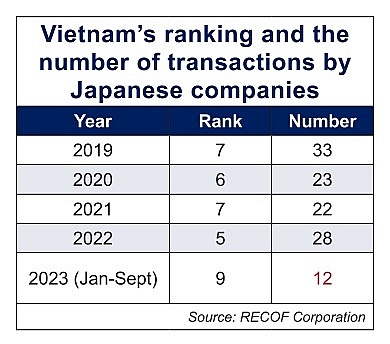

A noteworthy trend among Japanese investors is their evolving focus, now extending to other countries beyond Vietnam. According to our statistics on the number of transactions from Japan, 12 transactions in both Vietnam and Indonesia were announced before September this year, and two countries ranked ninth, after the US, the UK, Singapore and others. Vietnam ranked fifth in 2022 and was clearly ahead of Indonesia.

|

Japanese companies are not only facing competition from investors from Asian nations, but also from US investors. How do you see the competition in Vietnam’s M&A market in the coming time?

|

While Japanese private equity funds exhibit comparatively lower activity outside Japan than their US counterparts, it is imperative to emphasise that the majority of M&A transactions undertaken by Japanese companies are primarily strategic in nature. While there are some major investments by US private equity funds, they are financial investments (often on a minority basis) and may not be for the long term.

This is probably one of the reasons behind major Vietnamese corporate groups being more receptive to non-Vietnamese investors, as their influence tends to be less intrusive than pure strategic investors aiming for operational control of targeted companies. I believe these investments from the US (and from Singapore in most cases) have little impact on the competitive landscape for Japanese players.

Of greater concern for Japanese strategic investors is the escalating competition from South Korean and Thai companies in such sectors as manufacturing, retail and financial services. In some cases, Japanese companies lost opportunities against their competitors and are difficult to recover because the number of sizable target companies available for acquisitions is actually limited.

Could you compare the characteristics and strengths of Japanese buyers with those of other investors to secure a strong footprint in Vietnam’s M&A market?

Japanese investors are widely recognised for their methodical and cautious decision-making approach, which often results in missed opportunities due to their conservative nature. It often makes our business difficult because we are often involved in transactions between Japanese and Vietnamese companies, either on the buy side or the sell side.

However, once Japanese investors reach a decision, they exhibit a strong commitment to the success of their investments over the long term. Establishing a foothold and expanding within the Vietnamese market is a must-do for many Japanese companies seeking growth, and they adamantly continue their efforts to be successful in this market, either through acquisitions or greenfield investments.

Generally speaking, Japanese companies are in good financial positions, less reliant on external financing, and less affected by rising interest rates. This is one of the reasons why Japanese companies will remain one of the major players in Vietnam’s M&A market.

| Japan at fore of experience in agriculture High-tech agricultural development is set to be intensified between Vietnam and Japan. |

| Japanese VCs expand tranche of investment Despite headwinds in capital mobilisation, Japanese venture funds are doubling down on Vietnam’s startup ecosystem, underscoring the nation’s pivotal role in their quest to cultivate a vibrant Southeast Asian startup landscape. |

| Japanese investors still motivated by M&A promise Despite shrinking dealmaking activities involving Japanese investors, Vietnam still ranks high in the world in the top 10 mergers and acquisitions destinations for Japan. Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation, talked to VIR’s Thanh Van about the landscape of Japanese deals so far this year. |

| Japanese escalate investment studies Japanese investors are implementing a careful study of the business environment in Vietnam, providing a basis for their long-term and sustainable expansion. |

| Dong Thap calls for investment from Japan A conference aimed at promoting investment and trade cooperation between the Mekong Delta province of Dong Thap and Japan was organised on November 29, attracting more than 50 enterprises and investors from both sides. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- South Korean VC completes buyout of Chicken Plus Vietnam (February 25, 2026 | 07:55)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- KKR and Singtel step up data centre investment in Southeast Asia (February 06, 2026 | 13:09)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

Tag:

Tag:

Mobile Version

Mobile Version