Exchange rate spike not deemed an imminent threat

Specifically, USD was trading around VND23,833 bought and VND23,873 sold. After a lull, the VND-USD exchange rate has slightly recovered, yet the possibility of a sharp hike as seen previously does not look imminent.

|

| Exchange rate spike not deemed an imminent threat, photo Le Toan |

By late last week, the State Bank of Vietnam (SBV) listed the central exchange rate at VND23,830 per US dollar, broadly level with the week before.

A senior executive of state-owned lender BIDV noted that the move was different from the market situation in January, when the interbank exchange rate had maintained a downward trend since December.

The BIDV leader attributed January’s softened exchange rate to a variety of factors. First was the conducive international environment, with the US Federal Reserve expected to soothe the degree of tightening in the face of cooling inflation and a weakening economy.

Secondly, the domestic environment was also positive. The foreign currency balance resumed a large surplus estimated at $3.5-4 billion, with a bright spot in the trade surplus figure which was estimated at $3.6 billion, as imports fell more sharply than exports.

“In the context that the exchange rate tends to drop amid favourable conditions from both the domestic and international environment, the SBV returned to buying foreign currencies to replenish its already eroded foreign exchange reserves in 2022, with an estimated additional buying volume of about $3 billion,” said the BIDV leader.

The market movements also expose some pressures from the international market. In mid-February, Fed officials made comments on monetary policy, in which the base rate was expected to reach 5.25 per cent. This was higher than previous expectations, although the US central bank stressed that it would make decisions based on overall economic circumstances.

According to global derivatives marketplace CME Group, there was now more of a possibility that the Fed would raise the interest rate three more times this year, to 5.25-5.5 per cent. CME’s director said that the exchange rate in the market saw an upsurge because the domestic foreign currency supply has been slowing down and remittances fell in late January. There has also been a moderate trade balance situation.

The low unemployment rate in January would mean that the Fed had more room to maintain high interest rates, and it is expected that it will raise the interest rates by a total of 50 points in the upcoming two sessions in March and May.

Also, the domestic environment institutes a key factor driving the rate to go up further, according to BIDV, as imports of raw materials have significantly been slowing down recently, casting inevitable impacts on exports due to the intermediary characteristics of Vietnam in the global value chain.

“Indeed, the liquidity of the banking system has become more fruitful in February thanks to cash circulating back to the banking system after the Lunar New Year, supplementing the cash supply in the system,” said the BIDV executive.

Besides this, the mobilising-credit balance also tends to expand, with the gap hovering around 0.3-0.5 per cent in the favour of credit. Commercial banks continue to access additional capital through the deposit channel of the state treasury and the SBV’s open market, he added. Notably, the SBV bought in foreign currency early this month, which contributed to complementing the market VND supply.

Both experts and bank leaders, however, assume that the possibility of a spike is not substantial, as the Fed is approaching the end of the process of raising interest rates. China is still in the process of opening up its economy, and the domestic foreign currency supply-demand shortfall also may not return soon.

The SBV wants to act proactively with various tools to stabilise the domestic exchange rate. Accordingly, the interbank VND-USD exchange rate in February is expected to pick up 0.5-0.7 per cent compared to the end of January.

| Previous financial crises thus far averted via stable moves The increase of the central exchange rates and adjustment of the exchange rate band of the State Bank of Vietnam are suitable with the trends of other currencies at a lighter level. |

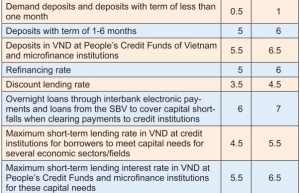

| State Bank of Vietnam alleviates market pressures The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates. |

| New exchange rate policy not without risk Exchange rate volatility is increasing due to geopolitical shocks across the globe. Thanks to its sound policy framework, Vietnam has remained largely immune to such international turbulence. However, exchange-rate depreciation is not without risks, writes Patrick Lenain, senior associate at the Council on Economic Policies. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version