EVFTA raises stakes in pharma market

|

| The EVFTA is expected to make a significant impact in the healthcare picture of EU investment in Vietnam |

The EU Business Avenues in Southeast Asia will bring some 50 groups involved in healthcare and medical technologies to Singapore and Vietnam between July 30 and August 3 to seek business and investment opportunities.

During their stay, these groups will showcase the latest technologies and innovations in lab equipment, telemedicines and remote health monitoring, assistive technology, dental equipment, ICT solutions, and aesthetic and other medical equipment.

The trip, which is being made following the signing of the historical EU-Vietnam Free Trade Agreement (EVFTA), proves how strong their interest in the Vietnamese lucrative pharmaceutical market is.

Open market access

The market is a burgeoning one in the EU, and is currently Vietnam’s biggest pharmaceutical import market. It is estimated that the country imports around 55 per cent of the total demand.

It is projected that the EVFTA will bring more investment opportunities to EU pharma businesses in Vietnam and stiffening market competition. The landmark FTA will open the Vietnamese market in fields that businesses have been seeking particular solutions to for years, such as intellectual property rights (IPR), direct pharmaceuticals imports, and tenders, among others.

According to the World Trade Organization (WTO) Centre of the Vietnam Chamber of Commerce and Industry, pharmaceutical imports from the EU into Vietnam will be more favourable, accessible, and direct under EVFTA commitments. What is more, IPR for pharmaceuticals will be intensified which make difficulties for patent-protected pharmaceuticals to become generic drugs, and thus have their prices reduced. And competition in tenders for groups of pharmaceuticals to open to EU bidders in the ethical, or prescription drugs channel will also be strengthened further.

According to the agreement, Vietnam will have to remove the requirement on the minimum period between the period of licence in the EU and that of seeking circulation in Vietnam, and remove the criteria that are stricter than the international practices in clinical research.

In terms of the rights to pharmaceutical business, Vietnam commits to allow EU-based foreign-invested enterprises (FIEs) to import drugs into the country. They will be also permitted to build warehouses to preserve imported drugs, carry out clinical research and trials, and introduce information about imported drugs to healthcare staff in line with local rules.

Essentially, these commitments are similar to those Vietnam commits to in the WTO. However, these commitments help make clearer the rights of EU-invested enterprises, as dealing with the contents cause differences in understanding of WTO commitments.

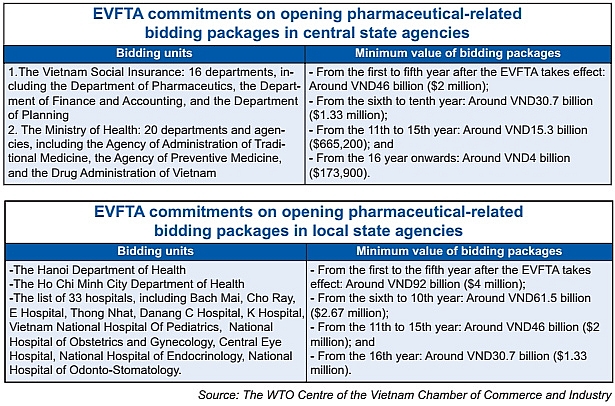

The other important change is drug tenders towards opening the government procurement market to EU businesses (see tables).

According to multinational corporations (MNCs), when they transfer technology of branded drugs to WHO-GMP factories in Vietnam, they eye tenders of Group 1 of brand-name drugs. Now, more favourable conditions will come for them to be able to venture further.

While having the advantage in many areas, the EVFTA will not make any changes to the pharmaceutical distribution market. This means that EU companies are still not allowed to distribute pharmaceuticals of other brands in Vietnam.

IPR, direct pharmaceuticals imports, and tenders have been among the concerns of EU companies when making business and investment in Vietnam. The European Chamber of Commerce in Vietnam’s (EuroCham) Pharma Group, which represents the voice of 23 members including Bayer Vietnam, Novartis Pharma, and Zuellig Pharma, have been seeking solutions to these at the Vietnam Business Forum and many other conferences to enable them to expand in the country.

|

EVFTA drives new investment

Vietnam is now available for many kinds of branded pharmaceuticals produced in third countries. MNCs tend to produce branded drugs in related nations to reduce costs and to focus more on the life science industry to tap into local advantages. Vietnam, where the drug spending per capita rose 10.6 per cent on-year to an estimated $53.54 in 2018, is forecast to increase further in the coming time.

According to Minister of Health Nguyen Thi Kim Tien, together with rapid economic growth, Vietnam is facing a big burden from disease including non-communicable diseases (NCDs) and communicable diseases. NCDs make up around 70 per cent of Vietnam’s disease burden and causes 77 per cent of total deaths in the country. To prevent and control NCDs in general, as well as heart disease and diabetes in particular, the Vietnamese government launched the Vietnam Health Programme with 11 solutions. Moreover, the ministry is also focusing primary healthcare at grassroots health centres. “We are calling for involvement of the private sector to join the Ministry of Health’s (MoH) efforts to fight NCDs and increase access to healthcare,” Minister Tien said.

Vietnam is seeing a growing number of partners in public-private partnerships (PPP), and more favourable conditions will manifest via the upcoming EVFTA. While MNCs are now expanding local production to reap the incentives from the supporting policies for domestically-produced pharmaceuticals and outsourcing, and to benefit from the EVFTA, many others are trending towards the innovative life sciences sector, with Novartis, Bayer Vietnam, GSK Vietnam, and AstraZeneca being among the big players.

Pharma giant Bayer Vietnam has collaborated with various entities to enhance knowledge and awareness of key health issues and NCDs in the country. The Bayer’s network of academic partners in the country is constantly growing, and it is collaborating across different disease areas from cancer through heart and eye diseases to gynecological diseases. For example, one week ago Bayer, in collaboration with the Vietnam Cardiology Association, brought together more than 400 multi-disciplinary experts from across the nation with leading international experts to exchange the latest knowledge and share best practices on optimal stroke management for Vietnamese patients. The company has also joined forces with the General Office of Population and Family Planning and the Vietnam Women’s Union to run a public health education programme for the past three years.

Elsewhere, British-Swedish multinational group AstraZeneca recently announced $220 million investment in Vietnam, building on its strong long-term prospects.

Despite the importance, attracting private investment in healthcare remains a tough task because of a lack of regulatory frameworks, qualified human resources, cumbersome procedures, and unclear mechanisms in using the state budget in such projects.

The absence of a circular guiding Decree No.63 15/2015/ND-CP on the PPP model has remained a concern for some time. Investors expected that the MoH would soon issue the circular to enable them to make the next steps, while studying a suitable PPP model for the sector.

The MoH was due to complete the document within the year to facilitate PPP development. However, the ministry may have to consider a delay as the long-awaited Law on PPP is to be published in the next few months.

MNCs are now ready to make the next steps. The issue now regards what Vietnam can do to create a regulatory framework that encourages attraction, thus enabling private and overseas investors to join the healthcare revolution for high-quality healthcare services of Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version