Decades of benefits becoming clear through expansive RCEP

Nguyen Thi Thu Trang, director of the Centre for WTO and International Trade under the Vietnam Chamber of Commerce and Industry, told VIR that Vietnam will get many trade and investment benefits from the Regional Comprehensive Economic Partnership (RCEP) to which it is a signatory.

“In addition to helping Vietnam amplify its trade with the deal’s member countries, and unlike almost other multilateral free trade agreements (FTAs) that have Vietnam’s membership, the RCEP will especially help Vietnam attract more investment from markets that are its top 10 foreign investors including South Korea, Singapore, Japan, China, Thailand, and Malaysia,” Trang explained.

|

The RCEP took effect on January 1 and includes the 10 ASEAN member states along with China, Japan, South Korea, Australia, and New Zealand.

According to Trang, while implementing projects in Vietnam, investors would need to import for production and then export abroad, including to RCEP member states.

“One of the most noticeable points in the RCEP is that this agreement has been designed to reduce costs and time for business people, and the deal allows them to export goods to each member market without having to meet that market’s own requirements,” Trang said. “This will help investors increase funding in Vietnam.”

“For example, for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), enterprises from Vietnam will find it difficult to take advantage of tariff incentives for their garments and textiles due to tough requirements in the rule of origin (ROO) applied commonly within the bloc because many types of materials Vietnam need are imported from China, which is not a CPTPP member. However, for the RCEP, the burden of import costs for input materials will be reduced thanks to tariff incentives.”

Furthermore, the RCEP will greatly benefit Vietnam’s many key export items including garments and textiles, agricultural products, and aquatic products exported to the member markets like Japan and South Korea.

Specifically, under the Vietnam-Japan FTA and ASEAN-Japan Comprehensive Economic Partnership and under the Korea-Vietnam FTA and the ASEAN-Korea FTA, the garments and textiles are subject to meeting second-phase ROO, meaning material must be produced within ASEAN or Japan or South Korea before receiving tariff incentives. Meanwhile, under the RCEP, Vietnam can import it from everywhere and conduct production in its territory, and the products can enjoy tariff incentives when exported to Japan or South Korea.

Similarly for aquatic products, those agreements require ROO in Vietnam, but the RCEP allows the country to import breeds from anywhere or source the breeds from inside of its territory, and all export products are still entitled to tariff incentives.

According to the Centre for WTO and International Trade, in 2021, Vietnam earned an export turnover of $132.32 billion from RCEP markets, up 16 per cent on-year, and spent $238.5 billion on imports from these economies – meaning a $106.18 billion trade deficit. “Thus it is expected to help Vietnam attract more investments from the member states and enable domestic companies to seek more partners,” Trang said.

She added that there is no worry about the RCEP causing a big trade deficit as Vietnam’s commitments on import tariff reductions are almost the same as other FTAs, and the demand for Vietnamese goods from those markets has been rising strongly. Meanwhile, almost all products imported into Vietnam are used for production and then re-exported to member countries and the wider world.

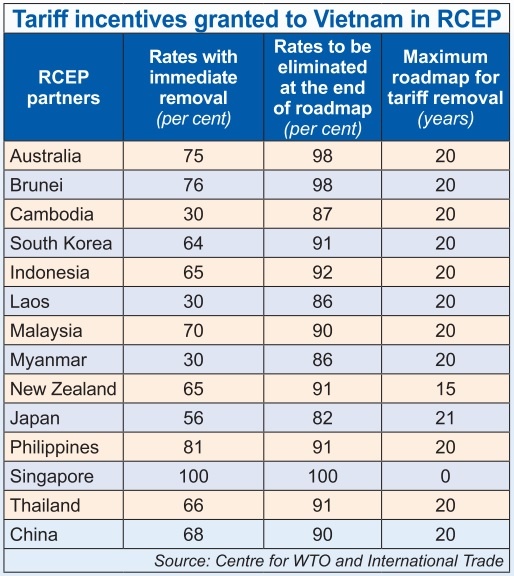

Under the deal’s commitments, member states commit to eliminating between 88 and 98 per cent of tariff lines for Vietnam, and ASEAN countries vow to do that with 86-100 per cent of tariff lines. The longest roadmap for tariff elimination is 15-20 years from when the agreement took effect.

According to the World Bank’s latest report on RCEP impacts, Vietnam is expected to register the highest trade and income gains among member countries. To estimate the economic and distributional impacts of the agreement in Vietnam, the bank formulated a baseline and four alternative scenarios based on different circumstances.

Specifically, exports and imports increase for all RCEP member countries under all scenarios. The increase in trade is higher when the full scenario with productivity kick is assumed. Under this scenario, the countries that experience a higher increase in exports are Vietnam (11.4 per cent), Japan (8.9 per cent) and Cambodia (6.5 per cent), while imports increase significantly in Vietnam (9.2 per cent), the Philippines (7.2 per cent), and Japan (6.4 per cent).

“In terms of total exports, the sectors that expand the most for Vietnam are motor vehicles (18.6 per cent), textiles (16.2 per cent), and apparel (14.9 per cent), mainly due to reductions in non-tariff measures: motor vehicles go down 3.5 percentage points; wearing apparel is reduced by 3.7 percentage points; and textiles by 1.4 percentage points,” read the report.

In the baseline, between 2020 and 2035, the average trade-weighted tariff imposed by Vietnam falls from 0.8 to 0.2 per cent, while the tariffs faced by Vietnam are reduced from 0.6 to 0.1 per cent.

The four policy scenarios will measure implementation incrementally. The first scenario is exclusively the implementation of tariffs according to the reduction schedules.

“In the productivity kick scenario, where a productivity shock is included, Vietnam has the highest gains of all member countries. Real income increases by 4.9 per cent relative to the baseline, higher than the gains for the bloc as a whole, where real income increases by 2.5 per cent,” the World Bank reported. “Trade also increases the most in this scenario, with exports expanding by 11.4 per cent and imports by 9.2 per cent, relative to the baseline.”

“With implementation, the market for Vietnam will expand, particularly to China, where Vietnam does not currently possess any trade agreement. Gains in the productivity kick scenario are concentrated mostly in the manufacturing sector, in particular apparel, electrical equipment, and textiles.”

According to an analysis by the Peterson Institute for International Economics, Indonesia, Malaysia, Thailand, and Vietnam will benefit the most from the RCEP, which will add between $2-4 billion each year to their respective economies by 2030.

However, Nguyen Anh Duong, head of the Central Institute for Economic Management’s General Research Department, noted that the World Bank highlighted the benefits for Vietnam in terms of percentage increases.

“But in fact, due to Vietnam’s economic scale and export-import turnover remaining relatively small, the percentage rises announced in the report has failed to be reflected in USD,” Duong said. “Meanwhile, a 1 per cent growth rate in other RCEP nations both in terms of GDP or exports or imports is far higher than that in Vietnam.”

The RCEP covers a market of 2.3 billion people and $26.2 trillion in global output, meaning about 30 per cent of the population worldwide and over a quarter of world exports.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version