Dealmaking in Vietnam likely to retain long-term visions

Vietnam’s merger and acquisition (M&A) market witnessed a significant decline in deal value from Japan in 2022. What are the reasons behind this downward trend?

|

| Masataka “Sam” Yoshida, head of the Cross-border Division of RECOF Corporation and CEO of RECOF Vietnam Co., Ltd |

Last year was not a remarkable one for Vietnam-Japan deals in these terms, that much is true. However, if we carefully analyse the trend of deal value during the last five years, Vietnam was not really the frontrunner in this segment as most of 2021 deal value consisted of one gigantic deal executed by SMBC Consumer Finance on FE Credit (circa $1.3 billion).

There are several reasons why Vietnam’s deal value has been relatively smaller than in other regional countries. Lack of statistics is one of the factors as we see that there are relatively more deals announced without transaction values. Meanwhile, in 2022, Japanese investors’ deals in the real estate sector did not perform due to various political and financial matters. Although Vietnamese enterprises’ size are becoming larger, they are still relatively smaller compared to the surrounding countries’ firms.

In addition, lack of outright acquisition deals has a strong impact on recent statistics of seemingly smaller deal value. This may be related to targeted companies which are still in the growth stage.

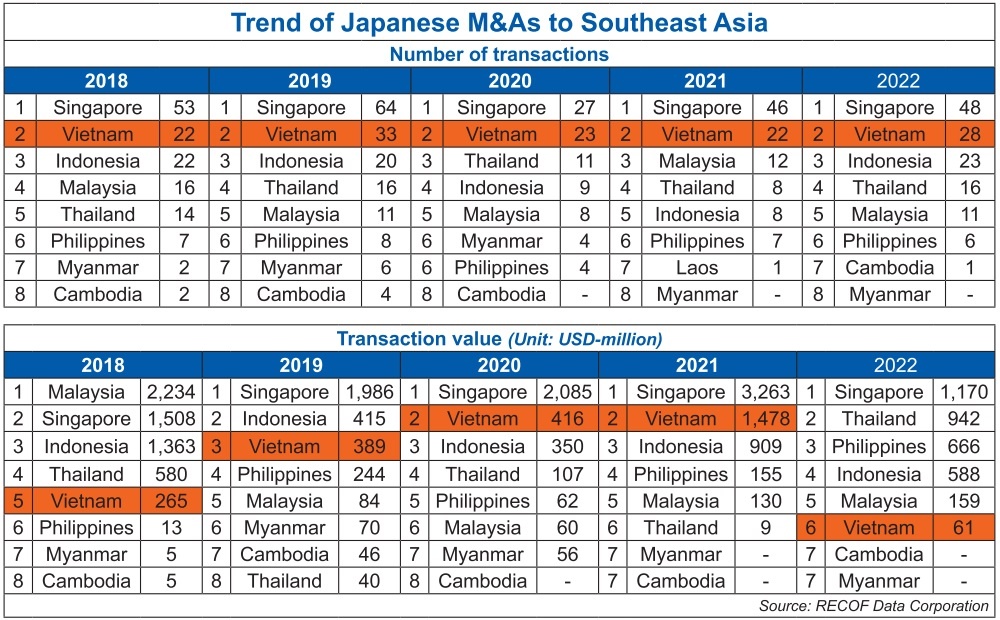

We tend to look at the Vietnam-Japan market from the number of deals between the two countries rather than the value. Excluding Singapore, which has an exceptional presence in the region, Vietnam has definitely been the top runner among the other countries for the last five years as well as being the number five destination in the world in 2022.

Do you expect Japanese firms to divest from selected Vietnamese groups to balance out cash flows amidst the economic downturn?

It may be difficult for many companies to maintain pre-pandemic level of operations due to diminished revenues. Under such circumstances, companies may opt to scale back their investments or divest assets to produce more cash and reduce their exposure to offshore risk.

Yet, Japanese companies may not find divestment to be simple. Alternatively, many may choose to hold on to their investments in Vietnam and ride through the risk of the downturn, especially if they believe in the market’s long-term potential.

Keeping their investments in Vietnam can help them maintain a diversified portfolio that allows them to capitalise on opportunities in multiple markets, while divestment might reduce portfolio diversification, thus increasing the risk exposure of their remaining assets at home. Divestments can also have a detrimental impact on relationships with partners, consumers, and other stakeholders.

Some Japanese companies might even decide to put more money into Vietnam if they see opportunities to acquire equities and assets at attractive valuations. In such instances, companies may view the current environment as a chance to get ahead of the competition and set themselves up for future growth.

In fact, historically, Japanese foreign investments tended to surge during economic downturns as investors sought to take advantage of the lower yen and look for larger profit margins in emerging markets such as Southeast Asia.

From what we know about the past, it does not seem likely that Japanese investments in Vietnam will decrease over the medium to long term. Investors, on the other hand, may encounter short-term hurdles and uncertainties such as geopolitical risks, inflations, and environmental issues.

|

What are Japanese investors’ major concerns for conducting M&A deals in Vietnam in such a challenging environment?

In the initial stage of the deals, the hurdles for Japanese investors are a lack of information about the sector that the targets belong to, and lack of disclosure from the targeted companies. These both derive from the difference in making official decisions. Japanese investors tend to be bigger and it is often the case that they need a board resolution to make the investment official.

There are multiple of procedures to obtain such resolutions but, once cleared, you will experience that Japanese companies could transform themselves to be super efficient in quick fashion. In the latter stage of deals, the concerns are often that owners will change their minds, especially on the previously agreed valuation of the transaction. This puts the Japanese investors in a difficult position, as they are usually unable to go back to their board and change the terms which have been resolved.

When do you expect the recovery in Japanese M&As in Vietnam this year? What are some factors to facilitate the recovery?

The recovery in Japanese M&As in Vietnam in 2022 was below our expectations, mostly because the pandemic situation in Japan had been alarming until summer and Japanese companies were not so keen to restart their overseas expansion.

Since autumn, the situation has changed and we saw an increasing number of Japanese companies visiting Vietnam and discussing potential transactions. We also found many Vietnamese business owners were open to discussions in order to accelerate the growth of their business period via cooperation with foreign investors.

For Japanese companies, such discussions usually take around 6 months before transactions are completed, and we are expecting that finalised M&A transactions that are publicly known about in the market will start to pick up very soon.

Having said that, continued instability in the global political and financial situations, as well as the volatile commodities market, are making some Japanese investors more cautious in investments than before.

| Japanese enterprises accelerate investment in Vietnam At the meeting with the Ministry of Planning and Investment and Nakajima Takeo, chief representative of the Japan External Trade Organization (JETRO), said that Japanese enterprises could not ignore Vietnam when looking around Asia for a destination to invest. |

| Forum promotes ties between Vietnam and Japan The 2023 Vietnam-Japan Economic Forum marks the 50th anniversary of diplomatic relations between Japan and Vietnam and represents an opportunity for business leaders from the two countries to meet, exchange, and seek cooperation on future development plans. |

| Japanese investors favour non-manufacturing sectors While concerning cost risks increase for businesses, more Japanese companies are looking to expand in Vietnam in non-manufacturing sectors like education, healthcare, retail, property, and finance to tap into growing demands there. |

| Long-standing gains continue with Japan Fresh efforts are being made to remove obstacles for a more transparent business and investment environment, leading to the country remaining a favourite destination for Japanese investors in particular. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version