Dairy groups take on greener vision

The most well-known dairy enterprise in Vietnam, Vinamilk, in October signed an MoU with two major food distribution enterprises in China to bring yogurt products north of the border.

|

| Dairy groups take on greener vision |

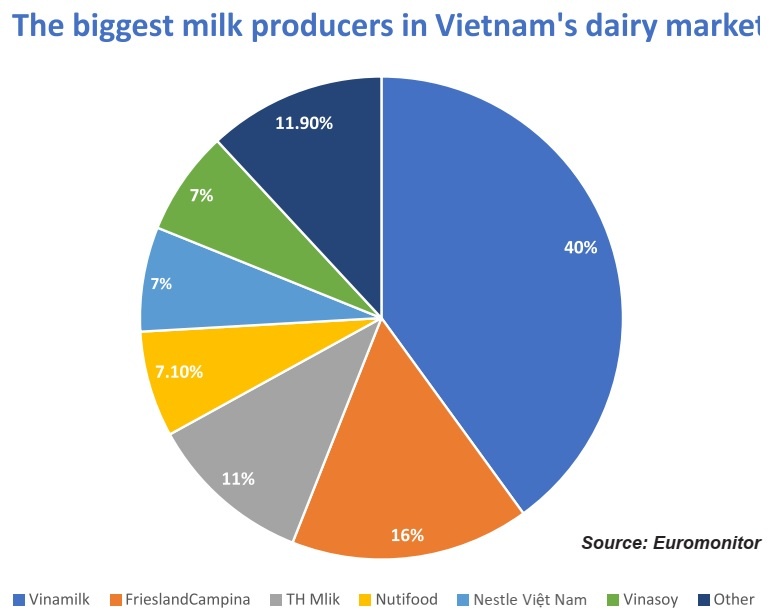

Vinamilk currently holds about 40 per cent of the domestic market share and exports a variety of products to nearly 60 countries and territories, including those with strict import requirements such as Singapore, Japan, and New Zealand.

The MoU has opened up opportunities for Vinamilk to access huge resources from China, the world’s largest import market for dairy products with a turnover of more than $10 billion per year. That is second only to the US in market volume, and the scale is more than 30 times larger than the Vietnamese milk market.

Vo Trung Hieu, Vinamilk’s International Business Director, said that its sustainable development strategy plays an important role in Vinamilk’s export expansion plan.

“Most of Vinamilk’s partners in developed market groups have mentioned requirements related to sustainable development,” he said. “The business has been asked by partners about sustainable development reports and requirements related to environmental certification, labour rights, and animal welfare for about 10 years already.”

Although these ideas were still quite new to most Vietnamese businesses a decade ago, Vinamilk was still ready to respond.

“We have been and are continuing to transform our operating methods, increase investment in equipment, focus on training and developing human resources, and moving towards digital and green transformation to adapt to new conditions,” Hieu added.

Yogurt products currently account for around one-quarter of the total volume of dairy products consumed in China in 2022. This is also one of the fastest growing products in the Chinese dairy industry, with revenues set to grow at a compound rate of about 15 per cent annually between now and 2029, according to Mordor Intelligence forecasts.

Passport for export markets

Going green and placing a major focus on sustainability is taking over the majority of industries, including dairy.

Europe, a major export market of Vietnam, has introduced a series of sustainability requirements aimed at climate neutrality such as the Carbon Border Adjustment Mechanism, the Circular Economy Action Plan, and the Biodiversity Strategy to 2030, all of which affect exporters here.

Vietnamese businesses also face many stricter non-tariff regulations from new generation free trade agreements, with environmental protection requirements including biodiversity and emission reduction all committed to a high level of binding.

Fierce competitive pressure with increasing requirements from import markets also forces businesses to pay more attention to environmentally friendly product standards as a way to get closer to consumers.

In New Zealand and Australia, where there are high requirements for environmental factors, Vinamilk aims to have all products exported to these two markets use high density polyethylene packaging before 2025. Currently, Vinamilk products exported to those nations do not have plastic straws or plastic lids under the agreement to reduce plastic waste into the environment.

Early identification and evaluation of the importance of sustainable development factors has helped the business achieve relatively positive initial results. Products from Vinamilk are being distributed at major supermarket chains Costco, Woolworths, Coles, Aldi, and Foodstuff, with sales growth of more than 10 per cent each year.

The value and development potential of sustainable export trends are also a driving force for Vinamilk to continue growing in high-income market groups in Asia, North America, and the Middle East, which contribute more than 85 per cent to the brand’s total export revenue.

Meanwhile, another domestic enterprise with influence in the Vietnamese dairy market, TH Group, is also promoting greener activities in both production and supply chain development.

In recent times, TH has made advances in areas such as wastewater treatment, clean energy production, waste reduction, promoting environmentally friendly consumption solutions, and encouraging a greener lifestyle.

In 2022, TH’s farm system reduced emissions by an average of more than 20 per cent per product unit, exceeding the set plan. Also last year, the company reduced emissions to around 0.1kg of CO2 per product unit, a low level compared to the emission reduction results of typical dairy factories in Southeast Asia.

According to Euromonitor, TH true MILK accounts for about 45 per cent of Vietnam’s fresh milk market share, currently exporting to China and ASEAN member states.

|

Increasingly high requirements

Even in the domestic market, customers are paying more attention to green products. Vietnam’s Customer Experience Excellence 2022 report from KPMG shows that well over 90 per cent of customers are willing to pay more for both products and services that are more integrated with environmental, social, and governance criteria.

Do Quoc Thinh, sustainability leader of Elovi Vietnam, a company under Morinaga Milk Industry founded in 1917 in Japan, said that the company has measured and reported greenhouse gas emissions and social-environmental impacts in the group’s consolidated report for over a year now.

“Elovi complies with the Morinaga Milk group policy, which focuses on activities such as mitigating impacts and adapting to climate change, recycling, reducing plastic waste, and human rights,” said Thinh.

Elovi has also made positive assessments of a solar power system to soon deploy at the factory. “In 2022, we have made improvements to increase the use of biological materials in packaging for the new Morinaga brand products to contribute to solving the problem of plastic waste from products. The Elovi’s important production line, packaging, and technology system is provided by Tetra Pak,” he added.

The company is going to a code of conduct for suppliers, not only requiring them to commit to quality but also to protect the environment, protect human rights, and corporate social responsibility.

Elovi currently owns a dairy factorys in Thai Nguyen province with transferred technology from Japan with a capacity of 80 million liters per year.

According to Research and Markets, there were about 200 dairy enterprises operating in Vietnam as of the end of last year. However, the dairy market is still mainly dominated by large enterprises such as Vinamilk, Nestlé Vietnam, Nutifood, FrieslandCampina, and TH Group.

| Dairy segment showing off potential with fresh launches Milk and other dairy products are emerging as a strong segment in the food and beverage industry, with an estimated average annual growth rate of over 12 per cent over the next few years. |

| Vietnam’s dairy game hits next level More and more foreign dairy brands are choosing the Vietnamese market as a springboard to reach out internationally, while domestic milk producers create more solutions to protect market share. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version