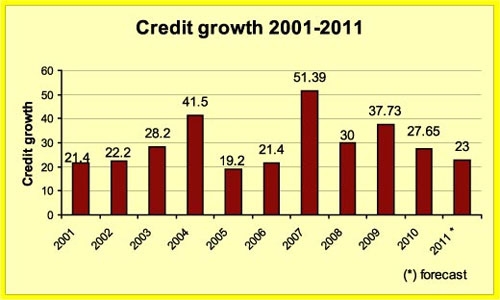

Credit growth targeted at 23 per cent

|

The State Bank also sent a clear message that monetary policy would focus on controlling inflation and stabilising the economy.

Foreign exchange policy would also be set in line with market signals to ensure system liquidity and a narrower trade deficit, the central bank said.

In meetings held in Ho Chi Minh City on Monday and in Hanoi yesterday, State Bank of Vietnam Governor Nguyen Van Giau told commercial banks that credit should be focused on manufacturing sectors and gradually shifted away from non-manufacturing sectors.

Credit growth targets for individual banks would be dependent on business scale and performance, Giau said.

The deputy head of the Central Institute for Economic Management (CIEM), Vo Tri Thanh, told Vietnam News a target of 23-per-cent credit growth was reasonable in light of next year's 7-per-cent inflation target.

"The target sends a clear message that the central bank will strictly supervise credit growth," Thanh said, although he cautioned that whether the central bank would achieve these targets would largely depend on other economic pressures.

Inflation reached 11.75 per cent this year, substantially exceeding the government's adjusted target of 8 per cent, orginally set by the National Assembly at 7 per cent.

Credit growth this year has been estimated at 27.6 per cent – or 29.8 per cent if gold and US dollar prices are taken into account. Both figures are well beyond the target set last year of credit growth of 25 per cent.

Total outstanding dong-denominated commercial bank loans this year were estimated to have increased by 25.3 per cent, while loans in foreign currencies grew 49.3 per cent. Meanwhile, total deposits on hand grew an estimated 27.2 per cent over December 2009.

At a meeting last Saturday with the National Assembly's Economic Committee, Giau noted that bad debt in Vietnam's banking system rose to an estimated 2.5 per cent of outstanding loans this year, up from 2.03 per cent in 2009.

The ratio would be higher if loans of VND26 trillion ($1.33 billion) extended to troubled state-owned shipbuilder Vinashin were included in the total.

Nominally, the Vietnamese dong also lost over 5.5 per cent of its value against the US dollar over the course of the past year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign fruits flood Vietnamese market (December 09, 2025 | 13:22)

- Vietnam’s fruit and vegetable exports reach $7.8 billion in first 11 months (December 05, 2025 | 13:50)

- Vietnam shapes next-generation carbon market (November 26, 2025 | 15:33)

- PM urges Ho Chi Minh City to innovate and remain Vietnam’s economic locomotive (November 26, 2025 | 15:29)

- Experts chart Vietnam's digital finance path: high hopes, high stakes (November 14, 2025 | 10:56)

- Vietnam’s seafood imports surge 30 per cent in first 10 months (November 10, 2025 | 19:35)

- Vietnam’s durian exports hit $1 billion milestone (October 30, 2025 | 17:41)

- Beyond borders: Sunhouse and new era of Vietnamese brands on Amazon (October 28, 2025 | 10:46)

- Record-breaking trade fair set to open in Hanoi (October 15, 2025 | 15:59)

- Timber sector seeks solutions to VAT refunds (October 14, 2025 | 18:58)

Mobile Version

Mobile Version