Construction cost hikes exacerbate real estate delays

|

| Construction cost hikes exacerbate real estate delays, source:freepik.com |

Construction and real estate businesses have been shocked by the galloping increase in the price of construction materials, affecting the agreements of many contractors with developers.

Since the beginning of 2021, steel has seen runaway price growth to now stand at nearly VND18 million ($780) per tonne, 40-50 per cent higher than quotes from the end of 2020.

In particular, some steel producers have increased prices six times within as little as 10 days. Meanwhile, the cost of cement also increased by VND30,000-50,000 per tonne ($1.30-2.20), and the price of sand nearly doubled.

In the face of rising construction costs, many investors said they would have to delay some projects and adjust the prices of their products.

|

Nguyen Hoang, director for research and development of DKRA Vietnam, said that the increase in the cost of construction materials will certainly impact real estate projects being implemented, as well as both contractors and investors.

“Costs increase at the expense of initial profit expectations, which could slow down the construction process at some projects or force developers and contractors to re-negotiate terms,” Hoang said, adding that the effects would reduce market supply towards the end of the year.

Other projects, he added, may pause to wait for prices to climb down. However, this will jeopardise construction progress and could negatively affect buyers.

Several disputes have already arisen between developers and buyers regarding the slow process at projects like Sunshine City Saigon, funded by Sunshine Group, in which buyers are requesting that their deposits are returned.

Meanwhile, Lim Hua Tiong, CEO of Frasers Property Vietnam, told VIR that increasing material prices generally affect a project’s profitability, planning, and in the worst-case scenario can lead to delays in construction and handovers.

“The sudden and unexpected spike will affect contractors with insufficient cash reserves to purchase materials to proceed with the construction,” said Hua Tiong, adding that the hike will, however, eventually stabilise within inflation range. His expectations are supported by a recent study by S&P Global which expects steel prices to soften in the second half of 2021.

At the same time, Hoang from DKRA warned that some developers could resort to cost- and profit-saving solutions such as switching to cheaper building materials.

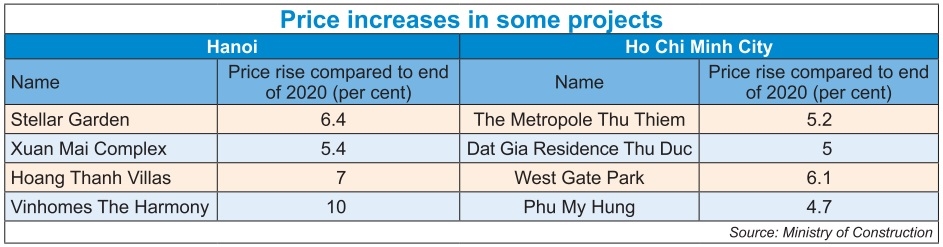

According to the Vietnam Association of Realtors, the price of apartments could increase 10-15 per cent due to material prices, instead of the 4-6 per cent originally forecast.

Hoang from DKRA suggested developers and contractors utilise their back-up budget on time to cope with the increased price of construction materials.

“They should also diversify their sourcing of irreplaceable construction materials and discover suitable alternatives while ensuring the quality of the construction,” Hoang explained.

Hua Tiong of Frasers Property added, “Investors and developers should continue to utilise their expertise and experience to plan, develop, and manage the project and work closely with their contractors to ensure timely project implementation.

It is also important for developers to have a strong balance sheet and cash reserves to tide over any economic shocks or adverse market conditions.”

At the same time, he said the current spike in construction material prices is only a short-term effect. “Rising land prices and delayed projects approval typically remain a bigger issue in Vietnam’s real estate market,” Tiong said.

He added that as a foreign developer, he hoped that there would be continued focus on establishing more transparent approval processes for policymakers.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version