Conflicts apparent regarding proposed consumption tax

|

| SCT has risen in Vietnam over many years, but did not help to lower issues like alcohol abuse, Photo Le Toan |

Dau Anh Tuan, deputy secretary general and head of the Legal Department under the Vietnam Chamber of Commerce and Industry, said at a seminar on the issue this month that the draft amended Law on Special Consumption Tax (SCT) will have a great impact on businesses and industries.

“The impact of the tax law will not be far away, that’s why businesses and associations are interested in amending it,” Tuan said.

Drafting and completing the SCT bill has been increasingly difficult. It faces conflicting opinions, as the Ministry of Finance (MoF) plans to add more taxable items to the draft and increase tax rates. The drafting board is currently under great pressure and the discussion process is long, Tuan said, so it is necessary to listen to many opinions to choose the most optimal method.

The government and the MoF wish to present the draft at the upcoming National Assembly session in October. After discussion through two sessions, it is expected that the amended Law on SCT will take effect from 2026.

The latest draft of the law proposes imposing a tax of 80 per cent, gradually increasing over the years and reaching 100 per cent by 2030 for alcoholic products over 40-proof in strength. For alcohol below that, the agency proposes a tax rate of 50 per cent from 2026 and increasing to 70 per cent in 2030.

Chu Thi Van Anh, vice president and general secretary of the Vietnam Beer-Alcohol-Beverage Association (VBA), the proposals on beverages could be harsh for businesses, and will be the largest-ever increases in the history of excise tax increase for the alcohol industry in Vietnam.

“We are concerned that increasing taxes will lead to increased indirect taxes on consumers, especially that they will switch to using alcohol that is currently unmanaged and not aimed at protecting consumer health. Therefore, the association proposes to delay the increase schedule to avoid shock, so businesses can adapt,” Anh proposed.

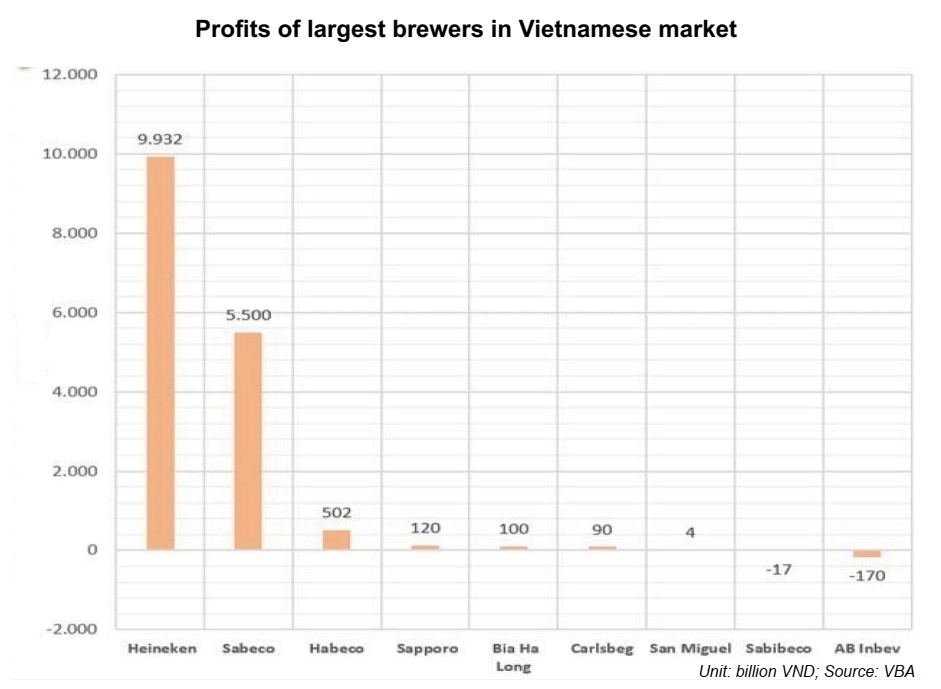

Since 2020, the alcohol industry has experienced a sharp decline in output. The entire beverage industry inventory index in 2023 was estimated to have increased by 120 per cent compared to 2022, and the second quarter also recorded a nearly 130 per cent increase in the beverage industry inventory index, according to the VBA.

“The proposal cannot fully assess the huge impacts because this requires time, full official statistics, a scientific tax impact calculation model, consumer reaction, and more. Businesses are not clear based on this proposal,” Anh added.

Nguyen Van Phung, former deputy director of tax policy under the MoF, noted that SCT doubled between 2005 and 2015, but the ratio of alcohol abuse increased 10-fold.

“It was only when new drink-driving laws were released in 2019 that a major impact was seen on alcoholic beverage consumption behaviour,” Phung said.

According to the MoF, the tax rate will be adjusted but the purchasing power of alcohol will still increase because income are projected to increase faster. They assess the tax and price to be currently low, accounting for about 30 per cent of the retail price, while in many countries it is 40-85 per cent.

|

| Nguyen Thanh Ha, chairman, SBLaw There is no comprehensive report on the impact of this proposal on all aspects of life or the quantitative impacts on budget revenue, the economy, the risk of increased consumption of smuggled goods, and the impact on health. This situation makes it unclear what the basis for this tax increase is to achieve, and what lessons the drafting committee has learned from previous increases. The publication of comprehensive impact assessments when adjusting the increase in special sales tax to ensure harmony between the interests of the state, businesses and consumers because this industry has a significant contribution to the economy. In addition, the MoF should also clarify whether the implementation of World Health Organization recommendations is appropriate for Vietnam’s actual circumstances and what is the basis for this recommendation to be legislated by the increased proposal. The fact that the total amount of tax payable is too large, and the increase roadmap is short, can cause the industry’s output to decrease significantly, directly affecting businesses and related subjects such as workers. In addition, the economy may stagnate indirectly, increasing the risk of tax evasion when the profit gap between legal and illegal products is considerable. Nguyen Quoc Viet, deputy director, Institute of Economic and Policy Research The SCT calculation method must ensure harmony with regulations on tax calculation methods of countries in the region and worldwide. The roadmap for applying increases also needs to be simple, easy to understand and implement, and convenient from the implementation process, by relevant parties to tax management, inspection, and inspection. The law must truly regulate consumption - the highest goal of this tax, limiting consumption of luxury goods and services that are harmful to health or have negative impacts on the environment and society. Therefore, the SCT rate needs to be determined reasonably to ensure effective state budget collection, but also not put pressure on macroeconomic factors such as inflation. The SCT law has to ensure fairness in tax collection for all organisations and individuals producing, importing, and exporting taxable goods and services. The list of goods and services subject to SCT and the applicable tax rates need to be clearly and transparently specified to create stronger conditions for compliance with tax laws. |

| Alcohol and beer could be subject to 100 per cent special consumption tax MoF proposes a 10 per cent special consumption tax on sugary drinks Beer industry compelled to adjust to potential tax impact |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version