Conclusions around corner as TikTok backlash heats up

Deputy Minister of Information and Communications Nguyen Thanh Lam has expressed concern over the status of popular app TikTok, with an examination currently underway and requiring further evaluation before conclusive findings can be made.

“As per legal provisions, information regarding the inspection process remains confidential and cannot be disclosed to the press at this time. It is anticipated that the results of the investigation will be available in July,” he said.

|

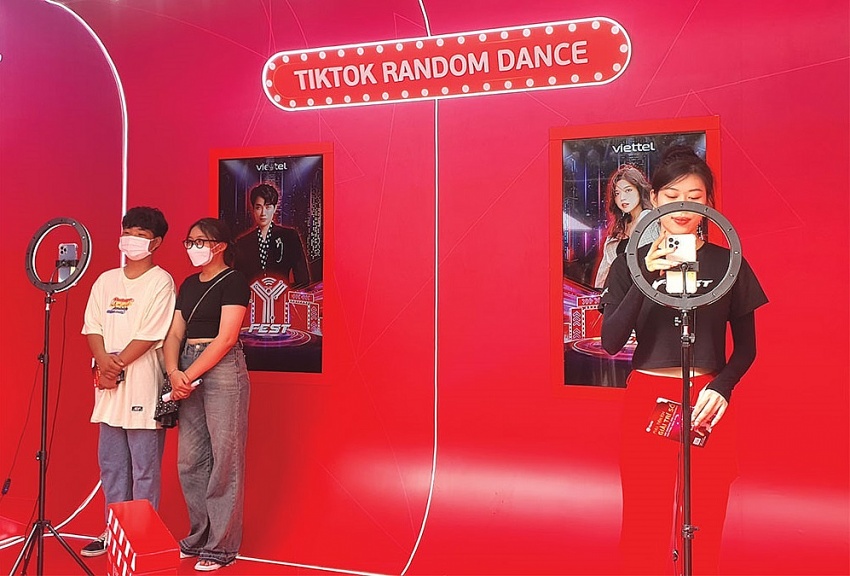

| It is estimated that there were over 50 million TikTok accounts in Vietnam at some point Photo: Le Toan |

Lam highlighted the significance of content creators being aware of the law to ensure their creative endeavours contribute positively to fostering a healthy online environment. It is hoped that content creators will play their part in cleaning up the platform.

Also earlier this month, Le Quang Tu Do, director of the Authority of Broadcasting and Electronic Information under the Ministry of Information and Communications (MIC), expressed grave concern regarding TikTok’s future and the implications for content creators following a comprehensive inspection.

“Should cross-border social media platforms fail to engage in collaborative efforts with state regulatory bodies, their operations within Vietnam will be met with stringent blocking measures,” Do said. “TikTok, if it chooses to disregard cooperation with the government, can only anticipate an inevitable ban.”

Before the comprehensive inspection, the MIC had already disclosed six violations committed by TikTok in Vietnam. The violations included inadequate control over politically related content that undermines the Party and state, dissemination of fake news, frivolous and harmful content, and content that endangers children.

Obvious loopholes

TikTok’s algorithm-driven content distribution mechanism tends to favour sensational and attention-grabbing content, regardless of its harmful or offensive nature, which negatively impacts the community and the youth.

Additionally, TikTok fails to effectively prevent illicit business activities, counterfeiting, the sale of fake goods, unregulated dietary supplements, and questionable drugs, cited the MIC.

Furthermore, it lacks efficient measures to manage the activities of content creators, and many produce frivolous content devoid of cultural value, targeting the curiosity of viewers, or even creating trends solely for profit.

The MIC has also observed that TikTok lacks effective measures to control copyright infringements, particularly in relation to content taken from movies. The platform fails to prevent users from misusing others’ private and personal images to spread false information, defame, or insult others, it said.

Despite facing allegations and scrutiny in various countries, TikTok remains determined to expand its operations in these regions, aiming to secure a larger market share and establish a stronger presence.

At the TikTok Southeast Asia Impact Forum in Jakarta on June 15, CEO Chou Zi Chew announced the firm’s intention to invest billions of US dollars in Southeast Asia over the coming years. TikTok currently boasts 325 million monthly users in Southeast Asia.

As attested by German online platform Statista, Indonesia commands the second-largest TikTok user base globally, surpassed only by the United States, with Southeast Asia being its most dominant stronghold. Vietnam, with its user count exceeding 50 million, secures a prominent position in the regional landscape, trailing behind Thailand, the Philippines, and Malaysia. Meanwhile, in addition to content-related issues, TikTok is also facing allegations of tax evasion in Vietnam. Domestic media investigations revealed that numerous businesses and individuals have been evading taxes by purchasing advertisements through rental accounts of agencies with official contracts with TikTok. These entities use unregistered rental accounts and transfer money to personal accounts, bypassing the 10.8 per cent tax.

An industry insider revealed that when the tax-free service is blooming, about half of customers are offered this.

To let an advertisement on air, businesses and individuals in Vietnam must pay TikTok’s legal entity in Singapore directly, or through businesses as agencies in the country.

At the beginning of 2022, TikTok informed its advertising buying partners in Vietnam that if they are a tax-registered organisation when buying ads, they will be responsible for tax declaration. Conversely, if they are not a registered organisation, they will have to pay an additional 10.8 per cent of the tax for TikTok to collect to return to the state.

Based on the total amount that agencies pay for ads, TikTok refunds 5 per cent for agencies to pay contractor tax to the state budget, which depends entirely on their discretion. Moreover, TikTok also applies more discounts of up to 8 per cent to agents who achieve greater revenue. Therefore, the more the agency expands the account rental service, the more profits they gain.

Closer coordination

To convince businesses and individuals to buy TikTok ads through rented accounts, agencies allow customers to self-integrate international payment methods such as Visa, Mastercard, and Paypal to recharge directly, or even apply digital currencies.

Nguyen Tien Hoa, director of ASL Law in Ho Chi Minh City, warned that banning international payment methods for TikTok ads without implementing effective tax management measures could hinder advertising activities on the platform and create obstacles in commercial transactions. Instead, he suggested finding a balance between regulation and tax management.

There is also a call for joint responsibility between overseas technology giants and local agencies. Tran Minh Hai, director at law firm Basico, emphasised that both parties must comply with Vietnam’s legal provisions, and if partners are found to be violating tax regulations, foreign tech groups should be held accountable.

Phan Vu Hoang, deputy general director of Deloitte Vietnam, added, “It is hard for foreign companies to manage. We should note more clearly the punishments regarding contracts between providers and agencies. For example, if Vietnam agencies do not comply with local legal provisions, the other party has the right to terminate the contract and claim compensation.”

Hoang also pointed out that while foreign service providers like TikTok generate millions in revenue, the state budget suffers from inadequate tax collection.

Agencies have to pay contractor tax as providing foreign ads service of TikTok, which is 5 per cent of total revenue for VAT and 5 per cent for corporate income tax.

“In the case that agents use other payment channels to hide revenue sources and do not put them into actual declarations, the state budget will lose a large amount of tax collection. When the offers are delivered on a massive scale, it is even more serious,” Hai from Basico said.

Nguyen Bang Thang, director of the Large Corporate Tax Department at the General Department of Taxation, suggested close coordination and data sharing between government regulatory bodies and tax authorities.

“By establishing a robust tax management database for e-commerce transactions, countries can combat tax evasion, ensure monetary security, and effectively manage tax risks. This approach has been recognised and supported by the prime minister through the issuance of Directive No.18/CT-TTg, which emphasises the importance of data connectivity and cooperation among relevant ministries and agencies in developing an efficient tax framework for e-commerce and digital platforms.”

Vietnam has over 150 advertising agencies for TikTok, with significant revenue and spending amounts. For instance, the balance in the advertising account of only one large agency in Vietnam can reach $3.5 million per quarter, and the actual spending amount for ads could be much larger.

The country ranks among the top 10 countries globally in terms of TikTok users, according to DataReportal, an online reference library offering hundreds of free reports.

Meanwhile, the e-commerce segment from TikTok Shop in Vietnam has recorded a six-fold increase in the number of orders compared to the first half of 2022. This growth entails the shift of online advertising money to TikTok to utilise business opportunities.

| Vietnam warns of potential ban on TikTok amidst calls for enhanced compliance The Vietnamese Ministry of Information and Communications has raised concerns about the future of TikTok in Vietnam, emphasising the need for compliance with local laws and cooperation with state management agencies. |

| TikTok probe’s findings expected in July: Deputy Minister Findings of the probe into TikTok operation in Vietnam are expected to be announced in July, Deputy Minister of Information and Communications Nguyen Thanh Lam said on June 5 at the ministry’s monthly press briefing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam manufacturing sees improved growth (March 02, 2026 | 16:27)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

Tag:

Tag:

Mobile Version

Mobile Version