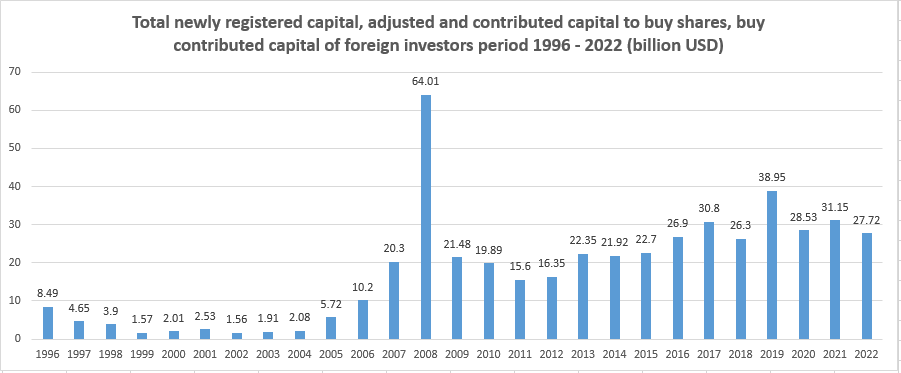

Changes in labour market since Vietnam's Law on Foreign Investment

The impact of foreign direct investment (FDI) inflow on the domestic labour market

|

| Nguyen Xuan Son, operations manager for Staffing and Outsourcing Services at ManpowerGroup Vietnam |

According to the results of the Labour Employment Survey from the first quarter of 2019 by the General Statistics Office, the FDI sector had been creating jobs for around 3.8 million employees, accounting for over 7 per cent of the total labour force (over 54 million employees) and over 15 per cent of the total number of permanent labourers (25.3 million people) in Vietnam.

In addition to creating direct jobs, the sector also indirectly created others for many staff members in supporting industries or other businesses involved in the supply chain for foreign-invested enterprises (FIEs).

The average salary of employees working in FIEs is often higher than in both the state-run and private sectors. Specifically, before the pandemic, the average salary of workers in the FDI sector was $350 per month. Meanwhile, staff members in the state-run and non-state sectors achieved average salaries of $328 and $272 per month respectively.

In addition, the FDI sector has also made an important contribution to improving the quality of Vietnam’s human resources (HR) through internal training programmes and partnerships with external training institutions.

Vietnam used to have a high proportion of personnel engaged in traditional sectors such as agriculture or handicrafts. However, with the growing development of other fields thanks to foreign investment, the proportion of labourers relying on traditional occupations has decreased significantly, especially outside the major cities.

Labour is now concentrated in the processing and manufacturing of food, textiles, footwear, and electronics, as well as accommodation, tourism and financial services.

The domestic labour market is becoming increasingly vibrant, developing in both quantity and quality, and attracting foreign capital flows into the country.

|

Labour market trends for the coming years

Employees will continue to have higher expectations for employers. Salary is no longer a top priority, with more focus on other factors such as learning and growth opportunities, benefits, and flexibility. With the rise of new technology and the changing labour market demands, the recruitment market will become more competitive. Enterprises, including FIEs, will have to put more effort into building employer brands and efficient HR policies.

Enterprises will need to accelerate training, upskilling workers in the context of the digital transformation. Job requirements will constantly change. By 2025, there will be 149 million new digital jobs in areas such as privacy and trust, cybersecurity, data analysis, machine learning, AI, and software development, as reported in the latest New Human Age Report by ManpowerGroup in early 2023.

The report notes that half of all employees will need reskilling by 2025 as the adoption of technology increases.

The trend of labour sub-leasing and outsourcing continues to prevail as employers realise the value of leveraging highly skilled staff and offering professional services. Businesses will rely on these extended arms to assist them in recruiting the right talent and managing labour in a professional, efficient, and cost-effective manner.

Talent has no borders. With strong international integration and open working conditions, a proportion of the domestic workforce opt to work overseas, while foreign workers and expatriates seek career opportunities in Vietnam.

AI and robots will help do some human work, so many jobs in the fields of advertising, law, content writing, manufacturing, healthcare, and hospitality will be affected or even taken if workers lack the digital skills and adaptability required by the 4.0 era.

| The demand for domestic labour is large, and labour shifts between industries have given rise to requirements for recruitment, management, and consulting activities. In this context, ManpowerGroup Vietnam is the first foreign-invested enterprise in the HR industry licensed by the Ministry of Labour, Invalids and Social Affairs to provide innovative workforce solutions. We are honoured to support the efforts of the Vietnamese government in developing local human resources to the next level. |

| Latest HR trends in logistics revealed Under the impact of the pandemic and digital transformation, the workforce trends witnessed in logistics are not new, but they are recognised as urgent and accelerate daily. VIR’s Bich Thuy had the opportunity for an exclusive interview with Trang Nguyen, country head of Permanent Recruitment and Executive Search at ManpowerGroup Vietnam about the most significant human resources trends in the logistics industry. |

| Accelerating trends and renewed urgency for labour According to ManpowerGroup’s recently released labour landscape report, this year will probably be one of the most transformative in human history. With workers taking more control of their professional lives, the rapid acceleration of digital adoption, and businesses realising they need to become more sophisticated, several labour trends have emerged that will impact organisations of every size. |

| Solving talent shortages amid fierce human capital landscape Worker shortages in various fields are creating headaches for both local and foreign-invested businesses (FIE) in Vietnam. Andree Mangels, general manager of ManpowerGroup Vietnam, shares his insights about the current demand for white and blue-collar workers in Vietnam as well as a strategy that employers should apply to attract and retain talent. |

| Vietnam Salary Guide 2023 introduced The Vietnam Salary Guide 2023 was officially introduced on December 12, providing practical insights and data on key industries, allowing organisations and individuals to make better preparations for next year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Green jobs needed as businesses embrace sustainability (April 06, 2023 | 11:24)

- HR leaders urged to handle work management in global uncertainty (October 20, 2022 | 17:07)

- Facing the biggest HR challenges in 2022 (October 10, 2022 | 12:14)

- Solving talent shortages amid fierce human capital landscape (August 26, 2022 | 16:18)

- Employers expect hiring to increase in H2 (August 13, 2022 | 21:30)

- Stakeholders seek sustainable strategies to retain workers (June 21, 2022 | 17:54)

- Accelerating trends and renewed urgency for labour (May 05, 2022 | 14:25)

- Latest HR trends in logistics revealed (April 28, 2022 | 14:38)

- Sustainable employment under digital transformation and the pandemic (October 29, 2021 | 15:04)

- Employment security and the future of skills for Vietnamese workers in digital transformation (October 26, 2021 | 17:20)

Tag:

Tag:

Mobile Version

Mobile Version