Cement sector faces bleak prospects

According to Ha Quang Hien, chief of office at Vietnam Cement Industry Corporation (VICEM), both production and sale indexes of the company fell below projections for the first half of 2023, despite the company having deployed a wide range of measures to boost sales.

Hien has attributed the gloomy situation to oversupply, stiff competition among sellers, a decline in the real estate market, and the slow pace of project implementation due to capital constraints and the slow disbursement of public investment.

Cement output in Vietnam for the first six months of the year amounted to 39 million tonnes, down 7 per cent on-year, and consumption reached 43 million tonnes, down 10 per cent.

Exports of cement and clinker during the period came to 15 million tonnes, down 15 per cent on-year, generating around $700 million in value.

|

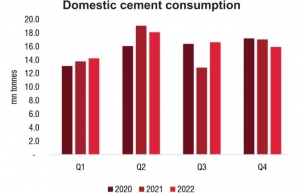

The cement industry also experienced an unfavourable 2022 when domestic consumption was around 63 million tonnes, and exports touched 30 million tonnes, representing half the amount exported in 2021.

Holding a 35 per cent domestic market share, VICEM fulfilled 90-95 per cent of its full-year projections last year after exercising a raft of measures to slash production costs and boost sales.

| Many businesses assume that the cement industry's prospects for the rest of the year will continue to be negatively affected by the downturn in the real estate market. |

As the export price of clinker plunged, large cement plants in towns such as Ninh Binh, Ha Nam, and Thanh Hoa have had to reduce production capacity or, in some circumstances, temporarily cease operations entirely.

Several projects that had completed their investment phase and were slated to begin in the first six months of the year have had to delay operations due to unfavourable market conditions.

Despite the CEO of VICEM, Le Nam Khanh's view that one of the core reasons behind the current bleak situation is oversupply, several new cement lines have gone into production at Long Son, Xuan Thanh, Dai Duong and Long Thanh cement plants, further exacerbating the situation.

Cement and clinker importing countries continue to apply policies that protect domestic cement production through technical barriers, coupled with high transportation costs. Furthermore, since the outset of this year, Vietnam has raised the export tariff on clinker from 5 to 10 per cent, creating more challenges for cement firms.

Many businesses assume that the cement industry's prospects for the rest of the year will continue to be negatively affected by the downturn in the real estate market.

Pham Van Bac, director general of the Building Materials Department under the MoC, suggested that as the building material sector had been developing robustly over the past few years, with output exceeding local consumption, that it might be time for a correction.

"Amid the current market difficulties, businesses must consider reducing output to combat the oversupply of inventory," said Bac.

Cement producers have called on the government to take measures to expedite public investment, while simultaneously unblocking capital sources for the real estate market, in particular, industrial real estate and housing.

| Vietnam’s cement producers strive to deal with excess Vietnam’s cement industry is anticipating an oversupply issue as a result of China’s reopening and lower coal prices. |

| Action required to halt cement supply-demand slip Cement leaders are calling for a tightening of approvals for new projects in Vietnam due to the current supply-demand imbalance in the sector. |

| Profits plunging for cement businesses The cement industry’s financial performance continues to slide, with Q2 losses piling up due to sluggish consumption and rising input costs. |

| Record input costs thwart cement groups Demand and oversupply issues continue to thwart the cement industry, as inputs for production are failing to see a drop in costs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Mobile Version

Mobile Version