Cement companies identifying cash flow solutions

Last week, the Singapore Green Building Council certified Viglacera’s autoclaved aerated concrete product as meeting eco-friendly criteria. This is a globally recognised certification that contributes to the global expansion of Viglacera’s autoclaved products by demonstrating its ability to satisfy the stringent requirements of consumers and green projects.

|

| Viglacera’s autoclaved aerated concrete product, Source: viglacera-aac.com.vn |

However, not all businesses have the potential to move in this direction, particularly as cash flow for production and businesses still rely on output, exports and domestic consumption, which are declining, and the housing market shows no signs of improvement.

The surplus may also deteriorate as production from new initiatives continues to increase. Hoa Binh province last month approved Xuan Thien Group’s project involving 10 million tonnes of annual cement with investment of $1.2 billion. Xuan Khiem Group has also funded Xuan Son cement plant, which has a capacity of 2.3 million metric tonnes per year and is scheduled to begin operations in 2024.

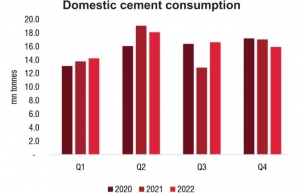

According to the Vietnam Association for Building Materials (VABM), the cement industry’s total design capacity has reached 114 million MT per year, with an estimated output of 93 million MT in 2022. However, the domestic consumption accounts for approximately 60–65 million, while exports account for the remainder.

According to the General Statistics Office, the country’s cement production in the first quarter of 2023 decreased by 9.9 per cent compared to the same period in 2022. In addition to difficulties in output, input costs also present a financial obstacle for cement producers.

“In recent years, the expense of input materials, particularly coal, has increased multiple times. It has an effect on both production and output,” Thai Duy Sam, vice president and general secretary of VABM, told VIR. “Currently, several significant corporations continue to ensure production. However, small enterprises with production lines that can produce 1,000-2,000kg per day face both manufacturing and consumption challenges.”

First, Sam added, the production lines of older projects have high depreciation costs and greater heat and electricity consumption than modern projects. Second, these units lack a trademark, which hinders their ability to be consumed.

The prevalence of loss-making enterprises is increasing. In the financial report for 2022’s Q4 that Quang Ninh Construction and Cement released at the end of March, $887,000 in debt was recorded. As a result, the company’s total assets are $71.3 million, its total liabilities are $45.3 million, and its profit after corporate income tax is $3.75 million, a decrease of more than $426,000 from 2021.

According to an estimate by Quang Ninh Tax Department, the company owed more than $4.5 million in July 2021, making it the largest debtor in the province’s construction materials industry.

Quang Ninh Construction and Cement is not the only example. Quang Son Cement’s sales revenue in the central province of Thanh Hoa continues to decline – the influence of cement consumption is significant, and the price of input materials (primarily coal) has increased, resulting in a $13.5 million after-tax loss in 2022, 3.6 times greater than the same period the previous year.

The output of the construction materials industry is significantly reliant on real estate. According to Sam, the cement industry is luckier than the majority of building material manufacturing businesses in the present day, as they can receive output from novel material lines used in green buildings, transportation, hydroelectric, and irrigation.

Sam also noted that the complexity of payment procedures for complex projects causes obstacles for contractors and consequently impacts material suppliers. “After nearly 10 years, the construction materials of Dong Tru and Vinh Tuy bridges have not been finalised,” he said. “According to the law, if payments are not made on time, interest must be paid.”

Nevertheless, the 2023 cement market can still be optimistic due to its reliance on public investment. In an earlier meeting this year, Prime Minister Pham Minh Chinh made it clear that the aim for 2023 was to disburse at least 95 per cent of the total $30.3 billion in public investment.

The Building Materials Department predicts that the demand for cement in the country will increase by up to 10 per cent from this year, reaching about 105 million MT.

| Cement businesses anticipate headwinds in 2023 Huge inventories, a stagnant real estate market, and capital source constraints are some of the factors heralding an unfavourable outlook for cement businesses in 2023. |

| Vietnam’s cement producers strive to deal with excess Vietnam’s cement industry is anticipating an oversupply issue as a result of China’s reopening and lower coal prices. |

| Cement exports under duress from neighbours The removal of a levy on imported cement in the Philippines could encourage Vietnamese exporters to engage in new ventures alongside Thailand. |

| Action required to halt cement supply-demand slip Cement leaders are calling for a tightening of approvals for new projects in Vietnam due to the current supply-demand imbalance in the sector. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version