Capital drawn to real estate market

|

| Real estate continues to attract investors from all over the world with its high yield potential, Photo: Le Toan |

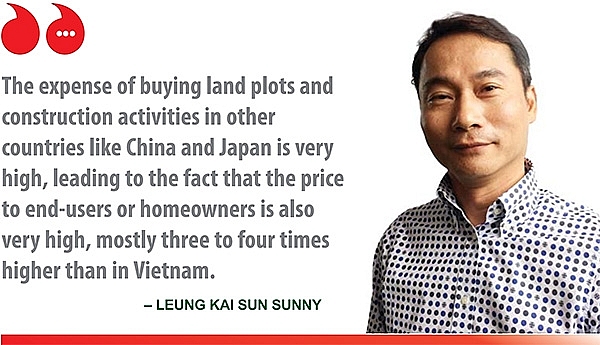

Cantonese Leung Kai Sun Sunny was eager to study a range of real estate projects around Ho Chi Minh City. A long-term investor, Sunny wanted to seek out the ideal property project that ensures long-running benefits.

Sunny had previously bought two units in Vista Verde and two others in Felix en Vista – both high-end residential projects invested in by CapitaLand Vietnam in Ho Chi Minh City.

With experience in many other countries in the region, Sunny realised that investing in Vietnam was bringing higher benefits than elsewhere.

“The expense of buying land plots and construction activities in other countries like China and Japan is very high, leading to the fact that the price to end-users or homeowners is also very high, mostly three to four times higher than in Vietnam,” Sunny told VIR in an interview.

“Then we have individual investors like me who are paying close attention to the benefits, which pays off. I would say that investors might face higher risk in other markets like China and Japan, where the investment cost for every project is very high,” he added.

Chen Lian Pang, general director of CapitaLand Vietnam, said that in some projects, the company took only 5 per cent of the profit, while the same project in Hong Kong or Singapore could drive 30 to 40 per cent of profits to the developers.

Moreover, the yield in Vietnam is now quite high, at 5-8 per cent per year, much higher than those in other countries.

Chen, who is the developer of many projects in Vietnam and also an individual investor, told VIR that the housing price in Vietnam is now much lower than in Kuala Lumpur or Bangkok. More specifically, for the price of a unit in Ho Chi Minh City, investors could not buy a unit in Singapore, not even a social housing one.

However, Chen stated that investing in Vietnam must be for the long term of five to 10 years at least, instead of only two or three years.

“With the recent improvement of infrastructure and urbanisation, the potential for price increases in Vietnam is huge, which is also a potential for investors who wish to buy property and then re-sell or lease that property for profit,” Chen said.

According to Lieu Nguyen, a representative from the American Real Estate Association in Vietnam, the US is now also keeping its eyes on Vietnam’s property market, despite hesitations over the not yet fully legalised status of regulations that permit overseas Vietnamese and foreigners to buy houses here.

“I expect that when the legal system is equipped with greater transparency, the number of Americans, and foreigners in general, interested in the Vietnamese property market will be much higher,” said Nguyen.

The current reality is that not many foreigners are able to buy houses in Vietnam due to legal barriers, complicated rules, and excessive paperwork.

“Expats do not have a clear understanding of the legal procedures and some administrative agencies are not used to dealing with foreign buyers,” noted Nguyen Minh, a real estate broker in Ho Chi Minh City.

Foreign owners remain few and far between

According to figures from the Ministry of Construction, even two years on from when the government issued regulations to permit foreigners to buy houses in Vietnam, less than a thousand foreign homeowners were reported. With 80,000 expats living and working in Vietnam and over four million Vietnamese expatriates, this figure is very modest.

“This figure is not fully reliable, as many foreigners are still naming their Vietnamese spouses or friends on their housing contracts for the authorities,” said Minh.

The 2015 Housing Law allows foreign investment funds, foreigners with valid visas, and international firms operating both in Vietnam and overseas to buy unlimited residential properties with leaseholds of 50 years.

Prior to that, they were only eligible to buy one apartment providing they were either married to a Vietnamese national, held a managerial position, or could demonstrate significant contributions to the country.

The shortage of publicised projects that foreigners are eligible to buy in is one of the biggest obstacles, according to industry insiders.

According to the Housing Law, developers can sell a maximum of 30 per cent of units in an apartment building to foreigners, and a maximum of 250 houses in a ward. Areas considered sensitive to national defence and security are still off limits to foreign buyers.

A barrier facing foreigners and overseas Vietnamese is the lack of property title insurance, a standard document issued in many other countries, added economist Nguyen Tri Hieu.

The number of red books issued to foreign organisations and individuals buying houses has been relatively low considering interest and demand.

According to Sergey Nam – deputy CEO of Kusto Home, the developer of the Diamond Island project high in foreign interest – the number of foreigners buying his units has been increasing, and he has nearly hit his targets.

“Actually, we have to admit that the revised Housing Law, which took effect on July 1, 2015, has affected foreign buyers. It’s easier for foreigners to buy residential properties in Vietnam, as long as they can enter the country legally, and there is now no need to have a residency visa like before. The doubled total of foreign buyers in our Diamond Island project in District 2 has demonstrated the foreign interest in Vietnamese properties,” Nam told VIR.

Nam further added that the big challenge now is how foreigners can apply and receive 50-year ownership certificates, and what the terms and conditions of extending the leasehold are.

“If it was clear by now, I am sure the number of foreign buyers would be much bigger,” he added.

|

Potential is high

Vietnam is quickly becoming one of the region’s hottest property markets for Hong Kong and mainland Chinese investors, as prices continue to soar through the roof in their domestic markets.

According to a survey released at the end of 2017, “Emerging trends in real estate, Asia Pacific 2018” by PwC – which surveyed 600 respondents including investors, fund managers,

developers, property companies, lenders, brokers, advisors, and consultants – Ho Chi Minh City was ranked among the top 10 investment and development prospects.

The report ranked Ho Chi Minh City in fifth position on the list, with a verdict of “generally good” in investment prospects. Only destinations in five countries were ranked in the category of “generally good”.

Ho Chi Minh City also ranked second to Sydney in development prospects. Only three countries were voted “generally good” in this category.

Vietnam was ranked the most popular developing market and continues to draw interest, according to the report.

Notably, PwC’s survey also ranked Ho Chi Minh City among the highest in terms of rental value growth, reflecting confidence that economic strength will spill over to property values.

In Vietnam, according to PwC, investors continue to draw favourable comparisons with the China of 10-15 years ago. GDP growth is in the area of 7.4 percent, and while bureaucracy remains an issue, the regulatory environment is slowly becoming less restrictive.

Encouraged by fast economic growth, supportive government policies, and low entry costs, housing prices in the country’s two largest cities, Ho Chi Minh City and Hanoi, have seen considerable growth in recent years.

Real estate experts and investors say that simpler procedures could have driven the number higher.

Nguyen Khanh Duy, head of the housing division at Savills Vietnam, said the number of foreign owners is low compared to the level of interest they have received since the new rule was introduced.

In the recent Vietnam Business Forum (VBF) held late last year in Hanoi, the foreign community also suggested the government push the process faster in permitting foreigners to buy houses in Vietnam.

Accordingly, the issuance of land use right certificates for foreigners is still delayed, along with the listing of residential housing developments which are allowed for foreign ownership.

“It is unclear at the moment what is holding back the issuance of such a list. Due to the delay in issuance of the Foreign Ownership Prohibited Projects List, the provincial Department of Natural Resources and Environment is refraining from issuing Land Use Right

Certificates (LURCs) to foreigners who have signed residential housing purchase contracts,” said David Lim, head of the VBF’s Real Estate Group.

“We propose that the Foreign Ownership Prohibited Projects List be issued as soon as practicable so that foreigners purchasing residential housing in Vietnam can obtain the LURCs in their name,” Lim added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- More than $40 billion investment recorded in Asia-Pacific commercial real estate (February 18, 2026 | 19:58)

- Keppel co-hosts Home Hanoi Xuan festival in Hanoi (February 14, 2026 | 09:00)

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

Tag:

Tag:

Mobile Version

Mobile Version