Can Southeast Asia’s largest mixed-use development revitalise Vietnam?

|

| Khanh Nguyen Associate director, JLL’s Capital Markets in Vietnam |

Over the past 30 years, Ho Chi Minh City has witnessed a meteoric rise. However, rapid growth comes with growing pains. Infrastructure within the existing central business district (CBD) is starting to buckle under the pressure of rapid expansion, vacant land is difficult to find, land value has reached a level that makes returns on office development and investment less attractive, and office rents have reached levels not seen in 2008. The master plan for Thu Thiem will alleviate these pressures, with the possibility of saving some of the historic urban centre of the “Pearl of Asia” from demolition and redevelopment.

The 657-hectare site of Thu Thiem is located on the Saigon River’s opposite site, facing the existing CBD. Comprising of 176 land parcels with approximately 3.2 million square metres (GFA) of residential space and 3.4 million sq.m (GFA) of commercial space, the total site will eventually accommodate a residential population of 145,000 and a workforce of 217,000. The new financial district will be home to a number of major head offices and will become a vibrant destination combining residences, offices, shopping centres, hotels, and serviced apartments.

Thu Thiem is a strategic getaway from Ho Chi Minh City to future development areas to the east, including the newly-proposed Long Thanh International Airport. With Thu Thiem Bridge 1 and Thu Thiem Tunnel under operation and once the four other bridges that are either under construction or planning are completed, residents in the CBD and neighbouring districts will have direct connection to Thu Thiem.

Thu Thiem will benefit from the future Metro Line No. 2, which stretches from Thu Thiem (District 2) and ends in An Suong (District 12) with the total length of approximately 19 kilometres. It is forecasted that once complete, the metro line will handle approximately 480,000 passengers per day.

Current land allocation land tender process

The most common way to obtain land in Thu Thiem is through the build-transfer (BT) agreement where a land plot is granted for developers in exchange for investing in infrastructure in the new urban area. 45 per cent of the total development site area have been officially approved through a BT agreement in which Dai Quang Minh Real Estate Investment Corporation, the developer of Sala City, has been granted the largest land bank in return for constructing four main internal roads (Crescent Boulevard, Central Lakeside Road, Saigon Riverside Road, and the road through the ecological forest located in the Southern Delta), Thu Thiem Bridge 2, and a pedestrian bridge. In addition, other parts of Thu Thiem are dedicated to this developer to build a 20-hectare Central Plaza and a 9-ha River Park, the 1:500 master plan of which are in progress.

Similarly, Ho Chi Minh City Infrastructure Investment JSC (CII) was granted approximately 90,000sq.m of freehold land and 6,000sq.m of 50-year leasehold land for residential and commercial purposes in exchange for the construction of technical infrastructure for the northern residential area, which consists of neighbourhoods 3 and 4 and the main North-South arterial road.

Phat Dat Real Estate Development Corporation has also been approved by the Ho Chi Minh City People’s Committee to conduct a study on the construction of Thu Thiem Bridge 4, which will link the peninsula to District 7.

Alternatively, land can be obtained through the bidding process. In 2011, the city authorities started the first tender for land parcels in Thu Thiem. Prior to 2016, 10 per cent of the total development site area was granted through the bidding process to different consortiums of large investors.

According to the announcement of the Thu Thiem Management Authority, in the second quarter of 2017, the remaining 16 per cent of the total development site will be tendered with a focus on five parcels in neighbourhood 2a.

|

| Can Southeast Asia’s largest mixed-use development revitalise Vietnam? |

Land value

With the majority of the total land bank in Thu Thiem confirmed, the remaining available land bank is scarce, while the demand for investment remains strong.

Land values within Thu Thiem have increased by 30 to 40 per cent in the past three years. While this is a considerable uplift, we believe it can be sustained for the following reasons: (1) the initial land value is coming off a relatively low base, (2) the speed of infrastructure construction has increased dramatically during this period, (3) the most recent residential projects launched in Thu Thiem have witnessed strong demand, and finally, (4) Thu Thiem is the largest undeveloped clean and clear master-planned land within the city centre.

On average, land prices in Thu Thiem are approximately one-third of District 1 and relatively low compared to neighbouring districts such as districts 3 and 4. In addition to land values appreciating in Thu Thiem, the neighbouring areas in District 2, such as Dong Van Cong, An Phu, and Thao Dien, have also witnessed increasing land prices. With rapid urbanisation, the establishment of Thu Thiem projects and some improvement in the legal and planning framework, it is reasonable to say that land prices will continue to increase over the coming years. The largest beneficiaries from this price movement will be the early pioneer investors in Thu Thiem as the higher risks that they had to bear in the early stage of development are compensated.

High-end apartments in target

With a booming high-end residential market and the abundant opportunities for commercial development, District 2 has become the focal point for large-scale developments in the last three years. Because of the quality of the master plan and the proximity to District 1, Thu Thiem is possibly the most attractive part of District 2.

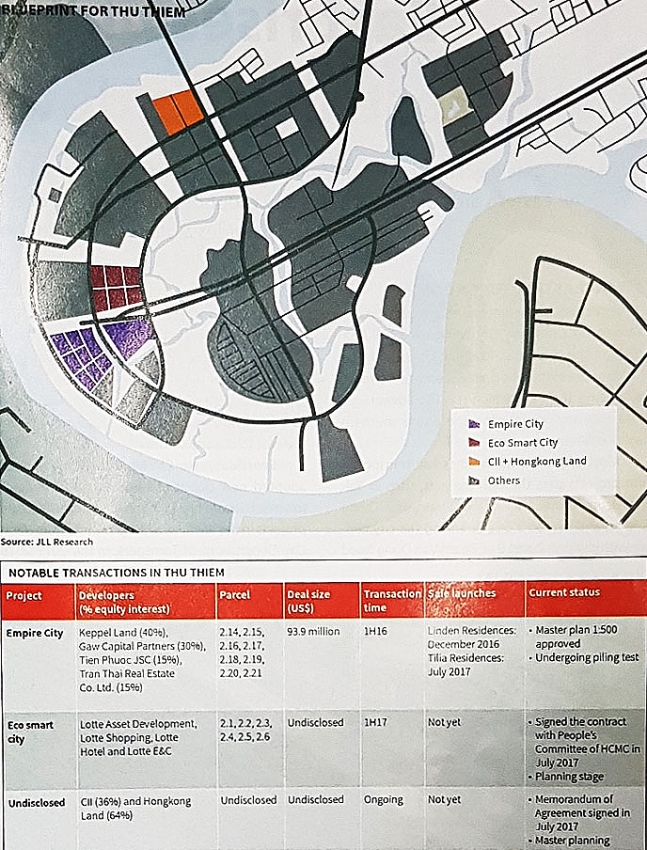

The Empire City project—developed by a consortium of Keppel Land, Gaw Capital Partners, Tran Thai Real Estate Co., Ltd., and Tien Phuoc Real Estate JSC—commenced a soft launch in December 2016 and a subsequent launch in July 2017, with the projects named as Linden Residence and Tilia Residence. These two launches demonstrate the latest ‘craze’ in demand for Thu Thiem. Both residential projects, totalling up to approximately 1,000 units, were almost sold out within the first few weeks of the launch. The average selling price of Tilia increased by approximately 20 to 25 per cent in comparison to Linden during the first six months. This increment is not only due to Tilia’s closer proximity to the Saigon River and better quality in terms of design and construction, but is also a reflection of high demand for the project.

Similarly, Dai Quang Minh’s Sala City has sold 95 to 100 per cent and recorded a 30 to 35 per cent increase in sale prices compared to the first launch in 2015. Both the projects of Empire City and Sala City have indicated strong appetite to invest in the high-end residential market in Thu Thiem.

Could the new supply threaten price tension?

Despite the recent increase in transaction volumes and prices, JLL believes that the current cycle has yet to reach its peak. It is forecasted that the supply of apartments in Thu Thiem will rise in the coming years as a new wave of luxury branded apartments from major investors is expected to hit the market. This new wave of supply might establish a new price level in Thu Thiem as the urban area becomes more developed with value-added services such as offices, commercial areas, shopping centres, entertainment venues, schools, and hospitals, among others.

The apartment selling price is predicted to keep on rising and we expect that this uptick will be an offset helping investors achieve the expected returns as land prices increase. Given a growing economy with strong demand from the buyers who either have cash on-hand or the ability to leverage, it is likely to see that buyers are taking a long-term view in their purchasing decision which is a positive sign for Thu Thiem. There are still plenty of investors hunting for good investment opportunities in Thu Thiem at a reasonable land price through acquisition or joint venture with good local partners. Hence, we expect this trend to support strong sustainable growth in this focal development of the city.

Vision for 2030

Although officially planned since 2005, it took two years to complete the first bridge and another four years to complete the tunnel, the second connection between Thu Thiem and the city’s downtown area. The paucity of support for infrastructure development and lack of incentives are the biggest impediments to Thu Thiem’s development.

Nonetheless, it is also observed that in these cases, it took time for the initial steps to be accomplished. As soon as the infrastructure development takes shape, the market will respond. Developers will be more confident and occupiers and buyers will be attracted to this rising opportunity.

As a late starter, Thu Thiem has the advantage of having an advanced master plan and learn from the experiences of other townships. Local authorities are able to introduce “smart city” concept and Thu Thiem will become Ho Chi Minh City’s premier destination for residential and commercial development.

With pressure mounting on the existing CBD and the renewed impetus to complete major infrastructure, JLL believes that now more than ever since its inception 12 years ago, Thu Thiem has reached a “tipping point.” It is time for investors to set their sights on Thu Thiem for the investment opportunities it offers.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Vietnam Property Outlook 2017

Related Contents

Latest News

More News

- Danang positioned as crucial economic hub for Central Vietnam (February 20, 2026 | 14:42)

- More than $40 billion investment recorded in Asia-Pacific commercial real estate (February 18, 2026 | 19:58)

- Keppel co-hosts Home Hanoi Xuan festival in Hanoi (February 14, 2026 | 09:00)

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

Tag:

Tag:

Mobile Version

Mobile Version