Bond market issuance high in 2016

|

|

By Hoang Thuy Luong Research Department VPBank Securities

In 2016, the State Treasury (ST) plans to issue VND220 trillion ($9.89 billion) of bonds, focused mainly on five-year bonds (VND100 trillion, or $4.49 billion) and three-year bonds (VND66 trillion, or $2.97 billion). The Vietnam Bank for Social Policies (VBSP) plans to issue VND16 trillion ($719 million) of government-guaranteed bonds, while the issuance planned by the Vietnam Development Bank (VDB) is VND25 trillion ($1.12 billion).

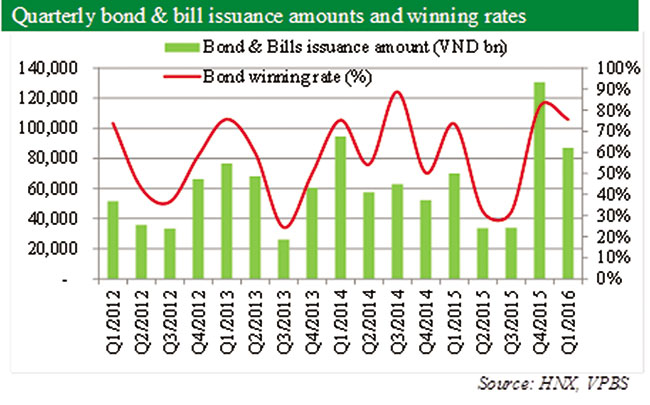

Issuance volume in the primary market remained high in the first quarter of 2016, after posting a record high volume in the fourth quarter of 2015. VND87.016 trillion ($3.91 billion) of government bonds were successfully mobilised in the primary market, an increase of 24.4 per cent over the same period last year. Short-term yields declined, while long-term yields were relatively stable. Long-term bonds with maturities of 20 years and 30 years were offered for the first time ever.

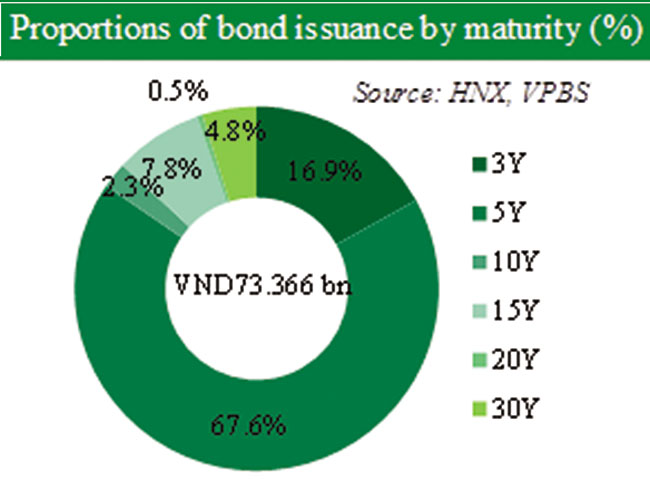

As of the end of the quarter, the ST had successfully mobilised VND73.366 trillion ($3.30 billion) of bonds, accounting for 96.5 per cent of the first quarter plan. The VBSP issued VND600 billion ($27.0 million), equivalent to 31.1 per cent of the plan, while the VDB issued VND13.05 trillion ($587 million), equal to 98.1 per cent of the plan. Bonds with five-year and three-year maturities have attracted investors due to high liquidity and low risk; VND49.61 trillion ($2.23 billion) of five-year government bonds were issued successfully, equivalent to 118 per cent of the plan and accounting for 67.6 per cent of the total issuance volume. Five-year bonds were followed in volume by three-year bonds with VND12.425 trillion ($558 million) issued, which was 69 per cent of the plan and 16.9 per cent of the total issuance volume.

The winning rate of government and government-guaranteed bonds averaged 75.6 per cent, higher than the 73.5 per cent level posted in the same period last year. Except for 20-year bonds, which failed to attract investors and produced an average winning rate of only 8.6 per cent out of the total VND4 trillion ($180 million) offered, the average winning rate for other maturities was from 75 per cent to over 95 per cent. Similar to the 20-year bonds, 30-year bonds were launched for the first time ever at the beginning of this year, but in contrast they have been attractive to investors, with VND3.541 trillion ($159 million) successfully mobilised out of VND3.7 trillion ($166 million) offered, for a winning rate of 95.7 per cent. Government-guaranteed bonds with maturities of three years and five years also posted high winning rates averaging over 92 per cent, while the 10-year and 15-year bonds could not attract investors.

Overall, three-year and five-year yields declined by around 20 basis points to 5.55 per cent and 6.38 per cent, respectively, in the first quarter of 2016. The declines of bond yields were due to several factors, including high rollover demand for a large amount of bonds that came due in 2016’s first quarter (VND56 trillion, or $2.52 billion); credit growth slowing in the first quarter as usual; and the USD/VND exchange rate remaining stable and even falling slightly in the first quarter of 2016. Meanwhile, yields of bonds with maturities longer than five years have remained unchanged; 10-year bonds were issued at a cost of 6.95 per cent, 15-year at 7.65 per cent, 20-year at 7.75 per cent, and 30-year at a cost of 8.0 per cent.

Outlook

We believe that bond yields will rise in the second quarter for several reasons. Inflation is forecast to increase in the coming quarters as crude oil and commodities prices in international markets are expected to rebound, and unfavourable weather conditions could affect agricultural production and thereby the prices of food and foodstuffs. In addition, deposit rates at commercial banks have been on an uptrend recently. Demand for credit is expected to increase at a faster pace in the second quarter to support production and businesses; this could limit the capital available for government bonds. Moreover, the need for government bond issuance remains high to ensure state revenue, while the demand for bonds could slow down in the second quarter.As such, these factors could push bond yields up in order to attract investors.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version