BNPL products come to aid of consumers

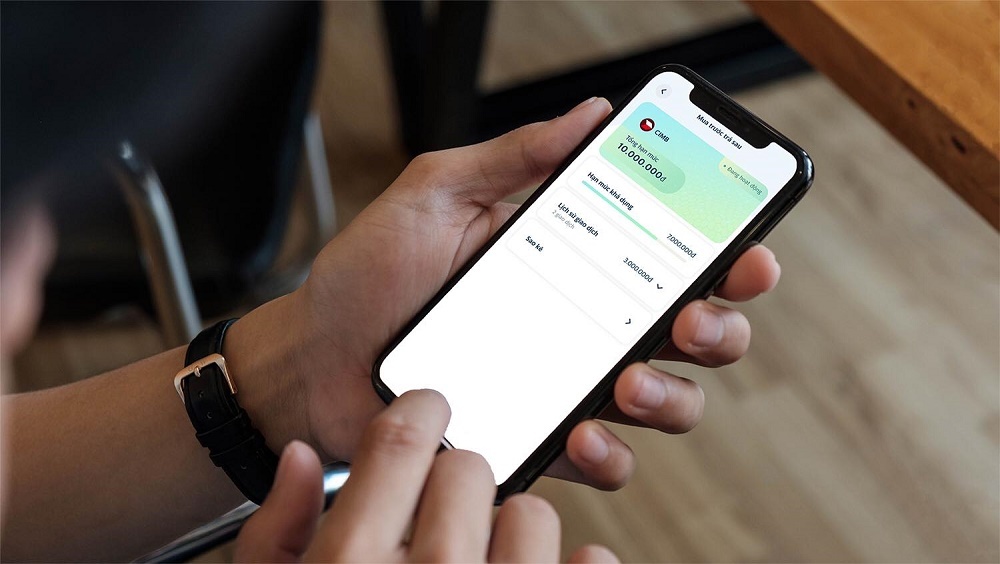

Malaysian bank CIMB in collaboration with Smart Net Trading Service JSC – the owner of the SmartPay e-wallet – unveiled last week a new buy now, pay later (BNPL) product with a maximum limit of VND30 million ($1,280). The move aims to facilitate shopping for consumers and boost sales for sellers.

|

| BNPL products come to aid of consumers |

With this payment option, customers can avoid lengthy applications or collateral when shopping online or offline. CIMB and SmartPay set the limit on how much customers can purchase, while customers can break up their payments into a series of instalments with different terms.

The tie-up is expected to boost the penetration of BNPL in the Vietnamese market. While CIMB is a pioneering digital bank in Vietnam with innovative financial products and banking services, SmartPay boasts a network of 740,000 accepted payment points across the country.

“BNPL has witnessed rapid growth as customers are increasingly aware of its outstanding advantages,” said SmartPay CEO Moin Uddin. “This solution makes smart and modern financial services more available to customers, especially to those who struggle to access consumer loan services and have difficulty in proving their finances.”

Meanwhile, Kredivo, an Indonesian digital credit platform, has become Sendo’s official BNPL service provider partner. It was established in Vietnam last August through a tie-up with VietCredit, and gradually introduced various service packages to the market, including instalment services for e-commerce purchases and personal loans. Kredivo actively partners with leading e-commerce platforms, payment gateways, and online retailers to promote its BNPL services in the country.

Ho Minh Tam, CEO of VietCredit Finance JSC, Kredivo’s strategic partner in Vietnam said, “BNPL is becoming a popular purchase method in Southeast Asia. The low credit card ownership rate for the Vietnamese market will open up many opportunities for us when participating in this market.”

Regarding customers’ data privacy, representatives from Sendo, VietCredit, and Kredivo highlighted that the sharing mechanism among trio-parties would be utilised for BNPL purposes only.

“Despite lingering concerns over cybersecurity attacks, we guarantee that our cutting-edge technology will safeguard customers’ privacy,” said Krishnadas Mohandas, senior vice president of Business Development at Kredivo. “Furthermore, we have also developed an exclusive customer rating methodology from the very first start, and it would assist us on how to choose the most eligible customers. Hence, we are confident that our AI-centralised, customers-centric approaches would bring timely benefits to our customers.”

BNPL services are now receiving more funding to realise their full potential. Home Credit is pouring in VND200 billion ($8.7 million) to build its own BNPL product, Home PayLater.

Michal Skalicky, chief customer officer of Home Credit, said, “We have focused on providing comprehensive investment for Home PayLater, including in human resources, attractive incentives for customers, and the application of technology to process systems for partners.”

Besides traditional transactions paid in instalments such as electronics, education, and motorbikes, with Home PayLater, Home Credit also opens up new schemes for air tickets, travel, cosmetics, and more. This creates opportunities to help retailers access modern financial solutions to increase sales, and also give consumers diverse options to balance their spending and personal finances.

The latest report by ResearchAndMarkets.com points out that BNPL payments in Vietnam are expected to grow by 126 per cent on annual basis to reach $1.12 billion in 2022. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a compound annual growth rate of 45 per cent during 2022-2028. BNPL gross merchandise value in the country will increase from $496 million in 2021 to reach over $1 billion by 2028.

BNPL products are gaining increasing traction among consumers in Vietnam as both startups as well as established corporates bet big on it, the report added. While the absence of specific BNPL regulations in Vietnam continues to pose certain risks, the adoption of BNPL schemes has accelerated over the last 1-2 years.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version