Big foreign groups await GMT direction

|

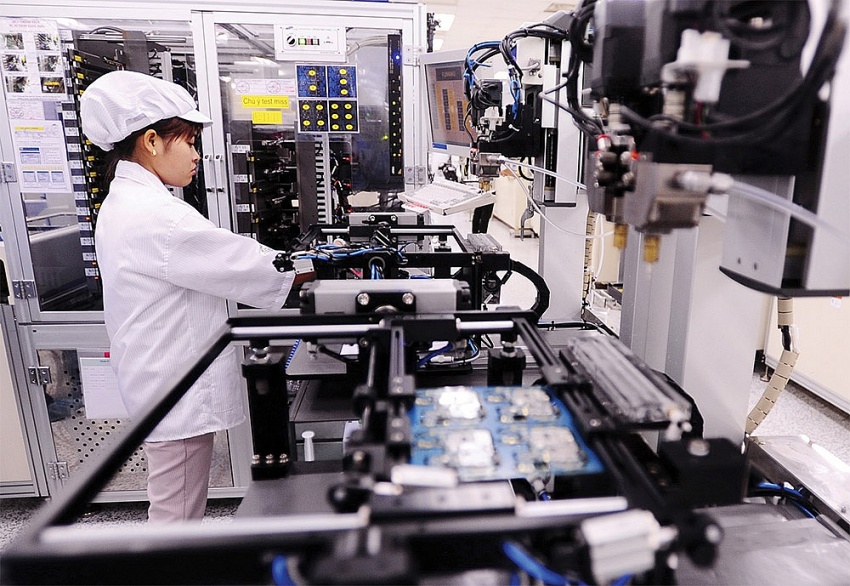

| An investment support fund is slated to support the business community, Photo: Le Toan |

Many foreign investors, including members of the European Chamber of Commerce in Vietnam (EuroCham), are encouraging the government to accelerate the application of the 15 per cent global minimum tax (GMT) rate, which is considered an opportunity for Vietnam to consider tax reform.

“The application should be carried out as soon as possible so as not to lose either tax revenues or foreign investment, as other countries will impose top-up taxes from 2024 and are also considering revising their tax incentive regimes in response,” said Gabor Fluit, chairman of EuroCham, at the Vietnam Business Forum last week.

At present, the Vietnamese government is taking the opportunity presented by the tax to undertake a comprehensive review of tax incentives currently in place. This includes studying the impacts of the GMT on current and future investors and considering effective solutions so that the tax adoption does not create a negative impact on the investment environment.

Government reviews show that if expenditure-based incentives were to be introduced instead of income-based ones, such as tax holidays, there would be less impact of the adoption on foreign investment with under the GMT. Accordingly, foreign investment could increase in targeted sectors and locations and the commitments.

The expenditure-based incentives that could be considered include accelerated depreciation for machinery and equipment in projects and double tax deduction of labour cost or research and development costs for encouraged initiatives.

In addition, the government’s review showed that expenditure-based incentives may increase the likelihood of generating additional investment as they directly target investment expenses.

Last December, the National Assembly (NA) proposed that the government draft a decree on the establishment, management, and use of the Investment Support Fund, using revenue from the GMT and other legal sources to build a stable business environment, encourage and draw in strategic investors and multinational companies, and support domestic businesses.

The Ministry of Planning and Investment has been actively developing a draft decree and is consulting opinions to complete it. At the end of 2023, the NA adopted a resolution on the imposition of top-up corporate income tax (CIT) of 15 per cent under the Global Anti-Base Erosion model rules, which took effect in January.

Under the resolution’s Article 2, the taxpayers in Vietnam include subsidiaries of multinational corporations with a turnover equivalent to €750 million ($821.62 million) or more in the consolidated financial statements of the ultimate parent company for at least two of the four years immediately preceding the fiscal year.

For Vietnam, the imposition of the GMT will help ensure the country’s right to levy the tax in line with the international practices currently deployed by many nations.

According to a government report on assessing the impact of the resolution, based on 2022 CIT data analysis, about 122 foreign-invested enterprises will be subject to the resolution, with a total amount of top-up CIT of about $616 million.

Vietnam’s current general CIT rate is 20 per cent, which is higher than the GMT rate. However, this rate is just of nominal value because all major foreign-invested projects in Vietnam have been currently enjoying special incentives policies covering various investment fields, locations, and more.

Thus, many multinationals are entitled to a four-year tax exemption and a 50 per cent tax reduction for nine years, or a two-year tax exemption and 50 per cent tax decrease for four years, so the total amount of their paid tax is less than 15 per cent.

“If Vietnam does not collect GMT from these enterprises, this tax value difference will fall into the hands of countries where the parent companies are based,” said the General Department of Taxation’s deputy general director Dang Ngoc Minh.

| Seck Yee Chung, head, Tax and Customs Working Group, VBF In order for the investment support policy to contribute to a stable business environment and retain and attract large corporations, we have some recommendations for further consideration and finalisation of the draft decree on the establishment, management, and use of the Investment Support Fund. In the high-tech sector, the current draft decree only targets companies with investment projects in high-tech product manufacturing, and not those operating in high-tech parks. According to regulations, companies in high-tech parks must meet very strict conditions, one of which is that their project’s areas of operation must fit one of the high-tech fields in which investment is encouraged. Thus, these businesses should also be targeted for support in the high-tech sector. Regarding scale of investment, the current draft looks at the enterprise-level or project-level scale. In fact, in the high-tech sector, research and development is highly technical, with high technology content, and related outputs are often applied to manufacturing of small but critical spare parts and components in terms of new technology or materials. Due to in-depth applications of each technology, tech companies often carry out investment activities under individual projects or subsidiaries, for each type of product with specific technologies. Therefore, high-tech companies and projects in Vietnam are often small in scale. If we only look at the scale of each project or subsidiary, which is actually supervised by a larger corporation/investor, we will miss important strategic investors in technology. Currently, there are big names in technology implementing investment activities and long-term commitments in Vietnam, with many subsidiaries and investment projects. It is suggested that support policies for investors in the field of high technology should target large corporations in terms of their total scale of investment in Vietnam as a single entity. Additional corporate income tax collection under global anti-base erosion regulations poses a significant challenge to maintaining competitiveness in Vietnam’s business environment. Therefore, when developing attractive policies, we believe that the government also needs to learn from the experiences of other countries to come up with appropriate and competitive policies. |

| New fund a solution to GMT concerns The Ministry of Planning and Investment has created a draft decree for a brand new investment support fund, but the scale of the projects and investors under the draft’s purview is the subject of intense debate and discussion. |

| Preferential support on cards for GMT alignment Green production and business, a favourable digital environment, high-quality human resources, and a suitable living environment are necessary factors for Vietnam in implementing the global minimum tax. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Mobile Version

Mobile Version