ASEAN aiming for tech-led innovation to foster growth

As a region, ASEAN has experienced years of consistent high growth. Its markets now draw more foreign direct investment and are wealthier than before – and by 2030, the region’s economy is expected to double from $3.1 trillion in 2019 to $6.6 trillion over the next few years, according to United Overseas Bank Ltd.

|

|

From a demographic perspective, the region’s credentials are equally impressive. ASEAN is currently home to over 660 million people – equivalent to a little under half the population of China – of whom 450 million are of working age. By 2030 these numbers will likely swell to 725 million and 488 million respectively. It is this demographic windfall, combined with economic expansion, that will power the region forward in the decade ahead.

Talking with VIR, CEO of Malaysian-based Elquator Henrik Pryter said the ongoing pandemic has raised vulnerabilities and is quickening shifts in key exchange hallways. On the other hand, worldwide supply chains are being broadened. This presents openings for both inbound and outbound activities for ASEAN.

Pryter’s company aims to expand to countries such as the United Kingdom and Denmark to meet the surging demand. If successful, the moves would further demonstrate the product capacity of ASEAN groups.

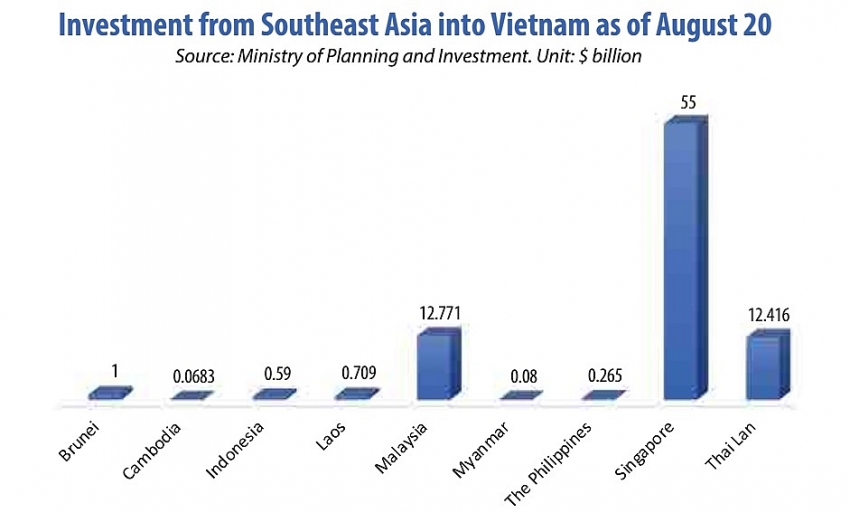

China remains the leader in global manufacturing, with every fluctuation in its manufacturing output and cost levels making headlines around the world. But foreign investors are increasingly turning their gaze southward to the 10 dynamic markets comprising ASEAN, with manufacturing one of the bloc’s key economic growth drivers. Already, the region is a global manufacturing hub and was estimated to have grown at a compound annual growth rate of 6.6 per cent in the last four years.

Many big names are already based here, including Bosch, Ford, ABB, Ericsson, GE, Samsung, LG, ExxonMobil, Coca-Cola, and Pepsico, and many more.

Foreign investors have a growing awareness of ASEAN’s value as a base of operations mostly focused on chemicals, food and beverages, metals, and motor vehicles, but other sectors such as renewables and water treatment are fast becoming new trends.

Horst Harbers, CEO and founder at OptiCat R2V Pte., Ltd. – which is collaborating with Swedish water purification innovators Drupp – told VIR, “My aim is to use renewable energy here in Southeast Asia to further promote the modular water from air technology to many businesses looking for a sustainable solution, including food and beverages and personal care manufactures.”

In recent report from Cushman & Wakefield (C&W), it was noted that the current China-US trade war and the ongoing pandemic may be catalyst for change but they are not the underlying drivers for the growth of ASEAN manufacturing.

“The manufacturing shift towards Southeast Asia has been a long time in the making. As minimum wages in China grew, more orders for labour-intensive products, such as clothes, toys, and shoes shifted to less expensive locations in India, Bangladesh, Myanmar, and Vietnam,” the report said. “However, despite government initiatives to attract manufacturers by Southeast Asian countries, China retains a clear infrastructure advantage with the ability to efficiently move goods via road, rail, or sea transport.”

In Southeast Asia, on the other hand, Ho Chi Minh City, Hanoi, and Manila enjoy a cost differential over all Chinese markets – offering cheaper land and labour. In fact, Vietnam has jumped a few notches in C&W’s global ranking of the most cost competitive manufacturing hubs to number two after China.

Beyond this, Jakarta and Bangkok act as alternative locations for higher order manufacturing due to higher costs in rent and labour respectively, according to the report.

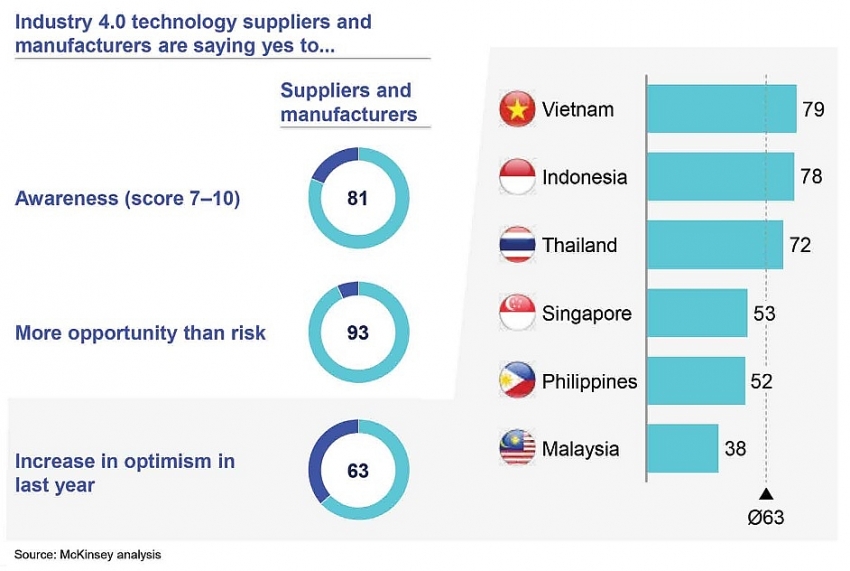

“ASEAN has been playing on cost efficiencies. It is time to transform that into technology-led innovation because that’s the way they will participate in global value chains and also grow across industries,” said a representative of Standard Chartered at last week’s ASEAN Business Forum.

Whether expanding into ASEAN or reconfiguring their current regional footprint, foreign investors need to carefully analyse both their medium- and long-term implications for two reasons, according to a report from McKinsey & Company. “Firstly, companies face extended time horizons for realising returns on capital-intensive investments. Secondly, the process for plant location requires significant time, resources, and organisational focus. Having to repeat this process unexpectedly, due to significant shifts in demand, for example, could have a material impact on a company’s supply chain, business strategy, and bottom line,” the report said.

| Natalie Black - UK Trade Commissioner for Asia-Pacific

The United Kingdom has launched the first Digital Trade Network, starting in the Asia-Pacific. This will increase UK digital tech expertise on the ground in ASEAN, allowing us to strengthen our partnerships for the digital economy and unlock the benefits that responsible tech can deliver. The UK government will further deepen its digital partnership with ASEAN through a pilot which will explore how micro, small, and medium-sized tech enterprises can deliver digital solutions to some of the more challenging business issues faced in the region. The UK will also continue to work closely with the ASEAN Business Advisory Council to develop a private sector regional digital trade connectivity roadmap, complementing the ASEAN Single Window programme which can lead to more facilitative trade within the bloc and beyond. Michele D’Ercole - President, ICHAM Vietnam

Italian companies and the skills found within mechanical segments can work as a vital resource for ASEAN nations inside the setting of modification of supply chains. Numerous conversations focus on making smart cities, e-governments, and networks as well as organising security. Smart cities and Industry 4.0 definitely help Vietnam along with other countries, as here in Italy, our government has also designed Industry 4.0 policy initiatives. They are an assignment given to a city that uses green vitality, clean vitality, and a framework for the long haul, upgrading the quality and execution of urban life to decrease utilisation, wastage, and costs. They also incorporate numerous perspectives which are not continuously simple for ASEAN nations that encounter fast and solid urbanisation. We are willing to share our experience with ASEAN nations, including Vietnam, on how to utilise smart cities and reach sustainable development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Drive ASEAN Forward

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version