Arduous path to LNG success

|

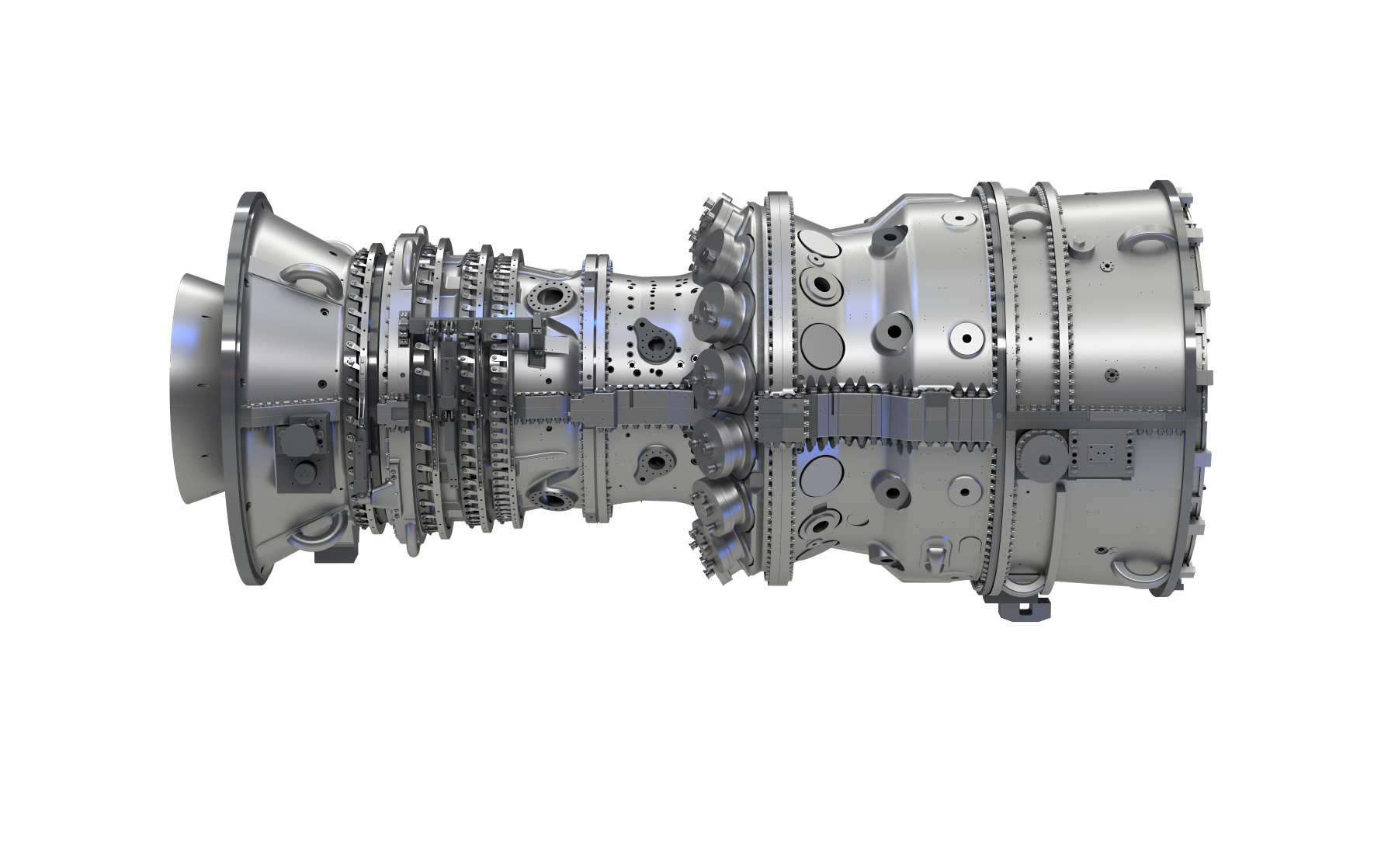

| GE's latest 9HA.02 turbine is accelerating the shift to LNG |

After a wave of investment in solar and wind power over the past two years, Vietnam is now witnessing strong interest in the field of electricity generated with the use of liquefied natural gas (LNG).

A report by the Institute for Energy Economics and Financial Analysis (IEEFA) published in January stated that Vietnam has quickly become one of the most promising LNG import markets in Asia, and many domestic and international investors have expressed their desire to pursue projects in the country. They are encouraged by changes in government management that no longer sees coal-fired thermal power as the centre of the power system, as well as the rapid growth of renewable energy in the nation’s power structure.

As such, investors have actively portrayed LNG as a cleaner source to replace coal and argue that gas-fired power units will be one of the main power sources required to feed public demand and supplement unstable renewable sources.

The IEEFA report also stated, “Vietnam’s electricity industry has never seen a wave of investors expressing so much interest as they do now, that – with the accompanying diplomatic pressure – remains unprecedented in the country’s history.”

Interest in LNG power may also be related to Resolution No.55/NQ-BCT on the orientation of Vietnam’s National Power Development Plan (PDP8), which emphasises the rapid development of LNG thermal power plants. However, at the same time, experts advise that priority must be given to developing LNG import and distribution infrastructures.

According to the nation’s target until 2030, Vietnam must import 8 billion cubic metres of LNG per year, while the current rate is zero. The focus on LNG power generation is also attributed to its advantages, such as ensuring a stable power supply and minimising the impacts on the environment.

“The third draft of the PDP8 for the period 2021-2030, with a vision to 2045, is proposing to quadruple the current capacity of gas-fired thermal power by 2030 to 28GW, equivalent to 21 per cent of the total system capacity. Most of these plants are then expected to use imported LNG,” the IEEFA report states.

According to experts, LNG power generation is flexible and can be adjusted as needed. Besides this, the carbon emissions of LNG account for roughly half of coal power, which helps to reduce the energy sector’s impact on the environment. At the same time, LNG power is capable of reaching higher power output when needed, without interruptions and dependencies on nature such as wind or solar power.

Given the fact that global CO2 emissions are still increasing, the power sector takes on a mandate and a multidimensional approach to take important steps to rapidly reduce greenhouse gas emissions and solving the problem of climate change on a large scale.

“Despite the massive deployment of renewables such as wind and solar power, the energy sector has not improved significantly to meet the goals set out in the Paris Agreement on carbon neutralisation. The International Energy Agency (IEA) said that to achieve improvements in power efficiency, instead of spending time building new renewable power sources, it is possible to convert from coal to gas to reduce emissions faster,” said Vic Abate, General Electric’s (GE) senior vice president and chief technology officer and former CEO of both GE’s Gas Power and Renewables businesses.

According to the current draft of the PDP8, there are about 24 LNG projects proposed with a total potential of 23GW by 2025 and 84GW by 2035, with a demand for imported LNG of about 60 million tonnes per year.

Challenging negotiations

According to experts, about half of the proposed gas power projects are complexes for LNG import ports, storage tanks, recycling systems, and gas pipelines and power plants, with the remainder being pure power plants running on LNG.

However, no LNG power project has started its construction yet because contracts related to their operation have not been completed, most notably because of the missing power purchase agreements (PPA).

Even though the Bac Lieu LNG project was licensed in early 2020, the project owners are still negotiating a PPA without seeing the finish line anywhere close.

Talking about the progress of LNG project implementation, experts from the energy sector, as well as several project brokers and financial advisors, also said that the biggest challenge will be to negotiate the PPA.

“PPA negotiations must comply with the regulations of the Ministry of Industry and Trade, whereby the approved project documents must be available before the negotiation. Based on investment costs, cash flow in and out, profits, and discount rates, the purchase price of electricity that investors want to sell will be set. Except for those cases that do not exceed 7 US cent per kWh, for which Electricity of Vietnam will sign a PPA immediately, other prices will take computation and consideration,” said energy consultant Nguyen Binh.

Other investors also said that since the government reaffirmed that there are no guarantees, the decision to invest in an independent power plant requires investors to make great efforts.

“Spending a few billion US dollars on projects without a foreign currency conversion guarantee will make it difficult for investors to keep cash flows in hand when unexpected situations occur,” said Binh.

|

| Track 4A power plant in Malaysia running on GE's latest generation of HA turbines |

Scale is king

According to Petrovietnam, the 24 planned LNG power projects recorded in the draft PDP8 will lead to a situation where the coastline of Vietnam will be covered by the configuration of “one power plant plus one LNG import and gas refinery warehouse”.

Meanwhile, other countries around the world are developing power plant clusters using large receiving ports to optimise the cost of gas infrastructure between the port and the power plants.

This means that these power centres choose a place with favourable conditions for convenient infrastructure with low cost, located near a suitable load centre and built according to environmental criteria. For instance, port warehouses must have a capacity of at least 6 million tonnes of LNG per year to be considered cost-efficient.

In parallel with the recommendations on the size of LNG terminals, experts also said that using new and innovative technologies will bring higher efficiency to an LNG power plant.

In the technology race, GE’s two world records for operating power plants with the highest efficiency have sparked the interest of LNG project operators in Vietnam as they offer significant cost savings compared to other technologies in the industry.

“The newest generation of turbines offers the lowest cost of capital and fuel conversion with a long engine life, thus reducing the total cost of ownership. As such, a generation H turbine combined with cycle plant for 1,000MW occupies an area of about 0.05 square kilometres, far less than the 20sq.km needed for onshore wind or solar power plants of the same scale,” said Christophe DuFault, general manager (Project Execution) of GE Gas Power Asia, adding that GE’s HA turbines are currently the largest and most efficient gas turbines in the world and have received more than 120 orders from more than 48 customers in 20 countries and regions.

With its strong development potential, the IEA expects the Asia-Pacific to be a region with many “breakthroughs in the development of LNG power plants in the next decade”.

GE has more than 80 years of experience in the supply and construction of combined cycle power plants, and it has been 29 years since the first H turbine generation. GE’s H-generation turbines currently supply 21.5GW at 24 locations worldwide and are monitored daily at its centre in Kuala Lumpur.

In addition to delivering outstanding energy efficiency and cost savings, GE’s newest H-generation turbines also cut emissions – a key factor in securing the future of the energy industry in Asia-Pacific.

However, experts also say that although LNG can be a superior solution to other fossil fuels in terms of efficiency and emissions, both these advantages depend heavily on related technology.

“Our new power plant operating in Malaysia demonstrates that low-carbon or non-carbon gas power technologies, such as our HA technology, can help accelerate CO2 reductions in power production. At GE, the combination of gas and renewable electricity will be part of the solution for the present and the future,” said DuFault.

LNG is now expected to lead the way in Vietnam’s energy structure, meeting a large portion of its capacity by 2030.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Sustainable Energy

- 16th national conference on nuclear science and technology opens in Danang

- Technology and Energy Forum 2023 to open in Quang Ninh

- Asia Clean Capital Vietnam receives backing from Swiss Investment Manager

- Amazon scales renewable energy to fight climate change

- Universal Alloy Corporation Vietnam partners with Asia Clean Capital Vietnam

Related Contents

Latest News

More News

- Addressing Vietnam's energy challenges with aeroderivative gas turbines (February 28, 2023 | 09:33)

- How to sprint ahead in 2023’s worldwide energy priorities (February 08, 2023 | 13:55)

- Boosting Vietnam's grid stability through gas turbine technology (November 22, 2022 | 20:02)

- Healthcare trio collaborates to provide thousands of free breast scans (October 27, 2022 | 17:19)

- GE Healthcare's vision for AI-backed radiology (September 29, 2022 | 11:53)

- GE brand trio to shape the future of key industries (July 19, 2022 | 15:35)

- GE unveiling brand names and defining future (July 19, 2022 | 15:16)

- GE: the shortest route towards sustainability (July 18, 2022 | 08:00)

- Be proactive in an uncertain world (May 20, 2022 | 11:40)

- GE secures first 9HA combined cycle power plant order in Vietnam (May 16, 2022 | 17:06)

Tag:

Tag:

Mobile Version

Mobile Version