Analysts appreciate VIB's Q2 2021 business results and strategic planning

|

| Analysts appreciate VIB's Q2/2021 business results and strategic planning |

The online event attracted more than 180 representatives from large funds, securities companies, independent analysts, and media. The content of the discussion revolved around three main topics. VIB's strong business results in the first half of 2021 were shared by CFO Hoang Linh.

The key business strategies that have made VIB the top retail bank that it is today were discussed by Tran Thu Huong – head of strategy cum head of retail banking. And, VIB's digital banking solutions as the future of its retail arm were shared by deputy CEO cum CIO Tran Nhat Minh.

Expanding profit margins while supporting customers and the community

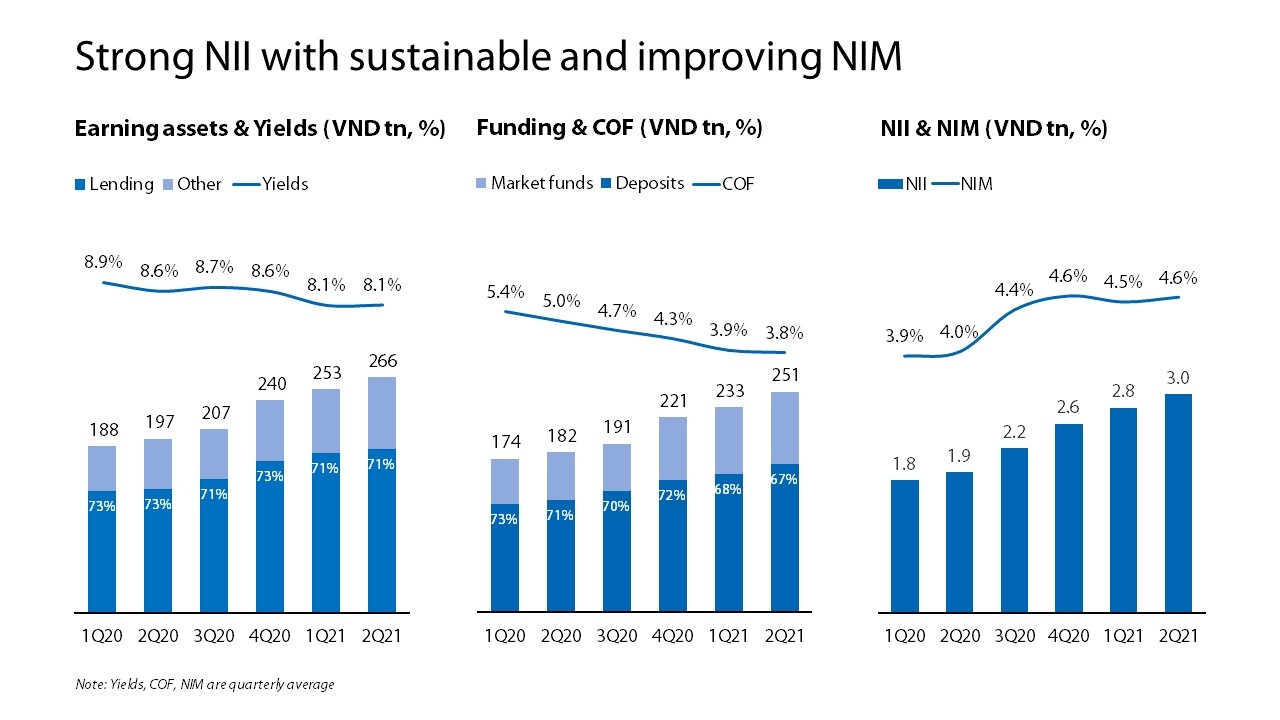

Since the pandemic started, VIB reduced lending interest rates for corporate and individual customers to support them during this difficult time. Simultaneously, VIB continued expanding its net interest margin (NIM) by promoting the development of the retail segment and optimising funding costs.

VIB's report shows that the NIM trend in the last six quarters has improved significantly due to the reduction in cost of fund (COF). VIB's COF decreased from 5.4 per cent in Q1/2020 to 3.8 per cent in Q2/2021. The NIM increased from 3.9 per cent in Q1/2020 to 4.6 per cent in Q2/2021.

In this regard, Linh said, VIB has actively optimised the funding cost by promoting the growth of CASA (current accounts and savings accounts), and at the same time, increased low-cost funding sources in the international market. VIB has also just signed a syndicated loan worth $260 million over three years with the Asian Development Bank and a number of other international financial institutions. The bank is also implementing a plan to digitalise all CASA and deposit products to further grow this capital source.

With the focus on its retail strategy, VIB's retail loan balance in the first six months grew by double digits, reaching 14.2 per cent, accounting for nearly 90 per cent of the total outstanding balance bank debt. The retail portfolio helps VIB reduce concentration risks and adapt well to the current volatile market environment. VIB is also the bank with highest retail loan proportion in the market today.

|

Maintaining a strong balance sheet

As of June 30, VIB's total assets reached over VND277 trillion ($12 billion), and the credit balance was over VND185 trillion ($8 billion), signifying an increase of 8.1 per cent compared to the beginning of the year. Deposits from customers increased by over 12 per cent.

VIB's non-performing loan ratio decreased to 1.3 per cent. With strict risk management, the bank has well maintained its risk indicators and prudential ratio. Capital adequacy ratio according to Basel II is at 10.3 per cent, and the loan-to-deposit ratio stands at 73.1 per cent.

Answering investors' questions about debt restructuring for customers affected by COVID-19, Hoang Linh shared that since the beginning of 2020, debts of more than 3,000 customers have been restructured by the bank, and nearly 10,000 customers are entitled to a reduction of interest rates from 0.5 per cent to 2 per cent.

From July 15, VIB continued to reduce lending interest rates for individuals and corporate customers with an average interest rate reduction of 1.5 per cent, focusing on customer groups severely affected by the pandemic.

VIB's support was timely and effective, so the outstanding balance of the restructured loans was paid in full and on time by most customers, helping the bank's total restructuring loan balance decrease.

Key business segments excelled

Huong shared that VIB's market-leading business segments include mortgage loans such as real estate, automobiles, credit cards, and insurance.

After five years of transformation, VIB's retail loan balance was in the top four by the end of 2020, and this position may even be improved in 2021. The retail segment accounted for 21 per cent of profit before tax (PBT) in 2016. By the end of 2020, the segment accounted for 70 per cent of PBT.

VIB's business strategies are gradually receiving positive results from the automation and digitalisation of sales and after-sales services in the retail segment.

Analysts asked whether VIB has difficulties in bad debt management and recovery, especially in the context of social distancing. Tran Thu Huong reaffirmed that VIB is not only the leading bank in terms of sales but also the industry leader in risk management of the auto lending segment.

VIB applies a strict risk management right from the development stage and the customer's debt repayment requirements. The loan to value ratio is always below 80 per cent, closely evaluating collaterals. At the same time, 90 per cent of auto loans are new loans for consumers that are among the top car brands in the market.

"Therefore, the bad debt ratios of the retail segment in general and the auto segment in particular at VIB have almost remained unchanged,” said Huong.

The exchange also focused on VIB's outstanding areas of bancassurance and credit cards. “Vietnam's bancassurance premium to GDP ratio is less than 1 per cent, compared with an average of about 10 per cent of other countries in the region. However, we love healthy competition,” said Huong when investors asked about the current competitive situation in the segment.

VIB has been ranked number one or two for many consecutive years in the bancassurance segment. Despite social distancing, VIB has maintained its top sales thanks to digital sales platforms and solutions that have been implemented by VIB in the last two years.

Huong shared that the bank's credit card opening and card spending rates reached the highest levels in the history because VIB is a pioneer in applying modern technologies to daily life. From the opening stage to usage, everything is completely online, besides others outstanding features that VIB applies in Vietnam.

After more than two years of strong implementation of the credit card business, the bank has successfully applied AI and big data along with modern technologies in the credit card approval process, setting a new record for processing and approval within only 15-30 minutes. As a result, VIB continues to be in the top in terms of growth in the number of credit cards and spending on cards, ranking second in the whole market, according to a report by the Vietnam Card Association.

“This confirms that our credit card development strategy is promoting our strengths in technology, as well as the unique product features and outstanding customer experience in the market”, Huong said confidently.

Some fund representatives questioned whether VIB would consider expanding its customer base through strategic partnerships with other companies. Huong said that VIB focuses on developing digital banking, with solutions to reach a diverse set of customers instead of just targeting a few specific customer groups.

At the end of the exchange, VIB's representative also expressed optimism and confidence in the policies of the State Bank of Vietnam and the government.

|

Pioneering digital banking

VIB has pioneered the application of leading technologies such as big data, AI, and cloud computing to enable transactions of customers easily and conveniently in a short time. Minh shared that customers can easily open cards for payments, online savings, and money transfer.

Other banking services of VIB are also offered 24/7 right at home without having to go to a branch. Because of these advantages, registrations for VIB's digital banking solutions grew by 130 per cent in 2020.

VIB also offers many full digital products and cooperates with partners such as Ho Chi Minh City Securities Corporation and VNDirect to offer a convenient experience for its customers.

Continuous and sustainable growth

In the first six months of the year, VIB recorded a pre-tax profit of VND3.95 trillion ($169.5 million), up 68 per cent over the same period in 2020. VIB representatives believe that the bank will continue the outstanding achievements of the 10-year transformation programme to maintain its leading position in retail and technology and, at the same time, exceed its challenging business goals in 2021.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version