Accelerating transition for a greener industrial sector

With its robust industrial base and booming economy, Vietnam stands uniquely positioned to spearhead this shift. Multiple factors, including governmental initiatives like the National Green Growth Strategy, indicate a strong commitment to sustainable development.

|

| Paul Fisher, country head of JLL Vietnam |

However, this transition encompasses complexities such as resource constraints, technological readiness, and limited business awareness, which must be navigated through collaboration, innovation, and strategic partnerships.

Vietnam’s geographic advantage situates it at the heart of global and regional supply chains. Its proximity to China, the world’s biggest manufacturing hub, further accentuates its strategic position.

As a vital member of the ASEAN Economic Community, Vietnam has secured enhanced trade access within ASEAN markets, driving continuous growth in foreign direct investment, especially in manufacturing.

Yet, this growth is accompanied by the pressing need to conform to evolving global sustainability standards, particularly those emanating from the EU.

The introduction of the Corporate Sustainability Reporting Directive in 2023 marks a significant shift. It mandates companies to disclose their environmental, social, and governance (ESG) practices, expanding coverage from 11,000 to around 50,000 EU businesses by early 2024.

EU has been a critical trading partner of Vietnam, and it was the third-largest export market and fifth-largest import market in 2023. Conversely, Vietnam ranks as the 16th biggest trading partner of the EU. Specifically in terms of exports, Vietnam ranks 11th among the largest goods suppliers to the EU. Therefore, these regulations carry immense implications.

Additionally, the EU’s Carbon Border Adjustment Mechanism, effective from 2026, will impose carbon taxes on imports based on their emission intensity, affecting Vietnam’s iron, steel, aluminium, cement, and fertiliser exports.

These stringent sustainability-driven regulations necessitate proactive adoption of eco-friendly practices by Vietnamese industries to integrate successfully into the global value chain and maintain critical business relationships, especially with EU partners.

Transformations and implications

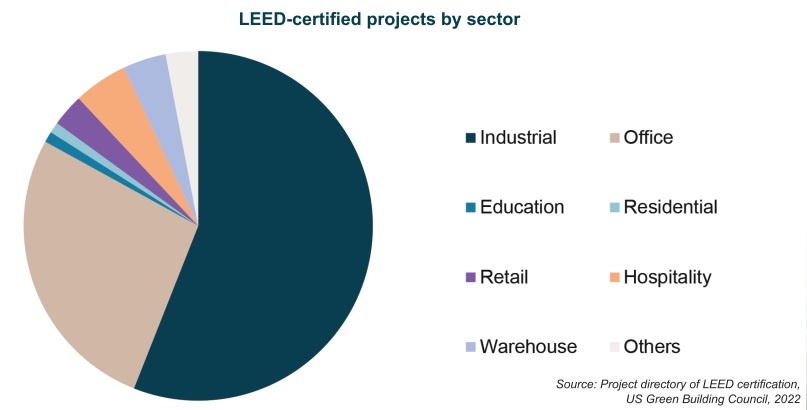

Manufacturers in Vietnam are leading the country’s sustainability efforts. More than half of LEED-certified projects in Vietnam are industrial factories. European firms in Vietnam, such as Heineken, Nestlé, and Tetra Pak, and so forth who have invested in Vietnam, have embraced circular economy principles in their production processes to minimise waste and pollution.

These companies demonstrate their commitment to sustainability through initiatives like packaging recycling, wastewater treatment, and the use of renewable energy sources, as highlighted in their public reports.

Local companies like Hoa Phat Steel and Duy Tan Plastics are also making significant progress by transitioning to sustainable energy sources, optimising operations to reduce CO2 emissions, and implementing efficient water usage cycles. This commitment is critical for maintaining competitiveness in a global marketplace that increasingly prioritises sustainability.

The demand for ESG compliance is compelling real estate developers in Vietnam to invest heavily in green assets. Developers such as LOGOS, SLP, Emergent, and Frasers are incorporating energy-saving measures like solar energy and LED lighting in their new industrial and logistics developments. They also obtain green certifications, such as LEED, Lotus, and Edge and so forth, to enhance market appeal and reduce operational costs.

Industrial park (IP) developers such as DEEP C and VSIP are establishing sustainable ecosystems by integrating renewable energy, allocating land for plantations, and implementing advanced water conservation methods like rainwater harvesting and water recycling. These measures are crucial not only for environmental sustainability, but also for attracting high-profile tenants driven by corporate sustainability commitments.

Recent trends highlight the importance of integrating value-added services and sustainable practices in industrial real estate development. As developers are increasingly launching projects that combine IPs with residential areas to maximise benefits for investors, businesses and residents, the adoption of sustainable practices in such developments is vital for sustainable growth.

In Vietnam, IPs like those developed by Amata and DEEP C serve as pilot models for eco-industrial development. These parks implement measures such as installing solar energy systems, recycling wastewater, and promoting industrial symbiosis. Despite regulatory challenges, these initiatives showcase Vietnam’s potential for sustainable growth.

For example, AMATA has improved its eco-IP index score from 41 per cent in early 2020 to 86 per cent by January 2024 through initiatives such as employing energy-efficient equipment, recycling wastewater, installing solar panels, and enhancing social management systems according to the company’s website.

Similarly, DEEP C has implemented numerous green projects, including installing a wastewater treatment and reuse system, converting waste materials into energy, and utilising solar panels on landfills. Its 2023 sustainability report highlights that the effort of DEEP C and its tenants in exploring and implementing water-saving measures and enhancing overall resource efficiency resulted in savings of approximately 5.8 million kWh of electricity and 90,000sq.m of water, among other achievements.

Despite these successes, challenges remain in transitioning to sustainability, including resource constraints, technological gaps, and limited business understanding. The absence of a comprehensive legal framework for eco-IPs and other related sustainable aspects, for example unclear regulations on the reuse and sale of treated wastewater, as well as the lack of financial incentives further compound these challenges.

|

Future directions

To navigate the existing challenges and sustain momentum, strategic partnerships and collaboration between public and private sectors are vital. Vietnam needs to accelerate the development of a comprehensive roadmap and supportive legal framework for achieving net-zero carbon emissions by 2050. For instance, clear regulatory frameworks tailored to different scenarios, such as establishing new eco-IPs or transforming existing ones, clear guidelines for waste recycling and reuse, among others, can be considered.

Besides that, promoting a market for green financing and accessible green financing options, and providing specific financial incentives and support for green technologies are vital steps towards this transition. Establishing a robust market for carbon credits and emissions trading will also further advance efforts towards a carbon-neutral economy by 2050.

Private sector developers and investors play a crucial role by integrating sustainable practices into all their projects. This approach enables them to future-proof against evolving development requirements and contribute to the overall sustainability goals of the country.

Furthermore, it is imperative that both the public and private sectors adopt a proactive approach to increase public awareness of sustainability and empower stakeholders to integrate sustainable practices into all of their activities. By prioritising energy efficiency, reducing emissions, and fostering a culture of sustainability, Vietnam can solidify its position as a leader in the global green transition, attracting investors and strengthening its competitive advantage.

Last but not least, the competitiveness and appeal of IPs can be improved by incorporating value-added services, including legal procedures, fitting-out construction, human resources, and project management. This comprehensive strategy can guarantee that Vietnam’s industrial sector not only adheres to global sustainability standards, but also prospers in the global green economy.

Vietnam’s industrial sector is at a tipping point. Embracing sustainability is not just a matter of regulatory compliance, but a strategic imperative that offers significant competitive advantages. By navigating the complexities of this transition through innovation, collaboration, and strategic planning, Vietnam can ensure its continued integration into the global value chain, reinforcing its economic resilience and fostering long-term sustainable growth.

Stakeholders across all sectors must champion sustainability. Embracing ESG practices will enhance market appeal, reduce costs, and avoid potential penalties. By focusing on sustainable development, Vietnam’s industrial and real estate sectors can remain relevant, competitive, and poised for success in an increasingly sustainability-driven world.

| KCN Vietnam takes up green mission Industrial property developer KCN Vietnam Group has unveiled its commitment to green building development, with a focus on achieving sustainability standards and certifications. |

| Industrial parks strive to level up Industrial, service, and urban zones with smart technology application in operation and management of technical infrastructure will become hot development trends in the Vietnamese market, especially when it comes to some of the nation’s biggest foreign investors. |

| TTC reaping rewards for IZ and logistics endeavours Thanh Thanh Cong Industrial Real Estate Corporation’s ownership and operation of two industrial zones, one cluster and a warehouse network in Tay Ninh and Long An provinces have been advantageous alongside Vietnam’s economic development towards modernisation. |

| IDICO’s green transformation towards a sustainable future Industrial and urban developer IDICO aims to build sustainable industrial park ecosystems, anticipating the net-zero trend towards 2050, as demonstrated through its strategy of developing high-quality, synchronised infrastructure |

| VIPF 2024: Going green for new investment waves The Vietnam Industrial Property Forum (VIPF) 2024, organised by Vietnam Investment Review in coordination with the Vietnam Industrial Real Estate Association, is taking place in Ho Chi Minh City from July 30 with the theme “Going green for new investment waves”. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version