Abundant liquidity key driver in OMO development

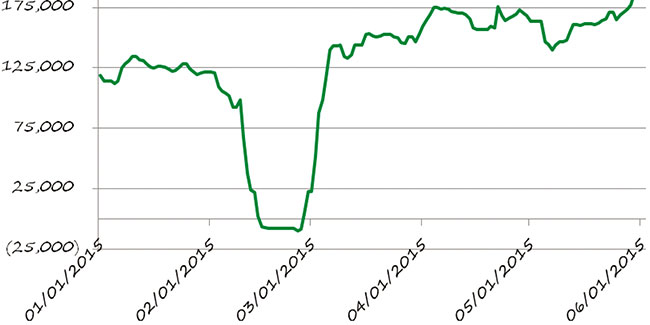

A total of VND201 trillion ($9.24 billion) of SBV’s bills were issued in the second quarter, up 14.4 per cent compared to the previous quarter. Meanwhile, there was only VND39 trillion ($1.81 billion) in reverse repo transaction value, down 76 per cent compared to the first quarter. So while the SBV net withdrew money via Open Market Operations (OMO), the outstanding balance of reverse repo and bill issuance increased throughout the quarter.

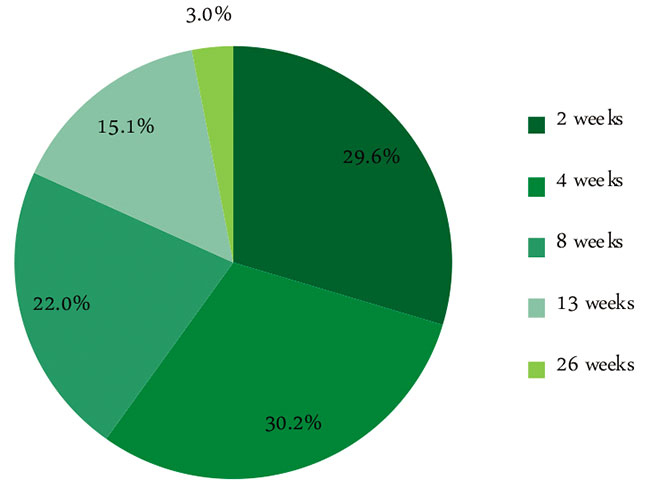

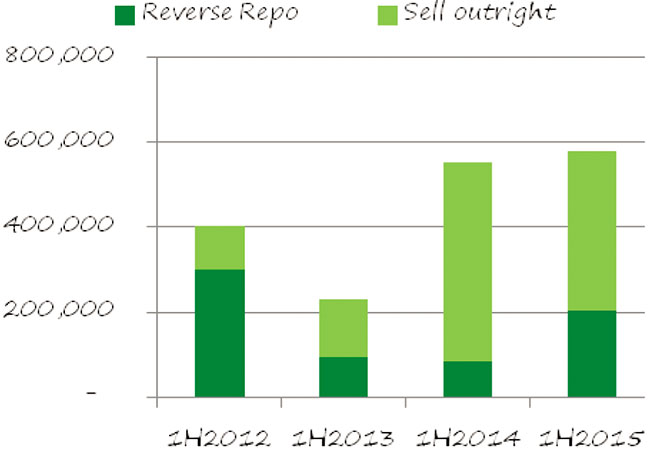

The total transaction value of reverse repos and bills issuance via the OMO in the first half of 2015 reached VND580 trillion ($26.6 billion), up 5 per cent compared to the same period last year. Lending volume through reverse repos was VND202 trillion ($9.3 billion), accounting for 35 per cent of total volume. Meanwhile, the volume of SBV bills issued in the first six months was VND377 trillion ($17.3 billion) contributing 65 per cent of total volume.

Abundant liquidity in the banking system was the key driver for OMO development in the second quarter. In this regard, it was similar to the interbank market.

First, the banks’ Tier 1 and Tier 2 capital grew strongly. As of May-end, the capital of the banking system rose 8.0 per cent from the beginning of this year, much higher than the growth rate of 2.3 per cent for the same period of last year. Following the SBV’s request, banks did not pay high dividends and retained most of their profit in order to raise equity.

Second, demand for borrowings via OMO as well as the interbank market fell due to a lower issuing volume of government bonds. In the primary bond market, the State Treasury (ST) only issued more-than-five-year bonds. As most of the funds in banks are short-term, their demand for long-term assets was not significant. Additionally, the winning yields of government bonds did not meet investor’s satisfaction.

Third, Circular 36 allows increasing short-term capital for medium and long term loans. This circular also allows the risk ratios of loans for real estate and stock investments – which account for the majority of banks’ outstanding loans – to be reduced from 250 per cent stipulated under Circular 13 to 150 per cent, the lowest levels ever allowed. As a result, banks now can provide more credit based on the same amount of capital and the same capital structure. This narrowed the borrowing demand from the SBV as well as in the interbank market.

Fourth, the SBV and the government may have purchased a significant amount of foreign currency during the quarter, although we don’t have an accurate figure for this at present. Among them were the $1 billion dollar-denominated G-bond issued to the Vietcombank. Asides from this, in this quarter, foreign investors were net buyers in the stock market, totalling $228 million; and net buyers in the bond market, totalling VND1.38 trillion ($63.5 million).

By the end of the second quarter, bill yields increased slightly compared to last quarter for almost all tenors. In particular, four-week bill yields reached 3.9 per cent per annum, up 40 bps compared to the yield level by the end of March. Similarly, the eight-week and 13-week bill also rose 30 bps and 10 bps respectively to the 4 per cent per annum. In contrast, the yield of two-week bills dropped sharply from 5 per cent per annum at the first issuance to 3.52 per cent per annum by the end of the second quarter, down 148 bps. 26-week bill yields remained constant at 4.3 per cent per annum.

In the last two weeks of June, the ST resumed the offer of short-term bills of 13 weeks and 26 weeks. The SBV therefore stopped issuing the 13-week bills, and in turn, raised yields of eight-week bills from 3.7 per cent to 4 per cent per annum, just slightly lower than the winning yields 4.08 to 4.10 per cent of the ST 13-week bills.

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version