Urbanisation and globalisation in a cup

|

| Rising living standards, urbanisation, and strengthening foreign influences are turning the heads of Asian consumers. Source: lemonbody.com |

China developing a taste for coffee

Newswire Bloomberg recently wrote about a growing trend of coffee consumption in China, a traditional tea country. As reported by various authorities, such as the International Coffee Organization (ICO), Chinese consumers are increasingly turning towards coffee shops and are developing a taste for what is essentially seen as a Western beverage.

Citing ICO figures, Bloomberg reported that the Chinese coffee market has been running laps around the global market in terms of growth during 2003-2014. The accelerating urbanisation, the growing middle class, and rising incomes are all seen as contributing factors to this shift—circumstances akin to Vietnam, effecting a similar turn-away from traditional robusta coffee to trendier, more Western brews and beverages like milk tea and bubble tea.

At the moment, tea is still the overwhelmingly dominant beverage in China, accounting for ten times the retail sales of coffee products. However, the astounding growth of coffee consumption shows great promise: by ICO estimates, the trend will remain strong until 2024 at an average of 16 per cent per annum.

Currently, Chinese consumers prefer 3-in-1 instant coffee products, with more than 90 per cent of coffee retail sales belonging to this type, according to Limin Yu, senior research associate at Euromonitor, as cited by Bloomberg.

However, big investors and coffee companies are banking on the expectation that as coffee gathers momentum, Chinese consumers will develop a taste for higher-end beverages and the milder, more expensive Arabica beans currently favoured in Western markets.

Striving to capitalise on this shift, a number of international coffee brands are starting to target China. American and world-favourite coffeehouse chain Starbucks, for instance, has spent $1.3 billion last month to buy out its joint venture partner in East China, gaining sole ownership of 1,300 coffee shops.

Having been present in China for 20 years, Starbucks’ latest investment almost doubled its coffee shops to 2,800, professing of the corporation’s faith in its second fastest growing market. The expansion is far from over as Starbuck’s has also reaffirmed its long-term goal of having 5,000 stores in mainland China by 2021, as reported by newswire Fortune.

“The first step is to switch tea into more mild coffee drinks such as 3-in-1s and the frappuccinos you get at Starbucks,” Cofco’s Reiner told Bloomberg. “Then coffee starts being consumed in the office and at home. That’s how it develops. We are talking a massive potential here, with between 450 to 600 million Chinese people joining the middle class by 2021-22.”

| “We think bringing East China into a company-operated model sets the opportunity for the next two decades,” Kevin Johnson, chief executive officer of Starbucks, said in an interview. “We’re playing a long game.” (Source: Bloomberg) |

Dunking Donuts, gathering itself after two previous failures, is gathering speed to take on China again to capitalise on the growing consumption trend of Western fast food and beverages. Undeterred by its previous faltering, the company aims to have 1,400 locations in the country within 20 years—a significant increase against the current 34 shops.

Nestlé SA, the current leader on the Chinese coffee market with a market share of 66 per cent, is optimistic about consumption prospects and expects China to become one of the leading coffee countries in the world, given time.

Vietnamese youth turning towards milk tea?

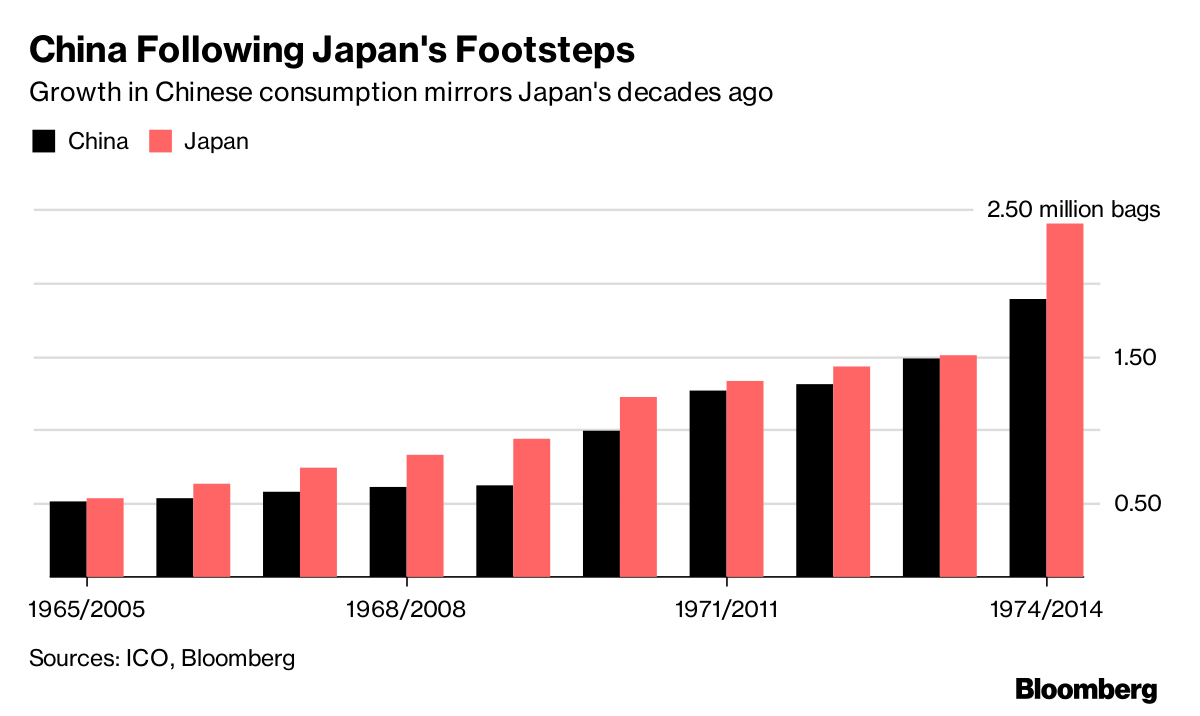

Chinese millennials turning towards coffee is not a unique trend in a global context. In fact, Bloomberg identifies strong similarities between the growth rates of coffee consumption in China between 2005 and 2014 and Japan between 1965 and 1974. An important addition to the similarities is that Japan has since become the fourth largest coffee consumer in the 2000s, drawing up promising prospects for the Chinese market.

|

In fact, Japan had been experiencing somewhat similar trends in the 1960s as China does now: consumers were increasingly exposed to the Western world and its consumption trends, while undergoing a period of positive income growth.

| “If you take the growth curve of Japan between 1963 and 1973, you will see it’s practically the same as China’s in the decade to 2014,” said Joseph Reiner, the head of coffee at Cofco International, a unit of China’s top food company. “They used to drink only tea and now you have that Starbucks effect.” (Source: Bloomberg) |

Urbanisation and globalisation, an expanding middle class, and rising income levels have a transformational effect on consumption trends, which in itself comes as little surprise.

Similarly, the fact that change originates from the most receptive consumer circles, in this case millennials and the youth more susceptible to what is coined as trendy, fashionable, and cool, simply makes sense.

While similar trends are working at large in Vietnam as well, an important point of difference is that due to the country’s French colonial past—the French being largely renowned for their café lifestyle—Vietnam already has a unique, budding coffee culture centring around the strong and characteristic flavour of Robusta beans grown domestically.

On one hand, there might be a turn towards the milder-flavoured Arabica beans as a high-quality coffee experience positioned as more refined and “worldly” for middle-class consumers willing to spend extra for the added touch. Based on the current coffee scene in the country, international and large domestic coffee chains like Starbucks and Highlands Coffee are opting for this approach: they reside in a generally higher price-band with the promise of quality coffee for the trendy connoisseur.

On the other hand, a trend cultivated not within the groves of the wealthy and well-to-do but urban youth, milk tea and bubble tea shops have been on a definitive rise in the past five or so years. These sweet and flavoured tea cocktails with added toppings are not a Western food and beverage innovation, but part of the Taiwanese—and a broader Asian—cultural, fashion, and consumption influence.

| Coffee and milk tea trends in Vietnam - Chain stores resonant with younger customers Vietnamese market research firm Q&Me provided valuable data on the metrics of the Vietnamese coffee and milk tea market. According to a Q&Me survey published in August 2016, about 47 per cent of respondents frequent coffee shops a few times a week or once a day, with another 6 per cent going more than once a day. Peak times include weekend night time, when 38 per cent of respondents usually go to spend time with friends or family. There is a roughly even spread of customers visiting coffee shops before and after work (26-25 per cent) and in weekend mornings (26 per cent). Independent coffee shops are the dominant market leaders in every age segment, leading before chain shops. There is a marked growth in the lead of independent coffee shops that increases with age, going from just 3 per cent in the 16-19-year-old segment (36 per cent against chain shops 33 per cent) to 23 per cent among 20-29 year olds and 33 per cent among 30-39 year old respondents, showing that younger generations are more susceptible to new trends and that chain shops have not yet managed to seduce older customers more set in their coffee habits. More than half of the respondents prefer Vietnamese “white” coffee brewed from Robusta beans with added condensed milk, while 34 and 26 per cent ordered Smoothies and Cappuccino. Surprisingly, only 23 per cent of customers ordered Vietnamese black coffee. Further, based on the Q&Me survey, chain stores are mostly popular for their “good taste” (52 per cent) and brand (33 per cent), while independent stores are visited for the atmosphere (43 per cent) and local stores for their reasonable prices. 25 and 31 per cent of chain stores and independent stores, respectively, are visited for the cosy and high-standard shop interior which makes for an altogether nicer place to spend time. Milk tea As reported by newswire Vietnamnet Bridge, with take-away drinks taking flight, milk tea and bubble tea brands are also gathering speed to “establish themselves in the minds of Vietnamese customers by investing in outlets with attractive designs and quality beverages.” The majority of the appeal of these new fast-drink companies is their trendy, modern design and fresh, foreign drink products, riding on the shifting consumption trend brought about by globalisation and urbanisation. According to a Q&Me survey published on May 19, 2017 on the evaluation of milk and bubble tea products, 67 per cent of respondents have been aware of the products for more than a year now, with about 91 per cent having tasted them before. Albeit extremely high already, this percentage is especially high among 15-22 years old, while being relatively level across other age groups and gender categories. Customers generally view milk tea products as delicious (49 per cent of respondents) and associate it with relaxation and youth (43 and 32 per cent). Taiwanese milk tea brand Chatime opened its first shops in Vietnam in 2012 and has been developing its franchise model to now have ten outlets in Hanoi and Ho Chi Minh City each, selling 300 cups a day at each outlet, as reported by Vietnamnet Bridge.

Ho Chi Minh City sees a slightly more even competition between Hot & Cold, Hoa Huong Duong, Phuc Long, and Tien Huong. The biggest names on the market, on the other hand, are Ding Tea with a total of 89 outlets, Toco Toco with 61, and Bobapop and Tien Huong with 49 and 47, respectively. Ding Tea and Toco Toco are mostly popular in Hanoi, with 53 per cent of respondents claiming to have tried Ding Tea and 49 visiting it the most among other milk tea shops. 35 per cent of respondents have tried Toco Toco and 16 per cent saying it is their go-to place for milk tea—marked drops against Ding Tea’s dominance, but still far above the 18 and 9 per cent of Gong Cha, which is running third in Hanoi.

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- List of newly-elected members of 14th Political Bureau announced (January 23, 2026 | 16:27)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- List of members of 14th Party Central Committee announced (January 23, 2026 | 09:12)

- Highlights of fourth working day of 14th National Party Congress (January 23, 2026 | 09:06)

- Press provides timely, accurate coverage of 14th National Party Congress (January 22, 2026 | 09:49)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- Minister sets out key directions to promote intrinsic strength of Vietnamese culture (January 22, 2026 | 09:16)

- 14th National Party Congress: Renewed momentum for OVs to contribute to homeland (January 21, 2026 | 09:49)

- Party Congress building momentum for a new era of national growth (January 20, 2026 | 15:00)

Mobile Version

Mobile Version