Positive indicators offer real estate market boost

According to CBRE Vietnam, 2013 ended with a range of positive signs such as slightly higher economic growth which is being supported by exports and foreign investment, having helped offset faltering bank lending. The increase in registered FDI to $21.6 billion was particularly encouraging.

CBRE Vietnam’s managing director Marc Townsend added that the trade balance was in surplus thanks to a booming year for Vietnamese exports to the US market and the tight control of inflation, despite the fact that it edged up toward the year-end.

He also predicted that the newly amended Land Law, passed in December, had increased clarity for investors, and that a draft bill on foreign ownership in the real estate market was promising for investors.

“Combined with a tax rate cut and an increase in the minimum salary, these indicate a more focused government policy intended to mitigate the effects of the sustained economic downturn that has been witnessed in Vietnam,” he said.

Townsend predicted that this year’s performance was expected to grow from stronger external demand, but also face headwinds from weak bank balance sheets and on-going structural reform at state-owned enterprises.

“It is believed that the government will manage to keep inflation in check, which means no major currency devaluation will be seen. This means that with the US dollar strengthening, Vietnam’s exports will become even more competitive and will provide momentum for economic growth next year,” he said.

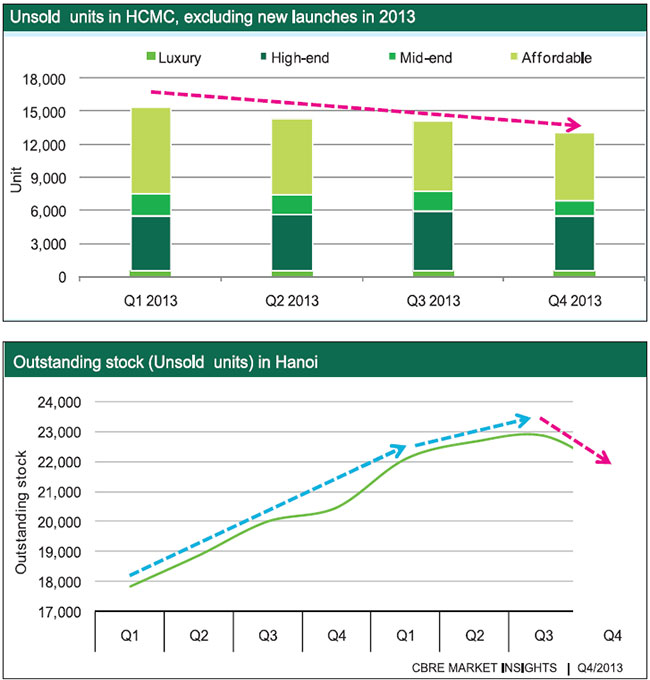

In Ho Chi Minh City, more cranes are expected to be seen in Thu Thiem peninsula as development prospects in District 1 remain difficult to access, while in Hanoi the east and north of the city will be the focus due to oversupply in the west and access to new developments in the CBD is almost impossible.

CBRE also predicted that by the end of 2014, the volume of sales in the mid-end residential sector will be equal if not greater than those in the affordable sector. They are even expecting a return of luxury residential to the market in 2014.

The office segment between Hanoi and Ho Chi Minh City is showing great divergenc. With limited availability of Grade A properties in District 1 of Ho Chi Minh City, and no new properties on the horizon, landlords will seize the opportunity to push rents. On the other hand, Hanoi will continue to see oversupply putting power in the hands of renters.

The entrance of famous brands like McDonald’s to the retail segment this year, and Vietnam’s obligations under WTO agreements to permit 100 per cent foreign ownership in the restaurant sector in 2015, will see a wide variety of retailers enter Vietnam during 2014.

Coastal destinations will continue to be the top performing hospitality sector. Deep-pocketed Russian will continue to shift strongly from Thailand to Nha Trang and Mui Ne (Binh Thuan), and gambling revenues are expected to surge, most notably in Danang.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

Mobile Version

Mobile Version