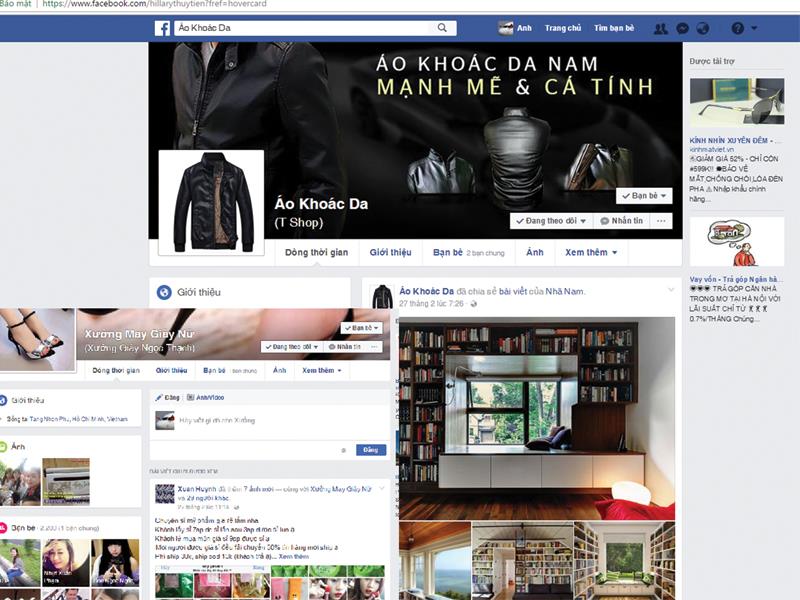

Ho Chi Minh City tries to tax Facebook sellers

| RELATED CONTENTS: | |

| Tax dept vows to collect tax from sales on Facebook | |

| Earning VND2 billion via Facebook, millionaires still can evade tax | |

Talking to newswire vnexpress, Nguyen Nam Binh, deputy director of the Ho Chi Minh City Department of Taxation said, “We only want to know whether their business is for the long term, whether they have declared tax. If it is a long-term business activity and they have not declared their tax, we will ask them to do so.”

He added that only businesses that have revenues over VND100 million ($4,400) a year have to pay tax. The branches at different districts are responsible for enforcing this rule. However, according to the Binh Thanh branch, no individual or organisation has come forward to work with them.

“Most of the invitee people and companies called and then said they had just started operations and have not sold much, that their revenue is really low and they did not know if they would keep their business for a long time, so they had not declared tax yet,” a representative of the branch said.

Binh said that if these Facebook sellers did not comply, the tax department would have to pay them a visit and ask them to file tax.

According to some experts, collecting tax from Facebook sellers is not easy because an organisation or individual may have several Facebook accounts and the transactions are mostly by cash, which makes it difficult to monitor them.

As reported by newswire news.zing.vn, the District 5 branch has discovered that some online businesses have very sophisticated ways of evading tax. For example, one business in the district imported extremely low-price goods from China then sold them at about eight times the original price without announcing the price publicly and replying in private messages to individual customers. In one case, the branch calculated VND3 billion ($132,000) of tax arrears and forwarded the case to the police.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Mobile Version

Mobile Version