While yet before corner is turned

|

| Macroeconomic uncertainties have spooked many investors who are prepared to sit on the fence until things settle |

It seems that the macro outlook continues to be the key for the cash flows from local and global investors. In 2010 and 2011, the adjustments of monetary policies depended upon the consumer price index (CPI) movements. Many investors expected that April would be brighter after listed firms released earnings and inflation stabilised from a peak 2.17 per cent in March. However, after the surprising fresh food price hike from the middle of March and a further petrol price increase of approximately 10 per cent at the end of March, the market is not expected to turn the corner for another two months.

In our view, unless inflation cools down to less than 0.6 per cent per month for at least two consecutive months, the State Bank will not rush to take any monetary loosening actions. Hence, if the macroeconomy remains investors’ main concern in the short run, April’s equity market will not have many opportunities to move from March’s poor showing in terms of returns and liquidity.

|

Factors influencing the stock market in April

It is likely that most of the macroeconomic policy adjustments that can negatively impact on short-term equity market happened in February and March. However, the financial market is influenced not only by the timing of the policies but also their outcomes.

To control inflation and the valuation of the local currency, recently the government took strong actions such as increasing the base cash rate, tightening credit growth to below 20 per cent - especially in the real estate and equity markets, controlling the gold and forex markets, raising the price of electricity and petrol to lower subsidies. Although such policies turned out to be effective to some extent, the economy has been under huge pressure and it might need at least two months extra to improve.

After the new petrol price adjustment by about 10 per cent on March 29, the State Bank’s most reasonable action is to ‘wait and see’ under strict price supervision. We do not expect too much from the short-term performance of the local equity market though we agree that the probability of a further crash is low.

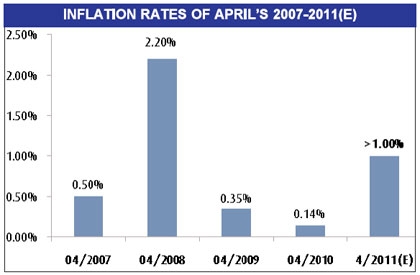

* Inflation: This is the key for all the monetary policy adjustments over the past year and a critical signal for any turnaround actions from the State Bank in the coming months. During February and March, many investors looked forward to a positive scenario in April that inflation would cool down from the 0.6 per cent average from the second quarter, opening opportunities for the State Bank to intervene to decrease the interest rates, solving problems for the difficulties in the operations of enterprises.

However, with the continued hike in food prices to almost 20-30 per cent within the last two weeks of March plus the new petrol price, it is too early to expect April’s CPI to be lower than 1 per cent. It means that if the State Bank wants to control 2011 inflation at single digits, the CPI for the remaining eight months must be lower than the total of the first four months. The plan will become much more challenging if the State Bank eases the policies at this stage.

* Interest rates: Due to the above reason, April’s interest rates might continue to hold the closing of March since ‘cheaper’ funds yet abundant though small banks have attempted to attract deposits at the rate higher than effectively 14 per cent. In order to cool down the interest market, the State Bank needs to take action. This seems too early since they need to wait at least until inflation becomes under control and there are more sustainable solutions for the forex and gold markets.

* Cash flows into the equity market: Cash flows into the equity market do not need to purely depend upon the credit growth. In 2010, the funds mainly came from retail and foreign investors, which do not originate from the bank loans. It implies that the State Bank’s decision to tighten the credit in 2011 is not as serious as it seems. The issue at this stage is that the cash flows from foreign investors rely on the macroeconomic stability and growth while such from local retail investors are highly psychological.

Currently, the unfavourable local and global economy and the low liquidity on the two exchanges are hindering the cash flows into equity in the short run. For active short traders from 2010, they are being trapped in the portfolios with average losses of 20-30 per cent, so the trend is to wait and sell down the position rather than further investments. For new investors, the market is still sensitive for non-experienced traders, so the optimal strategy is to wait. Therefore, in April unless liquidity is significantly improved, the ups or downs of the indices have less meaning.

When can we expect a turn in the macroeconomic outlook?

The answer for that question implies the timing for the ‘buy’ signals. As analysed above, the underlying reasons for all the current policies come from the occurrences of inflation and forex in 2010. Hence, the outlook could be brighter only when those factors are adequately solved.

* Inflation could become better controlled from May. While most of the petrol and electricity price adjustments in February and March were reflected into March’s CPI, the story is yet to stop.

The complicated performance of the price of fresh food in Hanoi and Ho Chi Minh City recently together with the 10 per cent increase of petrol price in late March might push up April’s inflation to the new height compared to the same period of previous years. If April’s CPI is under 1.0 per cent, it could be considered very successful.

In our view, unless the global economy becomes worse, inflation will start to be stable from May when all goods and services are all adjusted to the new level. The purchasing power has dropped recently due to the high price, so it is expected that any further price hike is less likely to happen.

* The forex market might be under strict control and remains stable until the end of the year. In March, the unofficial forex market was vigorously controlled. As a result, the quotes went down close by the listed rates with extremely low liquidity. This is clearly not a sustainable long term approach. The State Bank will need to consider new attempts to enhance the effectiveness of the forex market, both from regulating the demand-supply balance for the requirements of enterprises and individuals and the national forex reserves.

* Monetary policies might be gradually adjusted from June. In general, the State Bank needs to observe the performance of the CPI for at least two months before taking any new directions under complicated macroeconomic environment. If inflation cools down in May, the State Bank might start intervening into the interest rate market from June to help firms approach funds for operations. Although the equity might not get as much loan as other sectors, it has strong psychological effects, which can dramatically enhance the liquidity of the market. Hence, a more proper timing for fund disbursement might be deferred additional two months.

The impacts of first quarter earnings and AGM business plans on the equity market in April are as follows. As we mentioned in the Monthly Investment Strategies – March publication, April is the peak for AGMs. This is also the timing for first quarter earnings release. Quarterly earnings releases should always have stronger impacts than the business forecast news due to:

* The yearly business plan of local listed firms have proved to be not very accurate in recent years, so they have more referral meanings, investors are cautious in using that information for short run investment decisions.

* However, the first quarter earnings is a crucial fact to support the announced 2011 business plan feasibility of listed firms, also illustrates the impacts of the macroeconomy on the business performance.

* The performance of firms in the first quarter is also very critical in identifying the sources of cash for dividend payment of 2010.

Under the environment of the first quarter, we forecast securities and fund management firms will be heavily impacted, most of whom will incur losses since market liquidity was low (low brokerage revenues) and the prop trading portfolios decrease by almost 20-30 per cent on average. The real estate sector might also perform poorly because the first quarter is normally the most quiet period of the year and the market so far has been very gloomy.

On the other hand, some sectors might still perform well including F&B (high consumption season), telecommunication & IT services, and natural resources (price has been up).

Overall, since April is forecasted to be under continued macroeconomic pressure, same as in February and March, it is hard to expect any surprise in the share performance. Investors who survived to this stage are not willing to sell down portfolios in the face of losses of up to 50 per cent. On the other hand, the high opportunity costs versus bank deposits together with the sensitivity and risks from the macroeconomic policies are hindering buyers to place aggressive orders. The conflicts between buyers and sellers will create liquidity issues for the market.

In our view, this is not a proper time for short trading and financial leveraged investors, but might be under consideration of medium and long-term buyers searching for the gains in the second half of the year if the economy goes in the right direction.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version