What’s needed to shift towards higher-quality investment?

|

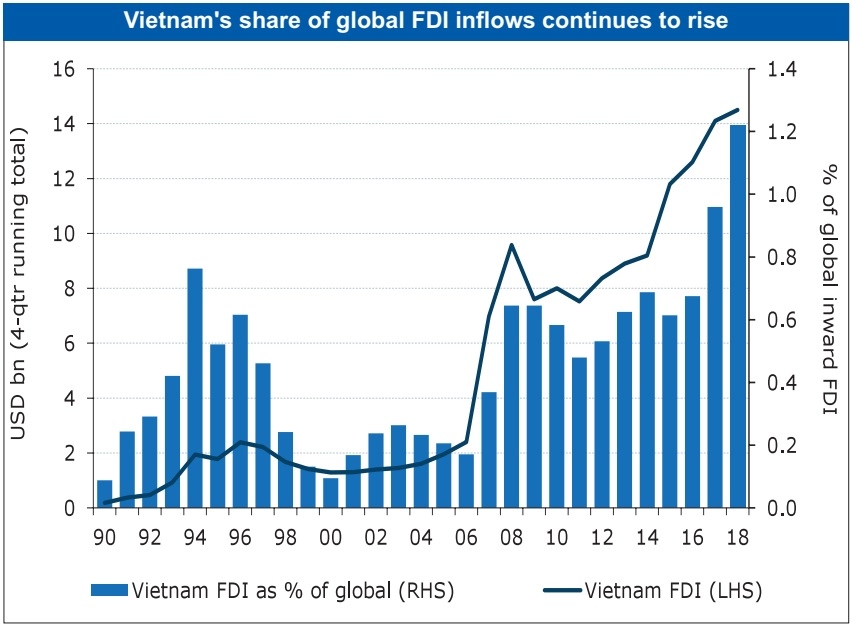

Vietnam has become a magnet for foreign direct investment (FDI). FDI inflows to Vietnam stood at $2.4 billion in 2006, or 0.2 per cent of the global FDI flows. This has grown to $14.1 billion and 1 per cent in 2017. This share is set to rise further as more multinationals seek to set up manufacturing production in the country.

In the first four months of this year, there have been 1,082 new projects that were granted investment certificates, with the total registered investment capital amounting to $5.34 billion, a 50 per cent increase from the same period last year. What attracts foreign investors to Vietnam are its political stability, a welcoming policy environment, skilled and competitive labour force, and access to the global market place with the country securing free trade agreements which will cover 60 per cent of the world’s GDP.

The benefits of FDI to the Vietnamese economy are evident in the strong GDP growth performance, the rapid rise in the country’s total trade as a percentage of the GDP at close to 200 per cent, and turning around the past external imbalances to now persistently running current account surpluses.

Even more remarkable is the rapid shift in the composition of Vietnam’s export mix. A decade ago, textiles and garments were the top export items, comprising around 15 per cent of the total value of exports. While textiles and garments remain an important export product, its top position has been replaced by phones and parts, which now account for a fifth of all exports. This would not have been possible without FDI.

Vietnam is in the enviable position of being a top destination for FDI despite continued uncertainty in the global environment. Vietnam will pick up a reasonable share of manufacturing production shifting out of countries like China and South Korea. In addition, the country will see increased interest from foreign companies keen to benefit from Vietnam’s fast growing economy and rising middle class, not to mention its strong tourism market. It is no surprise that in 2018, after manufacturing which attracted half of all FDI, the second largest foreign investment went into real estate, accounting for 29 per cent of the total.

Policymakers at present are focussed on attracting new-generation FDI. Going for quality rather than quantity is essential in ensuring sustainable economic development. After all, FDI that only relies on cheap labour and produces low-margin products will just as quickly move out once wage increases erode the benefits. There is no shortage of cheaper labour in neighbouring countries. Focusing on the right types of FDI will also ensure that scarce resources are allocated for the most efficient use, and that environmental effects are limited.

There are three important priority areas for the country to bring in new-generation FDI. First, developing the right skill sets in the labour force. Vietnam’s youth literacy rate is high, and its 15-year-old primary school students achieve scores that are well above the average of advanced economies in science and maths, based on the Organization for Economic Co-operation and Development’s Programme for International Student Assessment.

|

However, there are different requirements between what is needed for working on a factory floor and operating a hi-tech plant. Building up the technical know-how and management skills that are industry relevant requires a shift towards post-secondary education that prepares students for the new workplace. Increasing emphasis on innovation, creativity, and design will be important in attracting new-generation FDI.

Second, it is important to nurture domestic firms so that they are integrated into the production process of foreign multinationals. Despite the country’s success in attracting FDI, there is a distinct lack of linkages and spill-overs into local companies. The lack of integration of local suppliers risk a two-tier business environment where foreign companies utilise external inputs and attract the best workers, while domestic counterparts fall further and further behind and become uncompetitive.

Ensuring that FDI at least looks to have a minimal level of integration with local companies and that there are programmes in place to help lift the capability of domestic businesses is important. The ultimate goal is to develop domestic businesses that are innovative, competitive, and capable of exporting their products. Exports by domestic businesses have declined from 43 per cent of the total exports in 2005 to just 29 per cent at present. A vibrant and innovative domestic industry will help in attracting new-generation FDI.

Third, better co-ordination is necessary among the provinces to develop specific clusters and identify priority sectors to better target the type of investors that match the new-generation FDI that Vietnam wants to attract.

This requires leadership at the national level, and a shift away from relying on broad incentives towards more strategic investment promotion. Part of this is understanding what the specific requirements are, including infrastructure, to attract multinational companies to set up operations in Vietnam.

The co-ordination also helps to avoid different provinces competing to attract FDI, whilst ensuring the adequate allocation of resources. For example, provinces with higher unemployment could be favoured for more labour-intensive FDI.

In striving to implement new strategies for FDI, it is also important not to forget the important role that prudent macroeconomic management plays in ensuring an attractive backdrop. The Vietnamese economy is well managed with low and stable inflation, lack of external imbalances, and an exchange rate that is stable. Financial market liberalisation as the economy continues to develop will be important to maintaining the country’s attractiveness to multinationals, as well as ensuring that domestic businesses are able to adequately access capital for expansion.

The government is rightly looking towards the future, given technological changes, to adopt a new strategy for FDI. With the right policies and implementation, Vietnam can remain a magnet for the right type of FDI that will help push the economy into higher value-added industries and propel the country towards the upper middle income status.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version