Vietnam's 500 most profitable firms for 2023 unveiled

|

Alongside PetroVietnam and Samsung, several other household names dominated the charts, such as Viettel, Vietcombank, Techcombank, BIDV, MB, Agribank, and VPBank.

Among the private enterprises featured were notable high performers like Techcombank, VPBank, ACB, Vingroup, VIB, Vinamilk, HDBank, Hoa Phat, SHB, and TPBank.

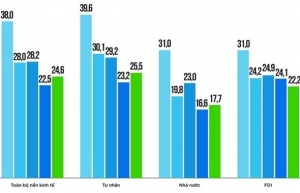

Despite not reaching their pre-pandemic heights, there has been a marked improvement since 2022. The average return on assets (ROA) of these 500 enterprises saw growth across all three sectors. The foreign-invested enterprises (FIEs) led the pack with an impressive 13.7 per cent, registering the most substantial surge of 2.7 per cent.

Their growth stands as testament to the stability of their business and their ability to derive profit from assets. Meanwhile, the private and state-owned businesses followed suit, recording respective ROAs of 11.2 per cent and 9.2 per cent.

2023 also witnessed a noteworthy shift in the average return on equity. FIEs and the private sector experienced robust growth rates of 4.6 per cent and 5.5 per cent respectively from the previous year, the highest in the last five years.

State-owned enterprises, despite witnessing an increase from 16.5 per cent to 17.2 per cent, showed modest recovery when compared to their counterparts.

A prevailing stagnation impacted numerous sectors, eroding business resilience and substantially thinning profit margins. The survey unveiled that fewer businesses maintained their growth momentum in the first half of this year compared to the same period last year. Presently, as two-thirds of the year has elapsed, less than half of the enterprises have achieved over 50 per cent of their profit targets - 40.9 per cent to be precise, a sharp decline from 73.9 per cent a year ago.

However, Vietnam Report is cautiously optimistic. With the global conversation gradually is shifting from 'recession' to a 'soft landing', indicators hint at a less bleak outlook for Vietnam's economy, signalling a potential pathway to recovery. Yet, the pace of this transition remains sluggish due to persistent challenges and lingering complications.

The research suggests that recovery will vary across sectors and businesses, depending on specific circumstances. Almost 55 per cent of businesses anticipate a mild profit improvement for the latter half of the year, while 4.5 per cent expect no change. 41 per cent predict an agonisingly slow recovery, potentially with short-term declines.

"Given the current backdrop, the profit landscape in the coming months will continue to grapple with headwinds faced in the first half," commented Vietnam Report.

| 500 fastest-growing companies in 2023 announced Tin Viet Finance JSC, Dolphin Sea Air Services Corporation and VPS Securities JSC are among the top 10 in the 500 fastest-growing companies in Vietnam (FAST500) this year as announced by the Vietnam Report JSC and the VietNamNet e-newspaper on March 16. |

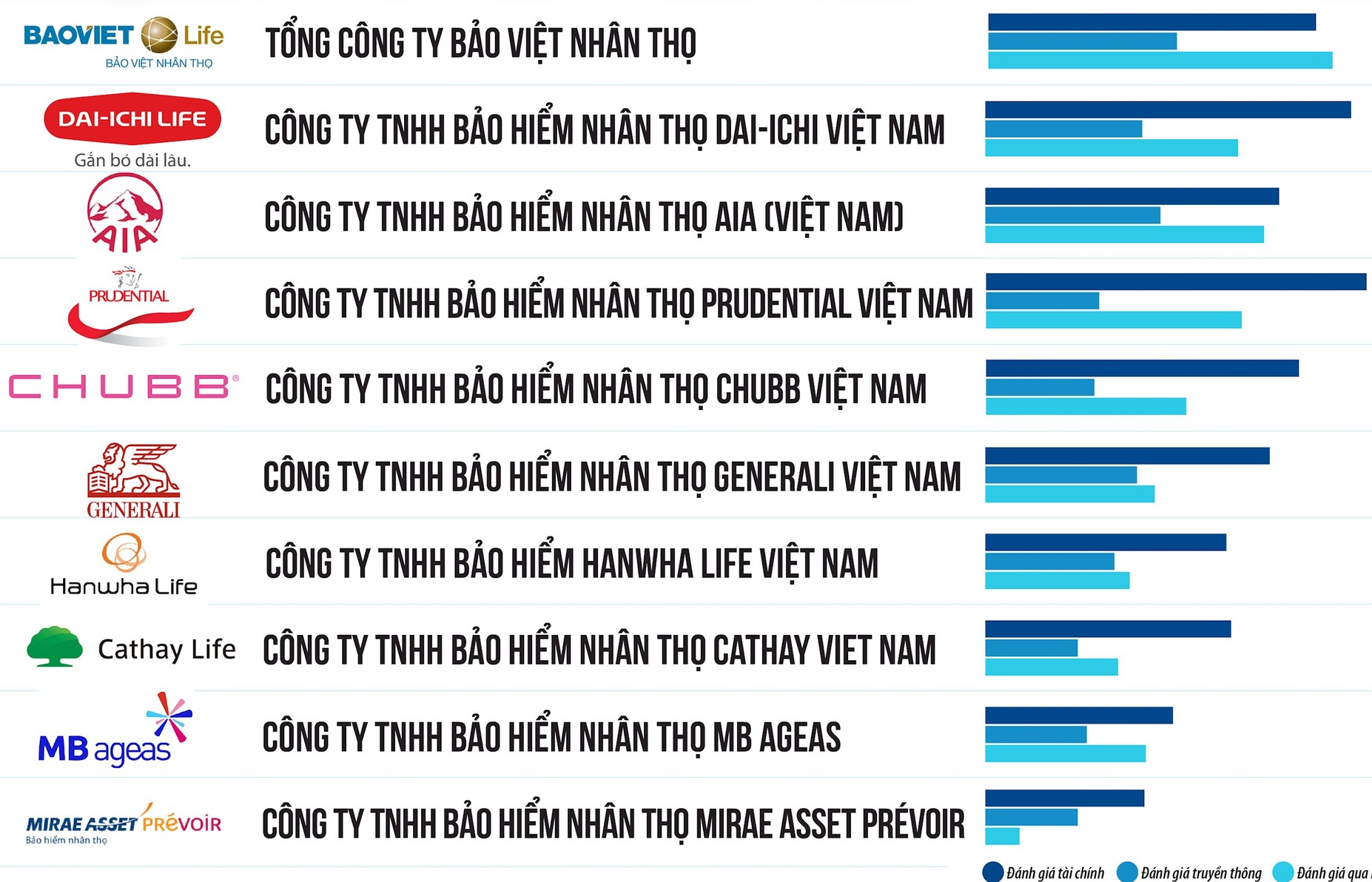

| Vietnam Report reveals Top 10 insurance companies in Vietnam in 2023 Vietnam Report has just released its highly anticipated list of the 10 most reputable insurance companies in Vietnam for 2023. The list encompasses two categories, life insurance and non-life insurance. |

| MB ranked in Top 5 most reputable banks On the morning of August 4, Military Commercial Joint Stock Bank (MB) secured its position in the Top 5 Vietnamese banks at an awards ceremony, a testament to its vital contributions towards its sustainable growth in the banking sector. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version