Vietnamese spend $1.4 billion on online food deliveries

|

The information was revealed in a report titled Food delivery platforms in Southeast Asia 2024 by Momentum Works on January 30.

According to the report, Southeast Asia’s food delivery platforms' gross merchandise value (GMV) climbed by a modest 5 per cent on-year to reach $17.1 billion in 2023, mirroring the growth rate observed in 2022.

The increase was driven primarily by the region’s smallest food delivery market, Vietnam (+$300 million or 27 per cent on-year), followed by Malaysia (+$200 million or 9 per cent on-year). Thailand and Indonesia registered low single-digit growth, while Singapore’s topline remained flat.

With continuous pressure to achieve sustainable profitability, most incumbent food delivery players have continued to rein in food delivery subsidies and adopt differentiated strategies to compete.

As of the end of 2023, Grab is estimated to account for 55 per cent or $9.4 billion of the region’s food delivery GMV, a 6.8 per cent increase from the year before.

Most food delivery markets in Southeast Asia experienced very modest growth, except for Vietnam, where total GMV grew by almost 30 per cent despite cost controls from almost all the players. Vietnam led the growth across all six major markets.

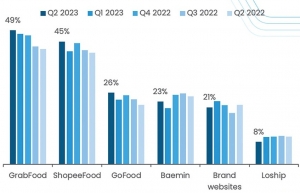

Among all food delivery platforms, Grab continues to maintain a significant market share of 47 per cent in Vietnam. ShopeeFood has risen to become the second most popular option in the country, holding 45 per cent of the market share. It is followed by Baemin and Gojek with 5 per cent and 3 per cent, respectively.

The report highlighted that the food and beverage (F&B) sector has recovered, but competition intensified, with most major shifts expected to continue into 2024. In 2023, the total F&B service expenditure in Southeast Asia finally exceed pre-pandemic levels, with many large operators seeing clear growth.

In 2023, there was a significant increase in the number of Chinese chain restaurants expanding overseas, and many of them chose Southeast Asia as their first destination. Mixue opened its first overseas store in Vietnam in 2018, and the Chinese brand now has close to 4,000 stores in the region.

Aside from the F&B recovery and entry of Chinese brands, the other two key trends are the digitalisation of F&B, as well as the divergence of platform strategies with the common theme of consolidation.

After one to two years of cost reductions, operational optimisation, and sometimes lay-offs, most platforms have achieved some level of profitability. The consolidation that is already happening in the sector is expected to continue into 2024.

| Food delivery market looks to restructure The impairment of Baemin in the food delivery sector may open a new opportunity for the current players to conquer to gain the remaining market share. |

| Food delivery firm Baemin bids farewell to Vietnam Baemin, the South Korean food delivery firm, has announced its departure from the Vietnamese market, effective from December 8. |

| Delivery apps help Vietnamese consumers discover new restaurants and shops 91 per cent of Vietnamese respondents have used the Grab app to discover new restaurants and shops that they have never tried before, according to Grab’s latest Food & Grocery Trends 2023 report. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version