Food delivery market looks to restructure

South Korean food delivery giant Baemin is narrowing down its operation in Vietnam by reducing its active area and laying off a part of its employees in Vietnam, while shrinking its scope of business in the country.

Cao Thi Ngoc Lan was appointed as a temporary CEO to replace Jinwoo Song, who resigned two weeks ago.

The company currently stops operations in Hoi An, one of Central Vietnam’s main tourism destinations. Baemin has also hailed operating in the northern provinces of Thai Nguyen and Bac Ninh.

News of food delivery firm Baemin’s decision to scale down its operations in Vietnam has raised discussions about what it takes to succeed in the new digital marketplace.

Dr. Hoang Ai Phuong, senior programme manager for Digital Marketing at The Business School of RMIT Vietnam, said, “In the rapidly evolving digital landscape, Baemin’s journey in Vietnam serves as an illustrative case study. It’s clear that succeeding in the digital world isn’t just about following a set playbook.”

Baemin has made a name for itself with the innovative way it connects with people through many stand-out marketing campaigns over the years and has garnered many fans among Vietnamese consumers, Phuong added.

Entering Vietnam in 2019, the firm was operated by Woowa Brothers Vietnam, a venture between South Korean firm Woowa Brothers and German multinational corporation Delivery Hero. By early last year, the company covered more areas in Vietnam than any other food delivery platform.

In 2020 and 2021, Baemin ranked first in terms of customer satisfaction, according to a market survey conducted by Q&Me.

|

Sustained success

However, in August, Niklas Östberg, the co-founder and executive director of Delivery Hero, told Reuters that the company’s growth potential in Asia is significant, except for Vietnam – where the company forecasts to never gain profit.

Although Östberg said that the Asian market has potential for growth, Foodpanda – another brand under the operation of Delivery Hero, issued the decision to reduce the personnel in the Asia-Pacific market, such as Singapore, Cambodia, Laos, Malaysia, Myanmar, Philippines, and Thailand.

Delivery Hero has confirmed with Reuters that they are negotiating to sell part of the company in Asia for a value of $1.07 billion.

Phuong from RMIT said that impressive marketing campaigns are not enough. Diving into the market with big discounts was a smart move at first for Baemin, but it got tough when the market began to change.

“It’s essential to remember that things change fast in the digital world. As competition becomes more intense, firms need to redefine the scope of their business. Sustained success requires a balance of broadening the business scope while staying within the core competencies. Leaders in the digital space must recognise and anticipate market shifts, consistently innovate, leverage ecosystem and network effects, and strategically pivot to maintain relevance,” Phuong said.

Doan Kieu My, founder of YellowBlocks, a Vietnam tech gateway, said that Baemin needs to make a great effort to take on other super apps that offer ride-hailing, parcel delivery, and other services. Operating a super app will be favourable to acquiring and retaining customers at a much lower cost, and also offer more value to its network of delivery riders.

“For example, at Grab, it also invested hundreds of millions of US dollars into Moca, a mobile wallet. The addition of payment allows the company to form a full ecosystem, which is not only more cost-effective, but much more defensible compared to a company that does only food delivery,” she said.

|

Reset to a new game

According to the market share report of fast food delivery services in Vietnam in 2022 by Germany’s market research firm Statista, GrabFood and ShopeeFood are the two applications holding the majority of the market share. Baemin entered the market in 2019 but only holds 12 per cent, while GoFood only holds 2 per cent of the remaining market share, creating quite a gap compared to the two top brands.

Baemin’s withdrawal from the Vietnamese food delivery market could create turmoil in the market, which has been fairly stable over the past years. Suspicions about fierce competition between brands are entirely possible to divide the 12 per cent market share left behind by Baemin.

GoFood, a food delivery application belonging to the Gojek ecosystem from Indonesia, is the first brand to make the shift. Since last week, Gojek has deployed GoFood’s food delivery service in Binh Duong and Dong Nai, two localities neighbouring Ho Chi Minh City that are growing rapidly.

“The expansion of operations marks an important milestone in our long-term business strategy, as well as demonstrating our commitment to serving users nationwide in Vietnam,” said Sumit Rathor, general director of Gojek Vietnam.

Currently, this application owns a network of 200,000 driver partners and tens of thousands of restaurants in Hanoi, Ho Chi Minh City, Binh Duong, and Dong Nai. Besides the food delivery service, GoRide, GoCar, and GoSend services were also introduced into these two markets by Gojek, along with the implementation of more than 10 new service features to provide better service and enhance user experience in Vietnam.

Meanwhile, GrabFood and ShopeeFood, with the advantages of super apps, also see the opportunity to increase market share through incentives and additional app services.

“Technology ride-hailing companies are very conscious of focusing on the right customer segment. They continuously give users solutions and services so that customers continue to stay and use their services to increase revenue per customer,” said Hoang Thi Kim Dung, Vietnam market director of Genesia Ventures Fund.

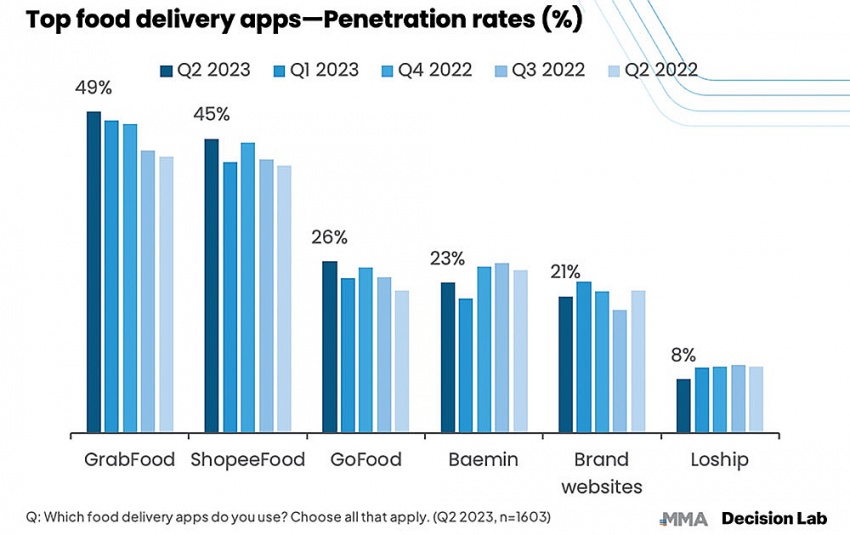

The Connected Consumer report for the third quarter of 2023 published by Decision Lab and the Vietnam Mobile Marketing Association said that GrabFood is the most used food delivery application with a rate of 49 per cent.

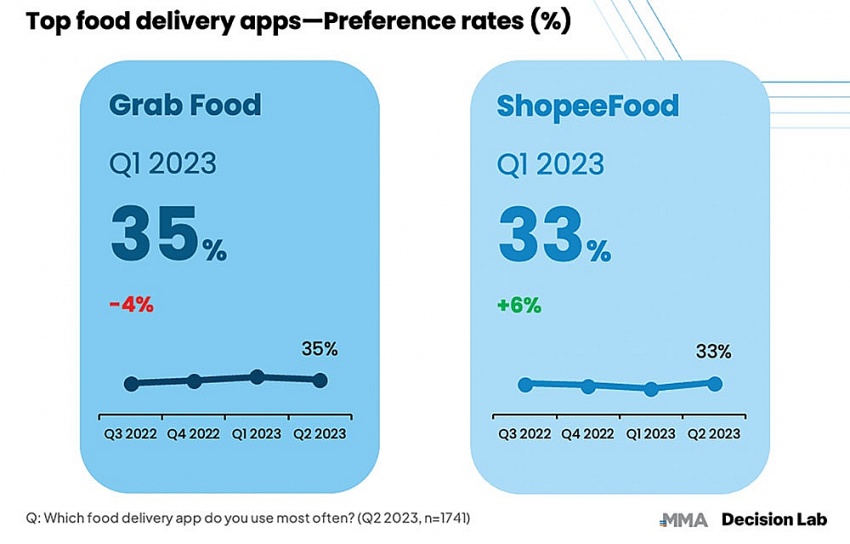

ShopeeFood also had a strong breakthrough after a decline in the previous quarter at a rate of 45 per cent. Compared to the first quarter of 2023, the level of popularity for ShopeeFood has increased by 6 per cent, to 33 per cent, and is only 2 per cent away from rival GrabFood to becoming the most popular food delivery platform among users.

The report has also shown that although GrabFood is still the most popular ordering app for Gen X and Gen Y, its popularity has gone down across all generations. On the contrary, the popularity of ShopeeFood increased sharply in Gen X and Gen Z.

“Usage rates and preferences of platforms vary. All platforms have growth in users and draw in different customer segments,” said Thue Quist Thomasen, CEO of Decision Lab.

Thue said this result would be a valuable source of information for food delivery platforms and brands to seek opportunities for cooperation, advertising and market expansion, by taking advantage of the existing user base and continuing to expand the market to reach new customers.

The online food delivery market in Vietnam is still considered a fertile land and has many opportunities to continue to develop. According to data from the Ministry of Industry and Trade, the online food delivery market is expected to reach $1.93 billion for all of 2023, some 29.5 per cent higher than last year.

The compound annual growth rate for 2023-2027 could reach nearly 16 per cent, equivalent to a revenue of more than $3.4 billion by 2027.

| Food delivery apps vowing to provide safety and hygiene The changing habits of customers due to the COVID-19 pandemic are pushing the food delivery market into a new race in which safety and hygiene are considered bigger priorities. |

| Food delivery resumed in Ho Chi Minh City After two months of suspension, restaurants and coffee shops can now resume takeaway delivery in Ho Chi Minh City. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version