Vietnamese beer market: foreign giants in control

|

| Vietnamese brewers are getting crowded out by foreign beer brands |

Foreign giants dominate

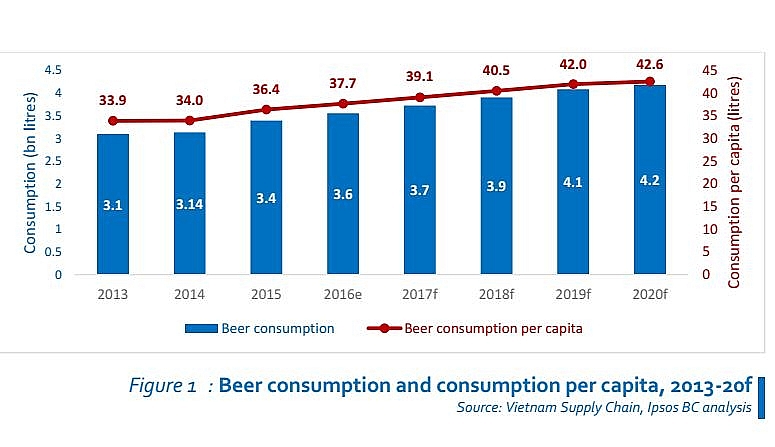

Vietnam's annual beer consumption leads Southeast Asia and is ranked the third in Asia after China and Japan. The beer market of 90 million people brings lucrative profit for beer producers.

Especially, the average beer consumption in Vietnam is expected to increase by 65 per cent in 2021. Vietnamese people spend about $3.4 billion per year on beer, at an average of $300 per person.

The Vietnam Beverage Association (VBA) stated that beer consumption in Vietnam has reached nearly four billion litres in 2017, with the average Vietnamese people drinking nearly 45 litres of beer during the year, according to cafeF.

|

The industry is characterised by a growing population as well as a rising number of middle income individuals. Consequently, various foreign beverage companies have expanded to this lucrative market, creating a competitive market environment. Over the recent years, ThaiBev, Heineken, and Carlsberg appeared as the three most notable foreign giants working to take over the Vietnamese beer market by buying out domestic firms and expanding their market share.

Thai Beverage Public Company Limited (ThaiBev) unveiled Vision 2020, its roadmap for the next six years. Thaibev aims to solidify its position as the largest and most profitable beverage company in Southeast Asia. To support and sustain this growth, the group intends to diversify its revenue streams, which currently stem mainly from the sale of alcoholic beverages in Thailand.

As such, revenue contribution from non-alcoholic beverages is targeted to increase to over 50 per cent by 2020. Revenue contribution from the sale of products outside of Thailand is also targeted to rise to over 50 per cent in the same timeframe.

According to the group’s report, its 2017 revenue hit $8.7 billion, 60 per cent of which came from Thailand, and other ASEAN countries contributed 36 per cent.

ThaiBev believes that the beer brand from Vietnam is strong enough to exploit both Indochina and Myanmar markets in their plans. In fact, the acquisition of 53.39 per cent of Saigon Beer, Alcohol and Beverage Corporation (Sabeco)’s shares has increased Thaibev's market share in the ASEAN from 23 to 26 per cent, according to the Bangkok Post.

On October 30, 2018, Sabeco published Resolution No.111A/2018/NQ-HDQT about lifting the foreign ownership limit on its website. Accordingly, foreign investors will be able to own up to 100 per cent of the capital instead of the previous 49 per cent – a decision which might bring in some much needed expertise and capital to turn the losing tides.

This means that if the Ministry of Industry and Trade (MoIT) intends to divest the rest of its 36 per cent at Sabeco, Thaibev would be able to take over Sabeco the way the firm took over VietBev.

Analysts also believe that ThaiBev will soon transfer Sabeco under its direct management to shorten ownership lines as well as restructure the financial capacity of their businesses.

|

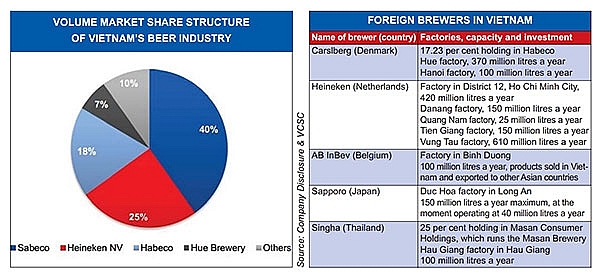

HEINEKEN’s major beer brands include Heineken, Tiger, Larue, and Amstel, which owned nearly 22 per cent of the Vietnamese beer market in 2017. In particular, HEINEKEN holds the high-end segment in hand with about 67 per cent of the market share, 40 per cent of which belongs to the Tiger brand and 27 per cent to the Heineken brand.

Being number one in the high-end segment helps HEINEKEN earn billions of dollars in annual profit, although the firm is not the largest beer company in Vietnam. Currently the company owns five factories, three of which are in the south and two in central Vietnam, which are the two key markets of the company.

Danish brewery Carlsberg, after taking over Hue Brewery Ltd., holds the fourth largest market share. According to the company, each of its customers in Vietnam consume up to 34.5 litres beer per year.

Habeco is currently the third in the market. Carlsberg's ownership at Habeco amounts to nearly 4 per cent of the Vietnamese beer market.

Especially, since becoming a strategic shareholder at Habeco, the firm has repeatedly expressed its desire to raise its ownership to over 51 per cent. The company also said to be working with the Ministry of Industry and Trade to negotiate the deal, according to cafeF.

If Carlsberg becomes the dominant shareholder of Habeco, the Vietnamese beer market will be practically devoid of domestic enterprises.

The sad reality for Vietnamese brewers

The Vietnamese beer market is now almost exclusively in the hands of foreign giants. Vietnamese brands are gradually disappearing. In many cases, after establishing a joint venture with a domestic company, the foreign partner bought out its domestic partner, turning the entity into a foreign business.

Sapporo is a prime example for this. After buying 29 per cent stake of Vinataba at Sapporo Vietnam Ltd. in 2015, the company officially became a wholly-owned subsidiary of Sapporo International Inc. (Sapporo Holdings Ltd. – Japan).

The company is actively investing in building its brand and currently ranks third in Ho Chi Minh City after Sabeco and Heineken, as reported by cafeF.

According to Euromonitor, the Japanese brewery owned about 1.7 per cent of the domestic beer market in 2017.

Carlsberg has been following the same strategy in Vietnam. It entered the market through a joint venture with Vietnamese partners to establish Hue Brewery Ltd., the owner of the Huda trademark since 1994.

However, after nearly two decades, Carlsberg officially paid VND1.875 trillion ($81.52 million) in the end of 2011 to buy 50 per cent of the shares from the Thua Thien-Hue People’s Committee, thereby acquiring 100 per cent at Hue Huda beer.

Another example of this is the beer brand Zorok, featuring Vinamilk.

In 2006, Vinamilk established SABmiller Vietnam Co., Ltd., a joint venture with the world famous brewery SABmiller. The SABmiller beer factory was officially “born” in early 2007 and launched the Zorok brand.

However, the distribution concept of utilising Vinamilk’s milk distribution network to also sell Zorok beer could not hold a candle to international brands in the market such as Tiger, Heineken, and San Miguel, among others. After only two years of floundering, Vinamilk had to sell its stake in SABmiller.

Shortly thereafter, SABmiller had to sell its operations in Vietnam to Anheuser-Busch InBev because of bad business.

In 2003, Tan Hiep Phat invested $20 million to produce the Laser beer brand. Even though it was a new brand on the market, the price of Laser was higher than Tiger's and was comparable to Heineken. After eight months, Laser disappeared from the market.

Consumption behaviour in Vietnam

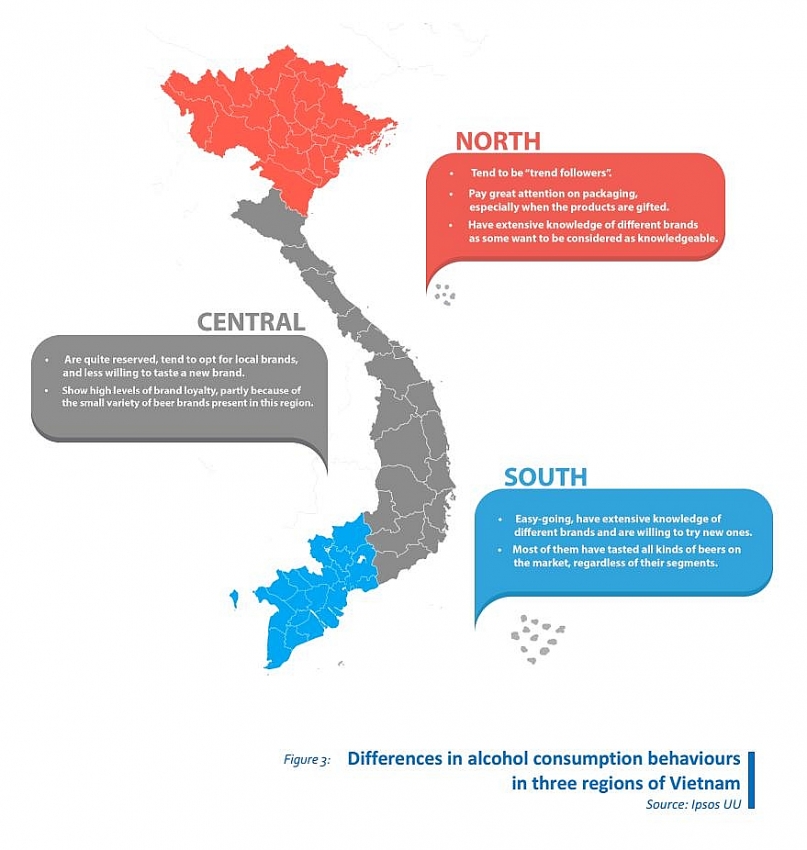

Operating in the Vietnamese beer market necessitates the understanding of the differences between the consumption behaviours in the three main regions of Vietnam, as reported in the following infographic by the EU-Vietnam Business Network (EBVN).

|

Brand expert Vo Van Quang shared with Tri thuc tre that the beer market is no longer a competitive game of products, but a competition of brands. Brewers fail because they do not understand Vietnamese culture and consumers.

Vietnamese consumers are increasingly willing to spend more on high-end products. Diversifying products, capturing the tastes of consumers is important for brewers to continue to grow.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version