Vietnam calls for more Greek involvement

|

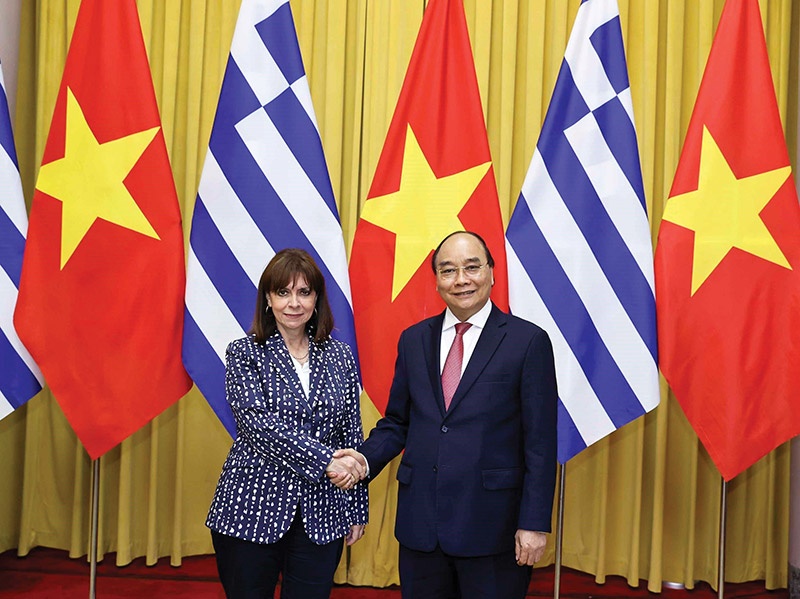

| State President Nguyen Xuan Phuc (right) met with his Greek counterpart Katerina Sakellaropoulou, VNA |

At last week’s talks between State President Nguyen Xuan Phuc and Greek counterpart Katerina Sakellaropoulou in Hanoi, both leaders agreed that the two nations will push negotiations for a double tax avoidance agreement (DTAA) and another on maritime transport in order to create a framework for bilateral economic cooperation.

The DTAA would help prevent Vietnamese and Greek businesses and investors from being double-taxed on their income. This also applies to legal entities and individuals. Vietnam currently has approximately 80 DTAAs signed.

According to consulting firm Dezan Shira & Associates, a company may be subject to taxes in its country of residence and also in the countries where it raises income through foreign investments for the provision of goods and services.

“It is extremely worthwhile for foreign investors to be aware of the existing DTAAs between Vietnam and various countries, as well as how these agreements are applied,” the firm wrote. “These treaties effectively eliminate double taxation by identifying exemptions or reducing the amount of taxes payable here.”

Vietnam and Greece have agreed to promote a win-win partnership, while encouraging favourable conditions for businesses from both countries to amplify exchanges, centring on sectors of Vietnam’s demand and Greece’s strengths such as shipbuilding, maritime logistics, energy, and agriculture.

Ultraship, one of Greece’s largest companies in the fields of ship design and marine technology, once came to Vietnam to explore investment and business opportunities.

“I have had several meetings with Vietnamese enterprises working in shipbuilding and logistics. I have found a major chance of cooperation in the future,” said company representative Spyros Stamou.

Greece currently has only five small-scale projects registered at $110,000 in Vietnam, in the sectors of wholesale and retail, vehicle repair, science and technology, and communications. Vietnam has no such ventures in Greece so far. In 2013, Greece landed contracts worth $200 million in Vietnam to build six ships.

President Phuc also called for more investment from Greece. To encourage foreign investment, the Vietnamese government has offered a wide range of investment and tax incentive schemes. For example, the new Law on Investment introduced a preferential corporate tax rate of 5 per cent for a maximum period of 37.5 years for large or especially encouraged investment projects. In addition, the government has also prioritised domestic infrastructure improvements and expanded the industrial real estate available to brand new developers.

“Vietnam continues to offer numerous opportunities for businesses and investors,” said Prime Minister Pham Minh Chinh at a recent meeting with overseas investors. “In infrastructure alone, Vietnam has a great demand for investment between now and 2030, totalling up to $30 billion per annum. The stability and robust development of the Vietnamese economy offers numerous opportunities for investors worldwide.”

President Sakellaropoulou said Greece supports Vietnam in strengthening its partnership and comprehensive cooperation with the EU. President Phuc, meanwhile, highly valued Greece’s ratification of the EU-Vietnam Investment Promotion Agreement and suggested that Greece supports and calls for the removal of the EU’s “yellow card” warning against Vietnamese seafood.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version