US ventures in LNG on the rise in Vietnam

Under a newly-signed MoU, US-Vietnamese joint venture Chan May LNG will receive a great deal of support from the US government to encourage liquefied natural gas (LNG) imports and set up partnerships with the US International Development Finance Corporation, Asia EDGE, the World Bank, the International Finance Corporation, Export-Import Bank of the United States (US Exim Bank), GE, Black & Veatch, Baker McKenzie, E&Y, McKinsey, and ERM.

|

|

With a total capacity of 4,000MW, the $6 billion Chan May LNG project is expected to start construction in the first quarter of next year and launch the first phase of commercial operations in 2024 as an independent power plant with 60 per cent capital from the US and 40 per cent from Vietnam.

Billion-dollar LNG projects could be a quick path to help balance bilateral trade and deepen economic interests between Vietnam and the US, following other deals by US-based AES Corporation, Gen X Energy, and Delta Energy Systems.

Just last year AES jointly signed an MoU on implementation of the $1.7 billion Son My 2 combined cycle gas turbine power plant with a total capacity of 2.2GW in the southern-central province of Binh Thuan.

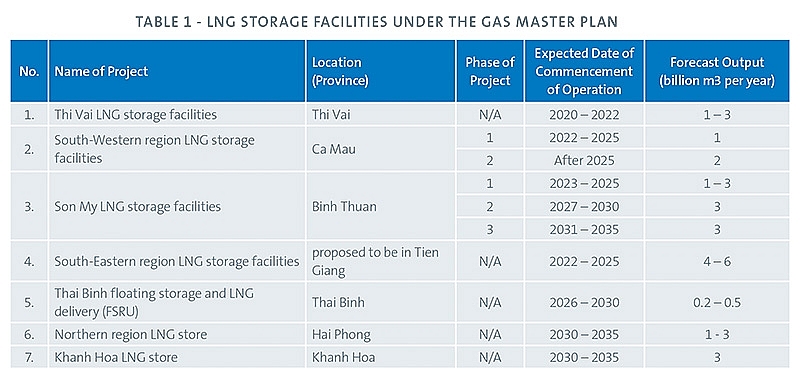

The interest comes as no surprise as the Vietnamese government plans to import large-scale LNG from the US to meet the demand. According to the plan, LNG imports will start by 2021 and the import demand will increase to around five million tonnes by 2025, 10 million tonnes by 2030, and 15 million tonnes by 2035.

At Prime Minister Nguyen Xuan Phuc’s online meeting with US firms in May, Vu Tu Thanh, deputy regional managing director and Vietnam representative for the US-ASEAN Business Council, said the US Exim Bank and the US International Development Finance Corporation are planning to provide up to $100 million in financial support to Vietnamese power producers to purchase LNG.

Meanwhile, as the top global producer of natural gas for the fourth consecutive year with exports reaching 38 countries across five continents, the US announced a policy to extend the term for LNG exports through to 2050.

Accordingly, it will allow authorised exporters for shipments to non-free trade agreement (FTA) countries, to apply for and extend export terms and conditions in that time.

Furthermore, applicants can amend their pending non-FTA applications to request a longer export term. This is good news for LNG projects in Vietnam as the change in US policy will help stabilise the price of LNG and fuel for gas power projects which will be put into operation in the next 30 years.

According to the Vietnam LNG sector update 2019 by law firm Allens, Vietnam’s need for LNG projects is greater than ever due to instabilities in the power system, power shortages which are caused by delayed investments at power projects, and rising concerns about energy security.

Under Vietnam’s Power Development Plan VII (PDP7) up to 2025 with a vision towards 2035, Vietnam will likely buy from one to four billion cubic metres of LNG per year in the 2021-2025 period. The purchases will likely increase under the new PDP8 to adopt to the new situation and energy demand.

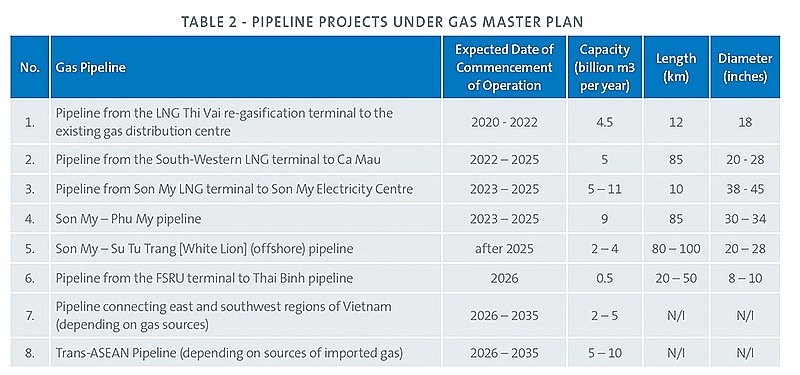

It has been reported that Vietnam will have to reinforce development of its LNG terminal system and related facilities, mainly located in southern Vietnam, to achieve the above target, signifying opportunities for enterprises to join these chains.

Meanwhile, research and investigation will be carried out in north and central Vietnam for future LNG needs. According to the National Steering Committee for Electricity Development, by 2030 the capacity of new power plants using LNG will be 12,750MW, excluding old power plants converted to use LNG.

At the turning point of energy transition, Vietnam will be one of the countries that imports LNG to substitute declining domestic gas production.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version