US institutions here to help local leverage

|

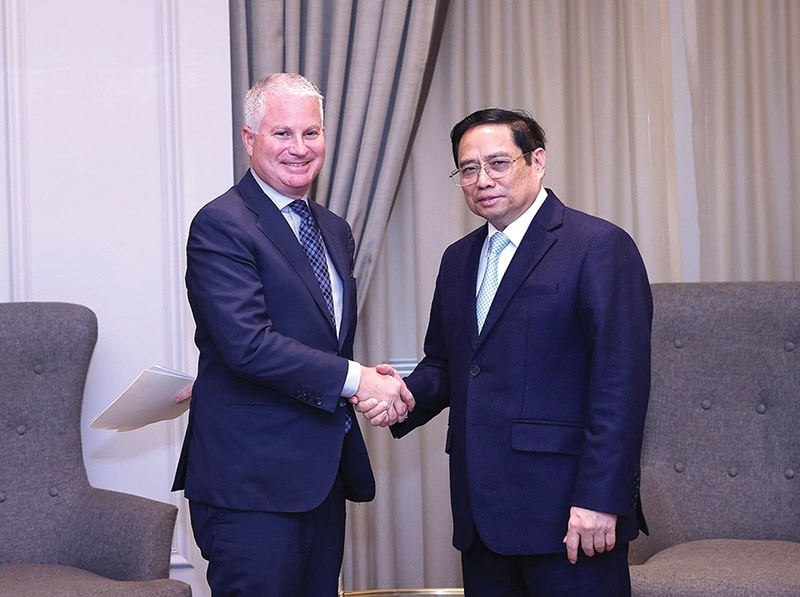

| Prime Minister Pham Minh Chinh (right) met with Charles R. Kaye, CEO of Warburg Pincus, VNA |

Following the visit by Vietnam’s Prime Minister Pham Minh Chinh to the United States last week, a number of American business leaders have expressed their confidence in Vietnam as a compelling story for them to generate alpha.

Charles R. Kaye, CEO of private equity firm Warburg Pincus, highlighted interest in Vietnam’s policy of restricting foreign ownership limits (FOL) in banking, set at 30 per cent for private commercial banks and 20 per cent for state-owned banks. The FOL barrier, consequently, could hamper international financing sources flowing to Vietnamese banks.

With a diverse portfolio, Warburg Pincus is now a prominent US backer, spending over $2 billion on a range of companies and joint ventures such as Techcombank, MoMo, Vincom Retail, BW Industrial, Lodgis, and The Grand Ho Tram Strip, among others.

“There are some significant issues that investors are always interested in – the responsiveness of domestic enterprises, macroeconomic stability, solid infrastructure, and the opportunity to communicate and exchange with the authorities,” Kaye said.

He also suggested that Vietnam’s stable macroeconomic and business environment is a huge impetus for foreign investors, and some challenges still need to be further improved, such as FOLs in the banking sector and infrastructure. Similarly, a Goldman Sachs representative also raised his concern FOLs as well as accessibility to foreign currencies.

Nevertheless, Asian investors, especially from Japan and South Korea, are continuing their buying spree in Vietnam’s banking landscape, with a handful of notable deals, which bodes well for the resurgence of cross-border merger and acquisition activity. US financiers, notwithstanding, have not been active in deploying their capital into the Vietnamese banking M&A market.

PM Chinh insisted that Vietnam’s legislative framework and banking laws are being improved, but due to vast differences in infrastructure, legislation, and experience constraints, it would take a different strategy than other economies such as Japan, South Korea, or the US.

On the other hand, the International Finance Corporation (IFC) under the World Bank Group has partnered with HDBank to boost access for Vietnamese small- and medium-sized enterprises to innovative funding, enabling them to take part in global supply chains and expand into new markets. The collaboration is expected to help HDBank build a supply chain financing portfolio of $1 billion by 2025.

“Supply chain financing that links buyers, suppliers, and financial institutions will efficiently support the trade cycles. IFC’s timely support will enable local businesses to leverage emerging trade opportunities and improve their linkages to formal supply chains, contributing to Vietnam’s economic growth,” said Thanh Pham, HDBank’s CEO.

Besides this, IFC will also support the State Bank of Vietnam in developing the legal framework for environmental, social, and corporate governance standards in the investment activities of Vietnamese credit institutions.

Joseph Y. Bae, co-CEO of Kohlberg Kravis Roberts (KKR), another prominent PE fund from the States, also emphasised the fund’s interest in enhancing its footprint in Vietnam.

“Given the country’s young demographic and strategic geographical position, Vietnam might be an ideal place for many value-added services on a regional and global scale,” Bae said. “Some of the exciting areas for KKR include real estate, infrastructure, digital transformation, food, consumer products, and tech.”

Meanwhile, Vietnam’s stock market is still some way from an upgrade to the emerging market category, with a number of actions awaiting execution in order to put the local scene in line with international norms.

Vietnam’s State Securities Commission and the New York Stock Exchange have also inked an agreement to facilitate Vietnam’s forthcoming market status upgrade, from frontier to emerging, and provide a mechanism for investors to engage in both markets. Standard & Poor’s has also signalled its readiness to assist Vietnam to be classified as an emerging market.

James Estaugh, head of Securities Services at HSBC Vietnam, believed that to pave the way for Vietnam to achieve emerging market status, the legal framework for a number of market reforms needs to be implemented as soon as possible.

“Two key aspects should be looked at – removing the new settlement and clearing system under the Central Counterparty Party model to replace the mandatory cash pre-funding requirement for buying trades; and solving the problem of limiting the capital ownership ratio with the launch of non-voting depository receipts,” Estaugh said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version