Two local plastic firms vying for market lead

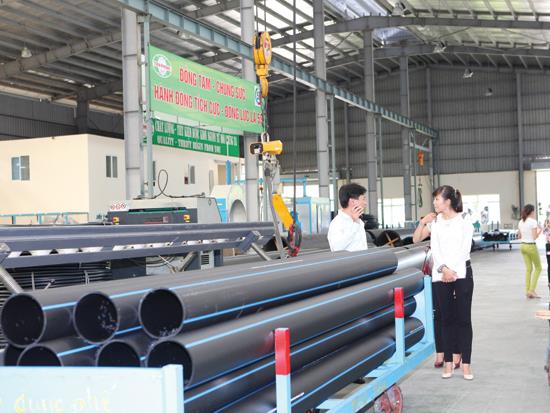

illustration photo

In September last year, Central Region Tien Phong Plastic Limited, a member under Tien Phong Plastic JSC (NTP) which holds 70 per cent of market share in the north, opened a plastic pipe factory at Nam Cam industrial park in central Nghe An province.

The plant, with revenues of VND37.5 billion ($1.8 million) last year alone, envisages running at full capacity from this year to tap tax incentives.

The other firm, Binh Minh Plastic (BMP), with 50 per cent of southern market share, bought a 29 per cent stake in Danang Plastic JSC (DPC) and expanded its distribution network in the central region.

The company reportedly considered buying an additional 15 per cent stake of DPC from the State Capital Investment Corporation (SCIC) to have the right to intervene in management and restructure it into a production and distribution base but later suspended the plan after finding problems with DPC’s facilities.

Six years ago, NTP surpassed BMP in terms of both revenue and profit. It reported bigger chartered capital, though meager equity, compared to BMP. However, in 2009 BMP raised its chartered capital to exceed NTP.

In terms of business efficiency, from 2011 BMP’s revenues came near NTP’s, and it surpassed it in terms of profits.

The earning per share of BMP is reported to be on the rise, while that of NTP is sliding.

BMP’s growth prospects for this year are reportedly limited as its factories are already running at full capacity and it may find it hard to increase market share due to low commissions for sales agents.

For NTP, its new production facility in the central region has helped it raise production and tap new markets.

But its home field in the north is seeing increasing competition from foreign firms as well as from firms in the south looking to expand their presence.

In this context, NTP has applied a raft of measures to maintain and further grow market share.

The company has constantly raised commissions for sales agents, as well as increased its promotion budget.

It has also kept prices at the same level for the last two years.

Many companies on the same field with NTP have followed suit, but BMP has not.

BMP has said it has no plans to lower prices or raise commissions.

Most recently, the company refused to be a supplier for a major project because even though the deal would have boosted revenue, it would have done little in the way of profits.

In the past, NTP has paid high dividends while borrowing to realise investment projects.

BMP has paid lower dividends and retained those profits for business activities, so it has little in the way of outstanding loans and fewer expenses.

Regarding new investment plans, according to NTP the demand for large HDPE pipes is steadily increasing in the Vietnamese market, and there is scarce supply. Therefore the company plans to spend VND150 billion ($6.9 million) to manufacture such products.

NTP general director Nguyen Quoc Truong said the company’s long-term investments might affect its revenue and profit targets in the near future, but were necessary to help the firm realise its ambition of becoming the leading plastic pipe manufacturer in Vietnam in the near future.

In terms of BMP, in 2012 it announced plans for a new factory in southern Long An province, but suspended the project due to falling consumption.

It now envisages starting the project this year with a VND160 billion ($7.6 million) first-phase investment and plans to complete the plant in the third quarter this year.

In the first quarter this year, NTP posted VND570 billion ($27.1 million) in revenue, up 8 per cent on-year while its pretax profit slid 8 per cent on-year to VND78 billion ($3.7 million) whereas BMP reported an 18 per cent revenue jump to an estimated VND457 billion ($21.7 million) with profits up 2 per cent on-year to VND102 billion ($4.8 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version