Trade upswing pressures local ports

|

| illustration photo, source: Shutterstock |

International container shipping company Maersk Line, the largest subsidiary of Danish business conglomerate Maersk Group, can now expand their business activities in the Vietnamese maritime market on the back of the commitments in the landmark EU-Vietnam Free Trade Agreement (EVFTA), which took effect on August 1.

Under the deal, Maersk Line and other businesses from the bloc are allowed to provide redistribution of empty containers and feeder transportation services initially on the Quy Nhon-Cai Mep Thi Vai routes before expanding to all shipping routes after the five-year enforcement in line with EVFTA commitments.

Arising prospects

Nguyen Tuong, deputy secretary general of the Vietnam Logistics Business Association, told VIR, “This is a service line that EU companies have been expecting to enter for years. And the golden opportunity is now coming,” adding that the race is beginning for both Vietnamese and EU companies, urging them to increase capacity to win customers.

Before the enforcement of the historic deal, the empty container and feeder transportation services had for years been restricted to Vietnamese companies, with shipping giant Vietnam Maritime Corporation (VIMC) being among the major domestic players. Evidently, along with shipping lines operating in Vietnam by Maersk Vietnam Ltd., those of APL-NOL (Vietnam) Ltd., MSC Vietnam Co., Ltd., and CMA CGM Vietnam JSC are now also able to go on the offensive in the playground.

With a huge sea network of 45 ports, 286 berths, and 18 anchorage and ship-to-ship transfer areas, Vietnam’s maritime market is a magnet to foreign players, including those from the EU. In the coverage, the Cai Mep-Thi Vai port area, which is home to seven ports, is among the most promising seaports in Vietnam. The port area boasts a total capacity of seven million TEUs (twenty-foot equivalent units) a year, with current capacity reaching 80 per cent, and is able to accommodate mainline vessels of 194,000 deadweight tonnage (DWT) connecting Vietnam with Europe, North America, and Asia.

Before the health crisis, groups have seen improvements in comparison with previous years thanks to a cargo volume increase.

These include SP-PSA, a joint venture between shipping giant Vietnam Maritime Corporation (VIMC) and Singaporean PSA; CMIT, backed by VIMC and Danish company APMT; and SSIT, backed by VIMC and US firm Carrix/SSA.

CMA CGM Vietnam JSC, which holds a 25 per cent stake in Gemalink Seaport, will also benefit. Gemalink Seaport is expected to come into operation in late 2020 with a total annual capacity of 8.5 million TEUs and handle 200,000 DWT or 23,000 TEUs, making it one of the top 20 seaports worldwide.

Christian Lamhien, director of Business Development at CMA CGM Vietnam, told VIR, “We are also looking to invest in local inland container depots and depots in Southern Vietnam to get us closer to industrial parks. Then we will expand to other regions.”

He elaborated, “We also want to develop technology applications to fast-track procedures for cargo entry into Vietnam and to connect with Tan Cang ports and others. We might face difficulties this year due to COVID-19 but see great promise next year amid an investment shift in Vietnam’s manufacturing.”

Looking forward, in addition to inland shipping services, many other maritime transport services are also open to EU firms to invest or do business, with passenger and cargo transportation services even being committed at a higher level than those in the World Trade Organization and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. Moreover, bilateral trade is forecast to grow significantly, thus opening huge business opportunities in the months to come.

Vietnam is the EU’s second-largest trading partner in the ASEAN after Singapore, with trade in goods worth €45.5 billion ($53.9 billion) in 2019. As forecast by the Ministry of Planning and Investment, the FTA is expected to help increase Vietnam’s GDP by 4.6 per cent and its exports to the EU by 42.7 per cent by 2025.

|

Future seaport pressures

Vietnam’s maritime transport system plays an important role in the country’s economy. Currently, up to 90 per cent of goods are transported by sea and, on average, the port system handles 550-570 million tonnes of cargo a year, with the figure forecast to rise further on the back of the EVFTA and new investment shifts.

According to the recent Drewry report of the investment research arm of global shipping consultancy Drewry, COVID-19 has strongly affected logistics businesses in Vietnam, especially marine container business which may lose 7-12 per cent volume throughput in 2020. However, marine transport is forecast to bounce back starting from 2021 when the pandemic is controlled and demand starts budding again.

Despite the opportunities, industry insiders warned about possible pressures on local seaport infrastructure due to a vessel upsizing tendency, as the majority of seaports in the country are unable to receive big vessels due to dredging problems, weak connection with other means of transport, and weak IT application.

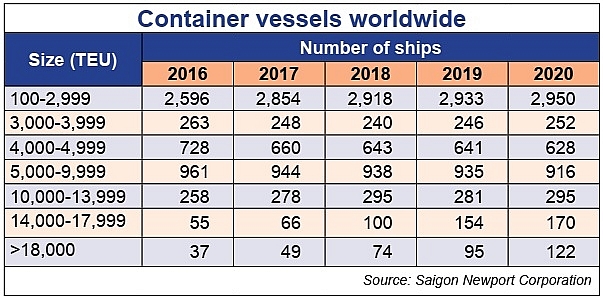

According to the statistics of Alphaliner, which harbours a wealth of maritime industry information, container ships have increased in size over the years with the average vessel being 2.5 times higher than two decades ago. The trend in the near future is the proportion of newly-built vessels is mainly 37 per cent of super-sized ships (over 18,000 TEUs).

A representative of Saigon Newport Corporation, a market leader in seaport operation, said that the upsizing trend in a short time puts pressure on port operators and authorities. Ports need to have synchronised investment to avoid lagging and to meet shipping lines’ demands.

“The investment should focus on dredging channels, building berths and equipment to receive mega ships, and increase productivity as mega ships carry large amounts of cargo. Unless productivity increases, increased port stay time will affect port productivity and put more pressure on peak time,” he explained.

For instance, with upsized vessels, the -14m channel depth and equipment at the Cai Mep terminal make them less attractive than other ASEAN ones. In the future, even though cargo flow between Vietnam and the EU increases, the bigger vessels and maritime routes between the two sides would still focus at ports of Singapore, Malaysia, and others which are more suitable for vessels passing through the Suez Canal.

The Lach Huyen deep seaport complex is in a similar situation, showing that if planning and dredging does not keep up with the vessel upsizing trend, logistics cost to the EU will remain high, reducing the competitiveness of local ports.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version